Understanding Derivatives Trading in India

Derivatives trading is key in financial markets, assisting traders with risk management and price speculation. In India, the market includes futures and options on various assets. This guide provides a concise overview of derivatives trading in India and platform like Option Matrix India to enhance your experience.

What are Derivatives?

Derivatives are financial contracts whose value is derived from an underlying asset, such as stocks, bonds, commodities, currencies, or market indices. The most common types of derivatives are futures and options.

- Futures: These are contracts to buy or sell an asset at a predetermined price on a specified future date.

- Options: These give the buyer the right, but not the obligation, to buy (call option) or sell (put option) an asset at a predetermined price before or on a specified date.

Derivatives Trading in India

In India, derivatives trading is regulated by the Securities and Exchange Board of India (SEBI) and is primarily conducted on two major stock exchanges: the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

- NSE: Offers derivatives on various indices like Nifty 50, Nifty Bank, and individual stocks.

- BSE: Provides derivatives on Sensex and other indices.

Traders can participate in derivatives trading through brokers who are members of these exchanges.

Types of Derivatives in India

- Stock Futures and Options: Derivatives on individual stocks.

- Index Futures and Options: Derivatives on market indices like Nifty 50, Bank Nifty, etc.

- Currency Derivatives: Derivatives on currency pairs, such as USD/INR.

- Commodity Derivatives: Derivatives on commodities like gold, silver, crude oil, etc.

Futures vs Options Trading:

- Obligation vs. Right

- Futures: Binding contract to buy/sell an asset at a set price on expiry.

- Options: Gives the right (but not obligation) to buy (Call) or sell (Put) at a strike price.

- Risk & Reward

- Futures: Higher risk (unlimited losses if market moves against you).

- Options: Limited risk (premium paid); profit potential remains high.

- Margin & Capital

- Futures: Requires significant margin (leveraged trading).

- Options: Lower capital needed (only premium payment).

- Flexibility

- Options: Can choose expiry, strike price, and strategies (e.g., spreads, straddles).

- Futures: Simpler, but less strategic flexibility.

Best For?

- Futures: Hedgers & high-risk traders betting on price direction.

- Options: Traders seeking leverage with controlled risk (e.g., hedging, income).

How to Start Derivatives Trading in India

Getting started with derivatives trading in India is straightforward if you follow these steps:

- Open a Demat and Trading Account: With a SEBI-registered broker. Learn how to open a Demat account.

- Understand the Basics: Learn about futures, options, and trading strategies.

- Choose a Trading Platform: Select a platform that offers real-time data and advanced tools. Explore the best trading platforms in India.

- Risk Management: Use stop-loss orders and position sizing to manage risks.

Tools for Derivatives Trading: Option Matrix India

Option Matrix India serves as a sophisticated analytical tool for traders, enabling them to assess option chains, track Open Interest (OI), and determine Put Call Ratios (PCR) with precision. It delivers comprehensive daily analyses of the derivative market, supplemented by real-time data from market participants.

- Option Chain Analysis: Helps identify high-probability trades by analyzing option prices, volumes, and OI.

- Open Interest (OI): Indicates the total number of outstanding option contracts, helping traders gauge market sentiment.

- Put Call Ratio (PCR): Measures the ratio of put options to call options, providing insights into market expectations.

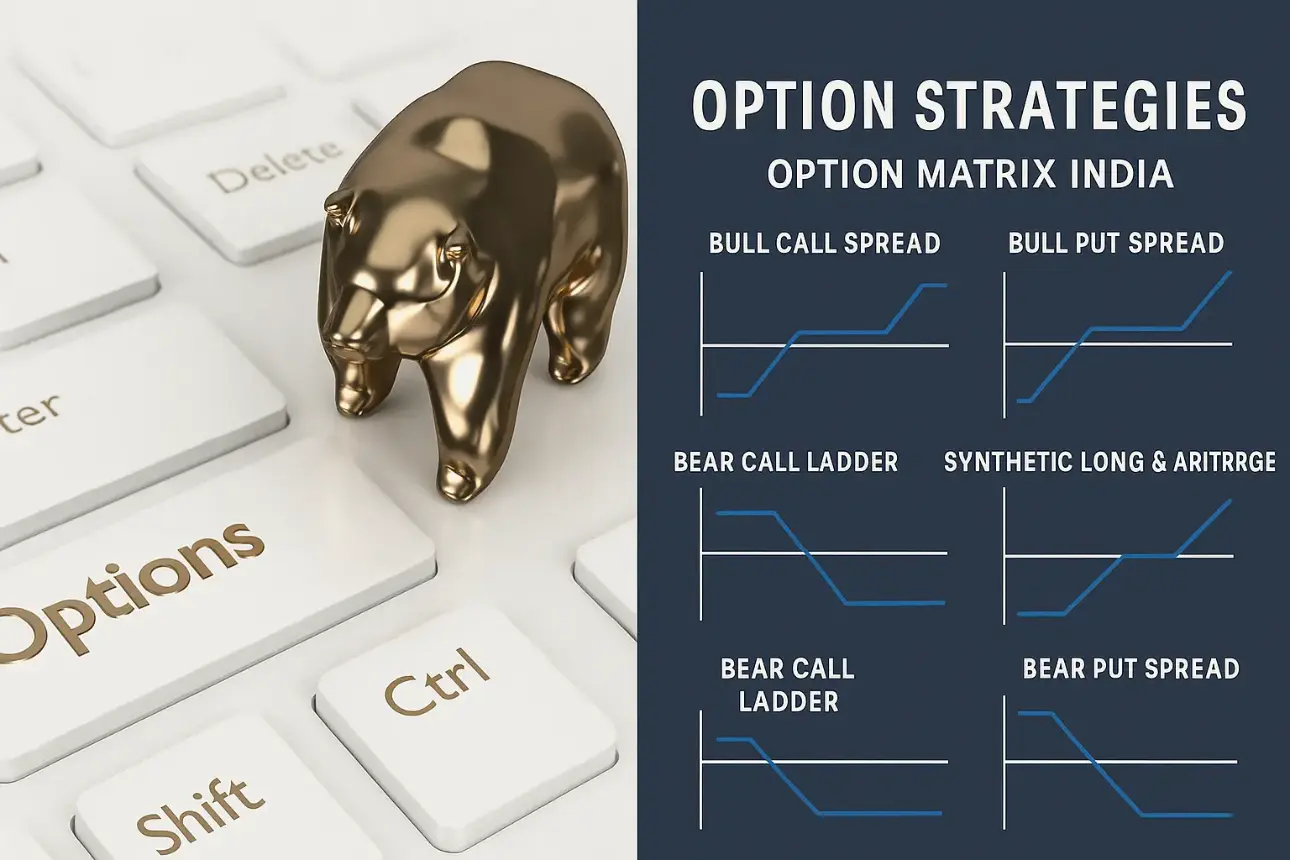

Derivatives Trading Strategies

Effective strategies can enhance your success in derivatives trading. Some popular approaches include:

- Hedging: Using derivatives to offset potential losses in other investments.

- Speculation: Taking positions based on expected price movements.

- Arbitrage: Exploiting price differences between related assets.

- Spreads: Combining multiple options to create a strategy with specific risk-reward profiles.

Top 10 options trading strategies

1. Covered Call

- Best for: Income generation in neutral/bullish markets

- How it works: Sell a call option against a stock you own.

2. Protective Put (Married Put)

- Best for: Hedging long stock positions

- How it works: Buy a put option to protect against downside risk.

3. Cash-Secured Put

- Best for: Income generation or stock acquisition at a lower price

- How it works: Sell a put option while setting aside cash to buy the stock if assigned.

4. Long Straddle

- Best for: High volatility (expecting a big move, direction unknown)

- How it works: Buy both a call and a put at the same strike and expiration.

5. Long Strangle

- Best for: Cheaper alternative to a straddle (wider breakevens)

- How it works: Buy an OTM call and an OTM put with the same expiration.

6. Iron Condor

- Best for: Low volatility (range-bound markets)

- How it works: Sell an OTM call spread and an OTM put spread for premium.

7. Iron Butterfly

- Best for: High probability of profit in low-volatility markets

- How it works: Sell an ATM call and put while buying further OTM options to limit risk.

8. Bull Call Spread

- Best for: Moderately bullish markets with limited risk

- How it works: Buy a call and sell a higher-strike call to reduce cost.

9. Bear Put Spread

- Best for: Moderately bearish markets with limited risk

- How it works: Buy a put and sell a lower-strike put to reduce cost.

10. Diagonal Spread (Calendar Spread)

- Best for: Earnings plays or time decay advantage

- How it works: Buy a long-term option and sell a short-term option at different strikes.

Bonus: Advanced Strategies

- Ratio Spreads (Unbalanced risk/reward)

- Butterfly Spreads (Pin risk plays)

- Jade Lizard (High-probability income)

Each strategy has its own risk/reward profile and is suited for different market conditions. Would you like a deeper breakdown of any of these?

Risks and Challenges in Derivatives Trading

While derivatives trading offers opportunities, it also comes with risks:

- Leverage Risk: Derivatives often involve leverage, which can amplify both gains and losses.

- Market Risk: Fluctuations in the underlying asset’s price can lead to significant losses.

- Liquidity Risk: Some derivatives may have low liquidity, making it difficult to exit positions.

- Counterparty Risk: In over-the-counter (OTC) derivatives, there is a risk that the counterparty may default.

Conclusion

Derivatives trading in India offers a dynamic and potentially lucrative opportunity for traders. By understanding the basics, using tools like Option Matrix India, and employing sound risk management strategies, traders can navigate the complexities of the derivatives market successfully.