Derivatives Trading Strategy for 22 Sept 2025:

Comprehensive Market Analysis & Options Strategy Guide

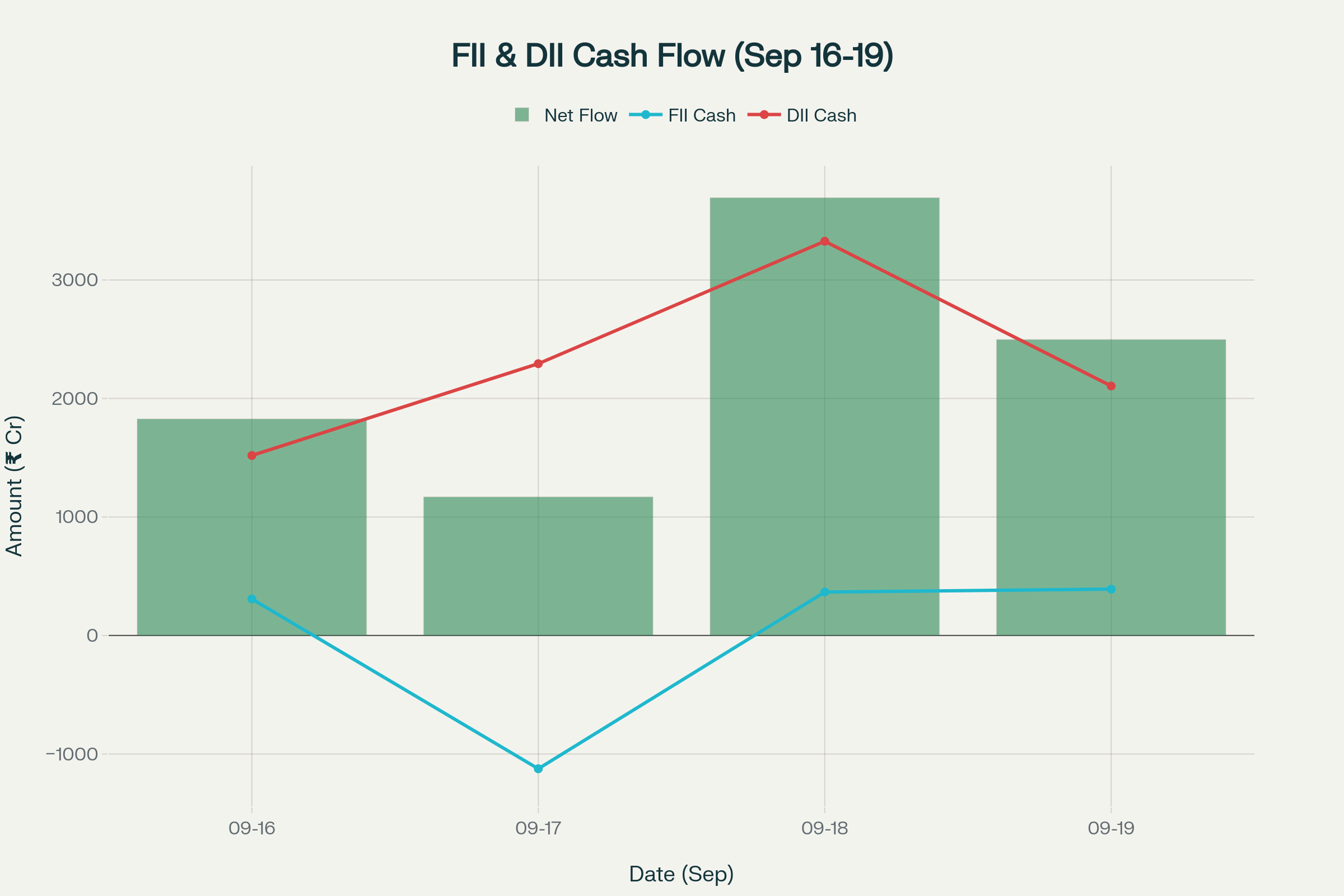

Market Snapshot (19 Sep 2025): FII inflows continued with ₹390.74 Cr net buying while DII maintained strong support at ₹2,105.22 Cr. Markets witnessed consolidation with Nifty closing at 25,327.05 (-0.38%), Bank Nifty at 55,458.85 (-0.48%), indicating healthy profit booking after recent rally.

FII and DII Cash Flow Analysis (September 16-19, 2025) - Foreign and domestic institutional investor activity showing market sentiment trends

Market Participant Analysis: Institutional Flow Dynamics

The institutional flow pattern over the last four trading sessions reveals compelling insights into market sentiment and future directional bias. Foreign Institutional Investors (FIIs) demonstrated mixed behavior with significant volatility, ranging from net selling of ₹1,124.54 Cr on September 17 to consistent buying on other days. This volatility reflects global uncertainty but overall positive sentiment toward Indian equities.

Domestic Institutional Investors (DIIs) exhibited unwavering bullish conviction throughout the period, consistently maintaining net buying above ₹1,500 Cr daily, peaking at ₹3,326.56 Cr on September 18. This sustained domestic support provides a crucial foundation for market stability and indicates strong confidence in India's economic fundamentals.

The combined institutional flow totaled ₹2,495.96 Cr on September 19, marking the fourth consecutive day of net institutional buying. This consistent institutional support typically translates into sustained bullish momentum, though the magnitude has moderated from the previous day's ₹3,693.25 Cr peak.nseindia

FII Activity Pattern Analysis

FII behavior shows a recovery pattern following the sharp selling on September 17. The quick reversal from selling to buying indicates that foreign investors view any market dips as attractive entry opportunities. This pattern suggests that while FIIs remain sensitive to global developments, their underlying view on Indian markets remains constructive.

The FII data across NSE, BSE, and MSEI for September 19 shows net buying of ₹390.74 Cr in cash markets, while the broader cross-exchange FII activity reached ₹2,105.22 Cr including all segments. This differential indicates significant activity in derivative segments, suggesting sophisticated hedging strategies by foreign institutions.

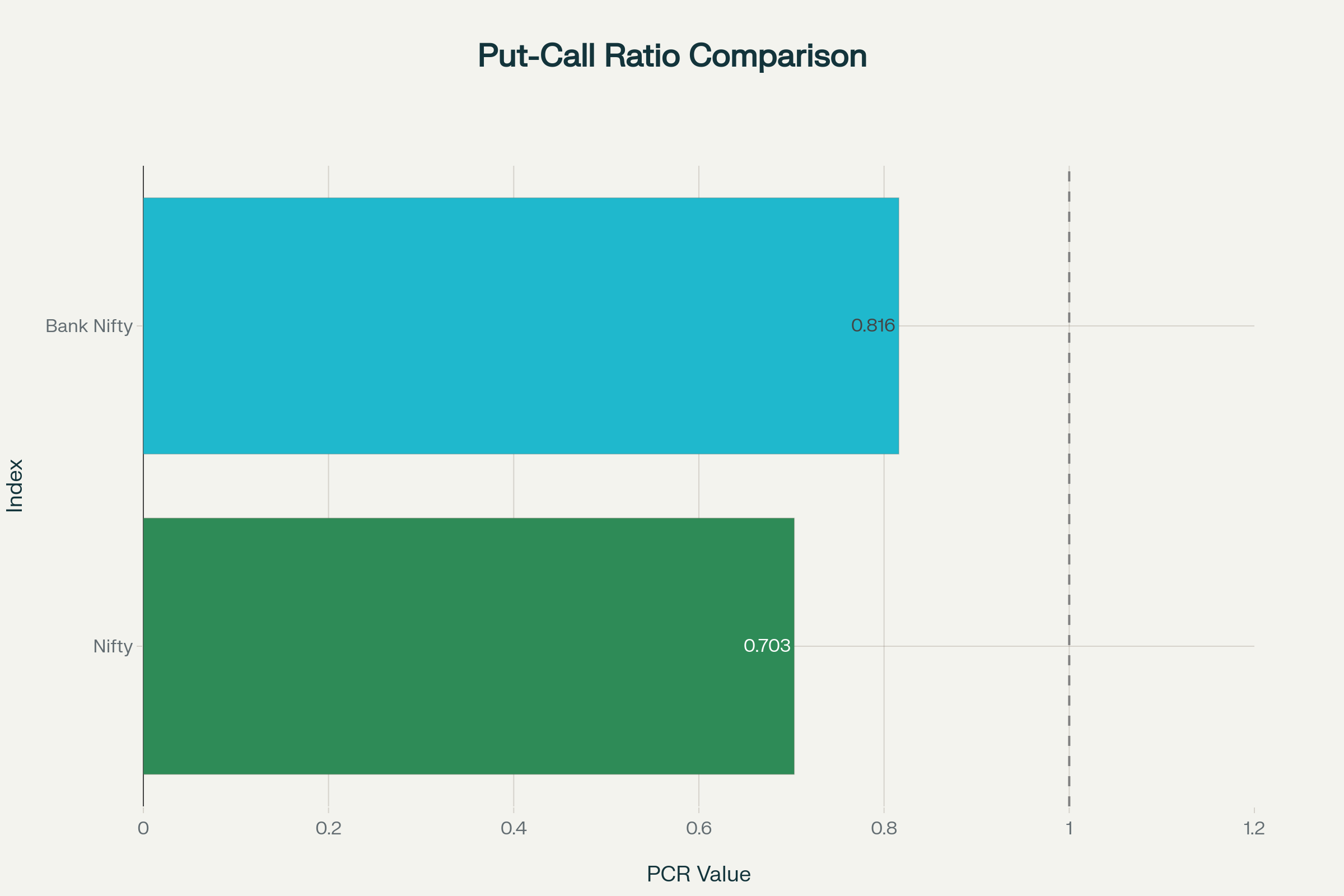

Option Chain Analysis: Nifty & Bank Nifty Positioning

Nifty Option Chain Insights

Current Nifty option chain analysis reveals a Put-Call Ratio (PCR) of 0.703, indicating moderately bullish sentiment among option traders. The PCR below 1.0 suggests higher call option interest relative to put options, typically associated with bullish market expectations.

Put-Call Ratio Analysis for Nifty and Bank Nifty - Current market sentiment indicator showing bullish bias in both indices

Max Pain Analysis: The highest combined Open Interest (OI) concentration appears at the 25,400 strike, slightly above current market levels at 25,327.05. This suggests potential gravitational pull toward the 25,400 level as options approach expiry on September 23 (Tuesday expiry).

Key Support and Resistance Levels:

- Immediate Support: 25,300-25,250 based on put option buildup

- Strong Support: 25,200 with significant put OI concentration

- Resistance Levels: 25,400-25,450 showing call option concentration

- Breakout Level: 25,500 for sustained upside momentum.

Bank Nifty Option Dynamics

Bank Nifty displays a PCR of 0.816, indicating a more balanced sentiment compared to Nifty but still maintaining a bullish bias. The higher PCR suggests slightly more defensive positioning among banking sector option traders.

Max Pain Zone: Bank Nifty shows maximum OI concentration around 55,000, significantly below current levels at 55,458.85. This large differential suggests potential downward pressure toward the max pain level as expiry approaches.

Critical Levels for Bank Nifty:

- Support Zone: 54,800-55,000 (confluence of technical and option support)

- Resistance: 56,000-56,150 representing call option barriers

- Breakout Target: 56,500+ for bullish continuation.

Technical Analysis: Price Action and Momentum

Nifty Technical Structure

Nifty's recent price action demonstrates a consolidation phase following a significant rally from August lows. The index has formed a small bearish candle but maintains the higher-high, higher-low structure on daily charts. RSI indicators have moderated from overbought levels near 70 but remain supportive above 60, indicating healthy momentum correction rather than trend reversal.

Key Technical Levels:

- Immediate Support: 25,286.55 (today's low) and 25,250

- Critical Support: 25,108-24,973 (previous swing lows)

- Resistance: 25,546-25,681 (previous breakout levels)

- Trend Continuation: Above 25,400 signals resumption of uptrend.

Bank Nifty Technical Outlook

Bank Nifty concluded a 12-session rally with today's consolidation, suggesting natural profit booking after substantial gains. The index maintains an upward bias despite the pullback, with technical indicators supporting further upside potential upon successful consolidation.

Technical Framework:

- Immediate Support: 54,922 (20-day EMA confluence)

- Strong Support: 54,000-54,200 (100-day EMA and previous breakout zone)

- Resistance: 55,995-56,327 (next hurdle levels)

- Bullish Target: 56,500+ on breakout confirmation.

Market Sentiment and Volatility Analysis

Volatility Environment

India VIX levels remain crucial for options strategy selection. Current moderate volatility environment favors specific strategies over others. The recent moderation in implied volatility following the Fed's dovish stance provides opportunities for premium collection strategies when market remains range-bound.

Sector Rotation Dynamics

Today's market action revealed selective profit booking in banking and financial stocks, while certain sectors like telecom (Bharti Airtel +1.09%) showed resilience. This sector rotation suggests healthy market dynamics rather than broad-based selling pressure.

Derivative Trading Strategy for September 22, 2025

Strategy 1: Weekly Expiry Advantage Play (High Probability)

Rationale: With Tuesday expiry on September 23, time decay acceleration creates opportunities for premium collection strategies.

Setup:

- Strategy: Iron Condor on Nifty

- Sell Strikes: 25,200 PE and 25,500 CE

- Buy Strikes: 25,100 PE and 25,600 CE

- Risk-Reward: Limited risk with high probability profit zone

- Exit: 70% profit target or Monday close.

Conditions: Execute only if India VIX remains below 13 and no major event risks.

Strategy 2: Directional Bias Exploitation (Bank Nifty Focus)

Rationale: Bank Nifty's technical setup suggests potential for directional movement toward max pain levels or breakout.

Setup:

- Bullish Scenario: Buy 55,500 CE if Bank Nifty sustains above 55,600

- Bearish Scenario: Buy 55,000 PE if breakdown below 54,800

- Stop Loss: 40% of premium paid

- Target: 1.5x to 2x premium received.

Strategy 3: Volatility Adjustment Strategy

Rationale: PCR levels and institutional flows suggest potential for volatility expansion.

Setup:

- Long Straddle: Buy 25,350 CE and 25,350 PE (Nifty ATM)

- Entry Condition: On any spike in volatility or news-driven movement

- Management: Adjust legs based on directional movement

- Risk: Premium decay if market remains sideways.

Strategy 4: Institutional Flow Following

Rationale: Strong DII buying and FII support suggest institutional accumulation continuing.

Setup:

- Cash Market: Accumulate quality large-cap stocks on dips

- Options Support: Buy protective puts on equity positions

- Sector Focus: Banking stocks on technical bounce from support levels

- Timeline: Medium-term holding (3-5 sessions)

Risk Management Framework

Position Sizing Guidelines

- Maximum Risk per Trade: 1-2% of capital

- Options Premium Risk: Never risk more than affordable to lose completely

- Diversification: Spread strategies across different strikes and timeframes.

Stop-Loss Protocols

- Options Buying: 40-50% of premium as stop-loss

- Options Selling: 2x premium received as maximum loss

- Time-Based Exits: Close positions by 2:30 PM on expiry day.

Market Condition Adaptability

- High Volatility: Prefer option selling strategies

- Low Volatility: Focus on directional option buying

- Range-Bound: Iron Condor and other range strategies

- Trending: Directional strategies with trailing stoploss.

Monday's Trading Plan: September 22, 2025

Pre-Market Analysis Checklist

- Global Cues: Monitor Asian markets and overnight US futures

- FII/DII Data: Check for continuation of buying pattern

- Volatility Assessment: India VIX movement and implied volatility changes

- Gap Analysis: Opening gap and immediate price action response.

Intraday Strategy Framework

Morning Session (9:15 AM - 11:30 AM):

- Monitor opening price action relative to previous day's range

- Look for breakout or breakdown confirmation with volume

- Execute directional strategies only on clear signals.

Afternoon Session (11:30 AM - 3:30 PM):

- Assess morning developments and adjust positions

- Focus on time decay strategies if market remains range-bound

- Prepare for expiry week positioning.

Technical Levels for September 22, 2025

Nifty Key Levels

- Bullish Above: 25,400 (sustainable move toward 25,500-25,550)

- Range Trading: 25,250-25,400

- Bearish Below: 25,200 (target 25,100-25,000)

Bank Nifty Critical Levels

- Bullish Above: 55,600 (target 56,000-56,200)

- Consolidation Zone: 54,800-55,600

Support Test: Below 54,700 (target 54,200-54,000)

Conclusion and Risk Disclaimer

The derivative trading landscape for September 22, 2025, presents multiple opportunities driven by strong institutional support, favorable technical setup, and approaching weekly expiry dynamics. The combination of sustained DII buying, recovering FII interest, and constructive option chain positioning supports a cautiously bullish approach with proper risk management.

Key Success Factors:

- Disciplined execution of predetermined strategies

- Strict adherence to stop-loss levels

- Position sizing appropriate to risk tolerance

- Continuous monitoring of institutional flow patterns

- Flexibility to adapt to changing market conditions.

DISCLAIMER: This analysis is for educational and informational purposes only. The strategies and recommendations provided are not financial advice or buy/sell recommendations. Derivative trading involves substantial risk of loss and may not be suitable for all investors. Past performance does not guarantee future results. Please consult with a qualified financial advisor before making investment decisions. The author and Option Matrix India assume no responsibility for trading losses incurred based on this analysis. Trade at your own risk and never invest more than you can afford to lose.