Technical Analysis for 24 July 2025:

Nifty and Bank Nifty Predictions

As we gear up for the trading session on 24 July 2025, understanding the market’s behavior on 23 July 2025 provides critical insights. The Indian stock market closed on a bullish note, with the Nifty 50 index at 25219.9 and Bank Nifty at 57210.45. Supported by favorable global cues, including a slight decline in crude oil prices and bullish trends in European markets and Dow futures, the stage is set for an intriguing trading day. This article offers a detailed technical analysis for Nifty and Bank Nifty, focusing on key levels, candlestick patterns, and predictions to help traders navigate the Indian stock market effectively.

Today’s Price Movement (23 July 2025)

On 23 July 2025, the Nifty 50 index opened at 25139.35, reached a high of 25233.5, a low of 25085.5, and closed at 25219.9, marking a gain of 159 points from the previous close of 25060.9. Bank Nifty followed a similar trajectory, opening at 56918.15, hitting a high of 57249.00, a low of 56715.8, and closing at 57210.45, up 454.45 points from its previous close of 56756.

Both indices formed bullish candlestick patterns, closing near their daily highs, which reflects strong buying interest. The Nifty’s daily candle featured a small upper wick (13.6 points) and a longer lower wick (53.85 points), indicating that buyers overcame early selling pressure. Bank Nifty’s candle showed a similar pattern, with an upper wick of 38.55 points and a lower wick of 202.35 points, reinforcing the bullish sentiment.

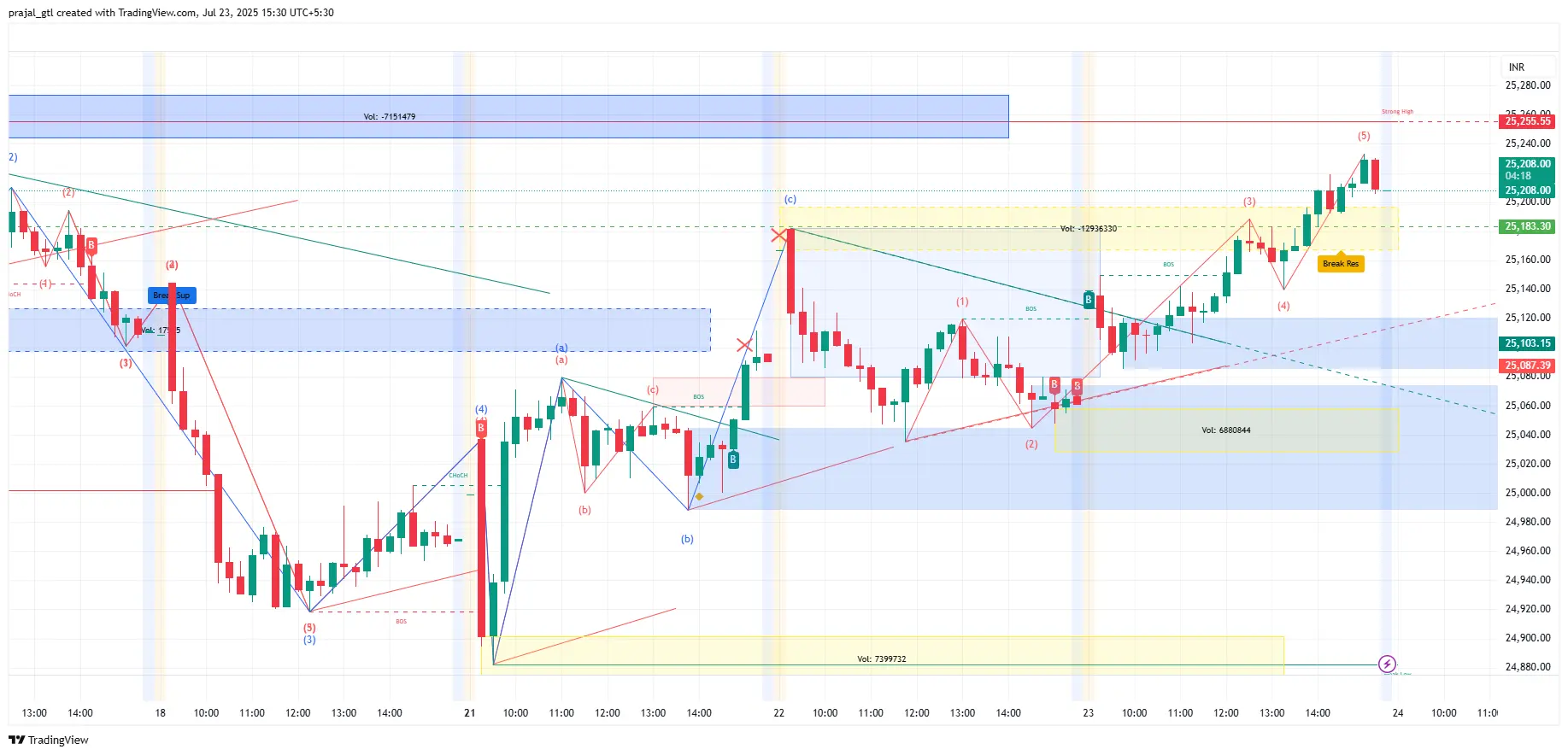

The chart above illustrates the price movements of Nifty 23 July 2025, highlighting the bullish candles and key levels for reference.

Market Closing Key Observations

Nifty 50

- Open: 25,139.35

- High: 25,233.50

- Low: 25,085.50

- Close: 25,219.90

- Previous Close: 25,060.90

- Daily Range: 148 points

Bank Nifty

- Open: 56,918.15

- High: 57,249.00

- Low: 56,715.80

- Close: 57,210.45

- Previous Close: 56,756.00

- Daily Range: 533.2 points

Summary:

- Nifty 50 closed higher (+159 points) with a moderate range.

- Bank Nifty showed strong gains (+454 points) with a wider intraday range.

- Both indices ended near the day’s highs, indicating bullish momentum.

- Nifty 50: The index’s close above 25200 signals strength, with a daily range of 148 points indicating moderate volatility. The bullish candle suggests continued buying interest.

- Bank Nifty: Closing near the day’s high at 57210.45, Bank Nifty showed robust momentum, with a wider daily range of 533.2 points, reflecting higher volatility in the banking sector.

- Market Sentiment: The bullish close, supported by global cues, points to a positive outlook, but traders should watch key technical levels for confirmation of the trend.

Understanding Technical Analysis

Technical analysis involves studying historical price data and trading volume to predict future price movements. Unlike fundamental analysis, which evaluates a company’s financial health, technical analysis focuses on price patterns, trends, and indicators. Key components include:

- Support and Resistance Levels: Support is where buying interest halts price declines, while resistance is where selling pressure caps upward moves.

- Candlestick Patterns: These visual representations of price action reveal market sentiment. A bullish candle (close > open) indicates buying pressure, while a bearish candle (close < open) suggests selling pressure.

- Moving Averages: These smooth price data to identify trends, with common types being the simple moving average (SMA) and exponential moving average (EMA).

- Oscillators: Indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) help identify overbought or oversold conditions.

For 24 July 2025, our analysis leverages price action and candlestick patterns, focusing on key levels provided by Option Matrix India’s proven strategies.

Nifty Predictions for 24 July 2025

Our technical analysis, which has been consistently accurate, identifies critical levels for Nifty on 24 July 2025:

- No-Trading Zone: 25183–25255. Within this range, the market may lack clear direction, and traders should avoid initiating trades unless a breakout occurs.

- Bullish Scenario: A 15-minute candle closing above 25255 signals a potential breakout, with targets at:

- 1st Target: 25330

- 2nd Target: 25430

- 3rd Target: 25480

- Bearish Scenario (False Breakout): If Nifty crosses 25255 but closes below it in a 15-minute candle, it could indicate a false breakout, targeting:

- 1st Target: 25180 (day’s low)

- 2nd Target: 25120

- Bearish Scenario (Breakdown): A 15-minute candle closing below 25183 suggests weakness, with targets at:

- 1st Target: 25130

- 2nd Target: 25070

- 3rd Target: 25000

- Alternative Bullish Scenario: If Nifty crosses 25183 but closes above it in a 15-minute candle, it could target:

- 1st Target: 25230

- 2nd Target: 25280

Trading Rule: Avoid bullish trades in bearish candles and bearish trades in bullish candles to minimize risk.

Bank Nifty Predictions for 24 July 2025

While specific levels for Bank Nifty were not provided, we can infer key levels based on its correlation with Nifty and recent price action:

Level Type | Price | Description |

|---|---|---|

Support | 57000 | Near recent lows, likely to attract buyers. |

Support | 56700 | Stronger support based on 23 July’s low. |

Resistance | 57300 | Immediate resistance near recent highs. |

Resistance | 57500 | Next resistance level for potential breakout. |

Bank Nifty’s bullish candle on 23 July 2025 suggests continued strength. Traders should monitor 15-minute candle closes for confirmation of direction, similar to Nifty’s strategy. A breakout above 57300 could push Bank Nifty toward 57500, while a drop below 57000 might test 56700.

Tomorrow’s Market Prediction

Given the bullish close on 23 July 2025 and supportive global cues, the Indian market is likely to open positively on 24 July 2025. However, the no-trading zone for Nifty (25183–25255) is a critical area to watch. A clear breakout above 25255 could drive Nifty toward higher targets, while a breakdown below 25183 might signal a correction. Bank Nifty’s performance is expected to align with Nifty, with key levels at 57000 (support) and 57300–57500 (resistance).

Sectoral Impact

The slight decline in crude oil prices to $64.93 per barrel could benefit sectors like aviation, paint, and tyres due to lower input costs. Companies such as IndiGo or Asian Paints may see positive sentiment. The marginal weakening of the rupee to 86.405 could provide a tailwind for export-driven sectors like IT (e.g., TCS, Infosys) and pharmaceuticals, as their dollar-denominated earnings translate to higher rupee values. However, these changes are minor, and technical levels should guide trading decisions.

Intraday Trading Tips

To capitalize on the market’s movements on 24 July 2025, consider these intraday trading strategies:

- Focus on Key Levels: Use the identified support and resistance levels to plan entries and exits.

- Monitor Candlestick Patterns: Confirm trades with 15-minute candle closes to avoid false signals.

- Set Stop-Loss Orders: Place stop-losses below support for long trades or above resistance for short trades to manage risk.

- Stay Updated: Watch for news or earnings announcements that could cause volatility.

- Risk Management: Limit risk to 1–2% of your trading capital per trade to protect against adverse moves.

Understanding Nifty and Bank Nifty

The Nifty 50 index represents the weighted average of 50 large, liquid companies listed on the National Stock Exchange (NSE), covering various sectors. Bank Nifty tracks the performance of the most liquid and capitalized banking stocks, making it a key indicator of the financial sector’s health. Both indices are critical for gauging market sentiment and are widely used by traders for intraday and positional strategies.

Global Market Influence

Indian markets are sensitive to global trends. Bullish signals from European markets and Dow futures suggest a positive spillover effect. For instance, strong performances in technology and industrial sectors in Europe could boost similar sectors in India. Conversely, any unexpected negative news, such as trade tensions or geopolitical events, could introduce volatility (Bloomberg).

Technical Indicators for Enhanced Analysis

While our analysis focuses on price action and candlestick patterns, traders can enhance their strategies with additional indicators:

- Moving Averages: Check if Nifty and Bank Nifty are trading above their 50-day or 200-day moving averages to confirm the trend’s strength.

- Relative Strength Index (RSI): An RSI above 70 indicates overbought conditions, while below 30 suggests oversold conditions.

- MACD: A bullish crossover (signal line crossing above the MACD line) supports upward momentum.

Traders should combine these indicators with our provided levels for a comprehensive approach.

Risk Management Strategies

Effective risk management is crucial for successful trading: click to evaluate risk

- Stop-Loss Orders: For a long trade above 25255 (Nifty), place a stop-loss below 25183. For a short trade below 25183, set a stop-loss above 25255.

- Position Sizing: Risk no more than 1–2% of your capital per trade to withstand market fluctuations.

- Avoid Overtrading: Stick to high-probability setups based on confirmed breakouts or breakdowns.

Final Verdict

The technical analysis for 24 July 2025 suggests a cautiously optimistic outlook for the Indian stock market. Nifty’s no-trading zone (25183–25255) and Bank Nifty’s key levels (57000 support, 57300–57500 resistance) will guide trading decisions. A breakout above 25255 for Nifty could drive significant upside, while a breakdown below 25183 may lead to a correction. Bank Nifty is likely to follow a similar trajectory. Our previous analyses have proven accurate, and we expect these levels to hold. Traders should use stop-losses and monitor 15-minute candles to navigate the market effectively.

Stay tuned to Option Matrix India for more insightful market analyses.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Trading in the stock market involves risks, and individuals should conduct their own research or consult a financial advisor before making investment decisions.