SIP Calculator

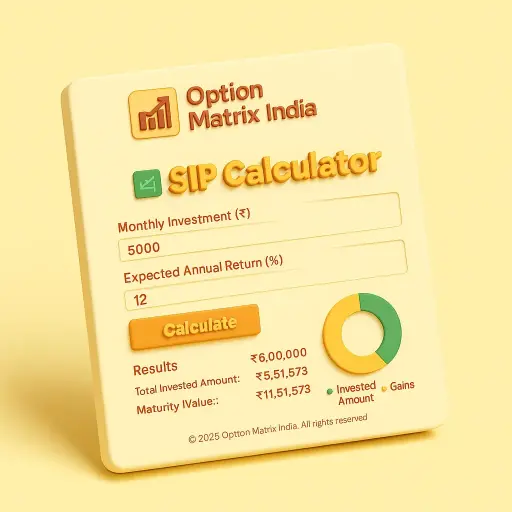

Elevate your investment planning with our free SIP Calculator, designed to provide you with comprehensive insights into your financial future. This powerful tool allows you to estimate potential returns, calculate the total maturity amount, and understand the wealth growth associated with Systematic Investment Plans (SIP) in mutual funds. Whether you are a newcomer to the investment landscape or a seasoned professional, our SIP investment calculator serves as an invaluable resource, enabling you to forecast your earnings accurately, set clear financial goals, and make informed investment decisions. By leveraging this innovative calculator, you can strategically optimize your SIP returns, paving the way for long-term wealth creation and financial security. Don’t miss the opportunity to take control of your financial journey—try our SIP Calculator today and unlock the potential of your investments!

Frequently Asked Questions (FAQ) – SIP Calculator

1. What is a SIP Calculator?

A SIP (Systematic Investment Plan) calculator is an online tool that estimates the potential returns on your mutual fund SIP investments. It considers factors like investment amount, duration, and expected returns to project your maturity amount and wealth growth.

2. How does the SIP Calculator work?

The calculator uses the compound interest formula:

Maturity Value = P × [ (1 + r)^n - 1 ] × (1 + r) / r

Where:

- P = Monthly SIP amount

- r = Expected monthly return rate

- n = Total number of months

Simply enter your SIP amount, investment tenure, and expected return rate to get instant results.

3. Is the SIP Calculator accurate?

The calculator provides estimates based on your inputs and assumed returns. Actual returns may vary due to market risks, fund performance, and expense ratios.

4. Why should I use a SIP Calculator?

- Plan financial goals (e.g., retirement, home purchase).

- Compare SIP vs. lump-sum investments.

- Adjust investment amounts/tenure for desired outcomes.

5. What is the ideal SIP investment duration?

SIPs work best for long-term goals (5+ years) due to the power of compounding. Short-term SIPs (1–3 years) may be riskier in volatile markets.

6. Can I change my SIP amount later?

Yes! Most mutual funds allow you to increase, decrease, or pause SIPs anytime.

7. How is SIP different from a lump-sum investment?

- SIP: Invests fixed amounts regularly (reduces market timing risk).

- Lump-sum: One-time investment (better in rising markets).

8. Are SIP returns taxable?

- Equity SIPs (held >1 year): 10% LTCG tax (over ₹1 lakh/year).

- Debt SIPs: Taxed as per income slab.

9. Which funds give the highest SIP returns?

Historically, equity funds (large-cap, flexi-cap, or small-cap) offer higher returns but with higher risk. Use the calculator to compare scenarios.

10. Can I withdraw SIP money anytime?

Yes, SIPs in open-ended funds allow withdrawals, but exit loads may apply if redeemed within 1 year.