FII Investment Trends in India, FII Outflows 2025:

Current Outflows vs Historical Market Corrections – Complete Analysis 2025

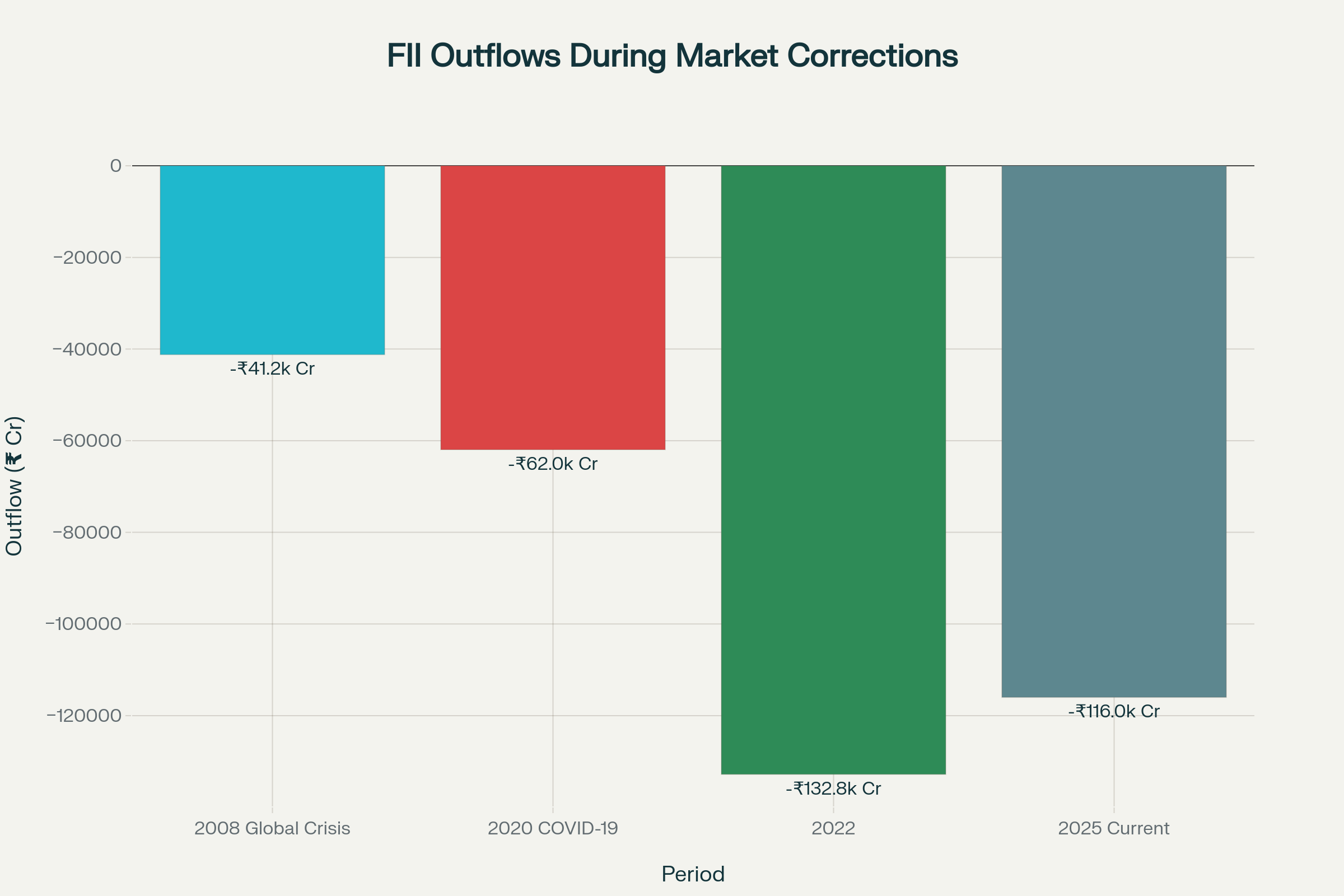

Foreign Institutional Investors (FIIs) have withdrawn a staggering ₹1.16 lakh crore from Indian equities in 2025, marking one of the largest sell-offs in recent history. This in-depth article explores current FII outflow patterns, compares them with past market corrections, and highlights key drivers and strategic insights for investors.

Current FII Investment Landscape in India

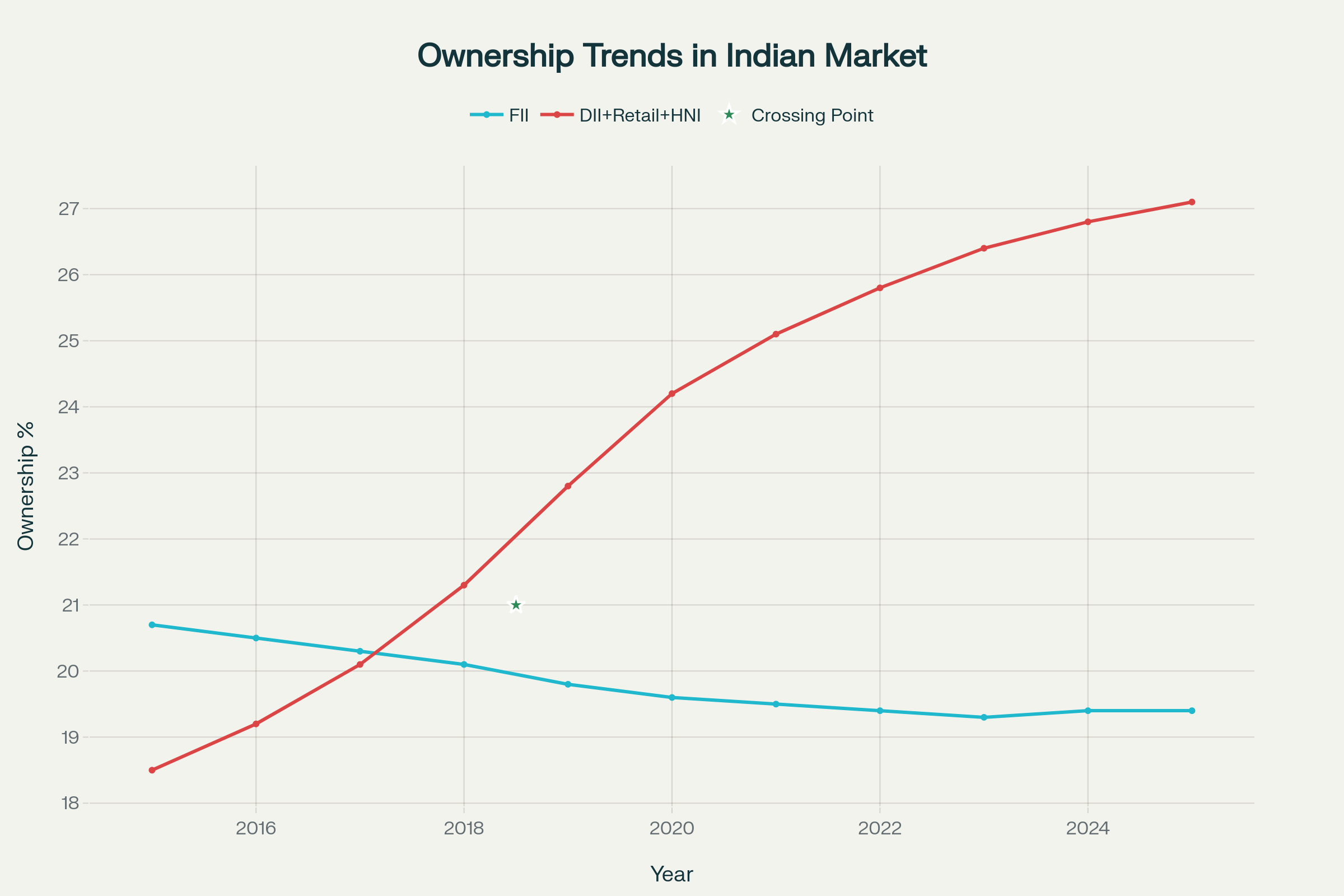

As of August 2025, FII shareholding in Indian equities stands at 19.4%, while domestic investors (DIIs, retail, and HNIs) collectively hold 27.1%, marking the first time domestic ownership exceeds foreign institutional holdings. This historic shift reduces reliance on foreign capital flows and underscores the growing strength of domestic participation.

The FII exodus in 2025 has been heavily sector-concentrated:

- Information Technology: ₹56,881 crore outflow

- FMCG: ₹17,770 crore outflow

- Power: ₹17,718 crore outflow

Despite these massive withdrawals, major indices posted gains thanks to strong domestic support and resilient market dynamics.

Key Highlights

- Foreign Institutional Investors India have pulled out a record ₹1.16 lakh crore in 2025, signaling a major shift in market dynamics.

- This FII outflow India 2025 contrasts sharply with historical outflows during the 2008, 2020, and 2022 market corrections.

- Our Indian stock market analysis reveals domestic institutional investors growth India has cushioned volatility through robust DII vs FII India counter-investment.

- Sectoral FII historical outflows data highlights eye-opening trends in IT, FMCG, and Power stocks during major sell-offs.

- Understanding FII investment trends historical data helps investors navigate corrections and spot recovery opportunities efficiently.

Historical Context: FII Behavior During Market Corrections

FII patterns during major corrections reveal consistent behavioral traits:

- 2008 Global Financial Crisis: ₹41,216 crores withdrawn → 37.9% market decline

- 2013 Taper Tantrum: ₹15,000 crores withdrawn → 12.5% market decline

- 2016 Demonetization: ₹23,081 crores withdrawn → 8.2% market decline

- 2018 Volatility: ₹80,919 crores withdrawn → 15.6% market decline

- 2020 COVID-19 Pandemic: ₹61,973 crores withdrawn in March → 38% crash

- 2022 Fed Rate Hikes: ₹1,32,815 crores withdrawn → 24.7% decline

Domestic institutions consistently stepped in to cushion these shocks, with DIIs investing record amounts during each episode to stabilize markets.

![FII Outflows During Major Market Corrections in India]

FII Outflows During Major Market Corrections in India

Key Drivers Behind 2025 FII Outflows

- Valuation Concerns

The Nifty 50 trades at 24.1× PE versus a 10-year average of 21.9×, making Indian equities relatively expensive compared to global peers. - US Federal Reserve Policy

The Fed funds rate at 5.5% (highest since 2007) and 10-year Treasury yields near 4.6% attract yield-seeking flows back to the US. - China Market Revival

China’s Q1 2025 GDP growth of 5.3% and a 12% rally in the Shanghai Composite have drawn FII reallocations. - Geopolitical & Currency Factors

Global trade tensions, inflationary pressures, and INR volatility have added to repatriation incentives.

DII Emergence as Market Backbone

Domestic Institutional Investors have become the primary stabilizers:

- DII inflows: $80 billion over 12 months

- FII outflows: $40 billion over the same period

- SIP contributions: ₹20,000+ crore monthly, totaling ₹9 lakh crore AUM

Retail participation has surged with 16 crore+ active demat accounts, signaling a structural shift toward domestic ownership.

![Shift in Indian Stock Market Ownership: FII vs Domestic Investors (2015-2025)]

Shift in Indian Stock Market Ownership: FII vs Domestic Investors (2015-2025)

Strategic Investment Implications

- Sectoral Value Opportunities:

IT, despite a 17.6% pull-back, offers attractive entry points. Telecommunications and Services sectors continue to attract selective inflows. - Market Resilience Indicators:

Recovery patterns suggest stabilization within 6–18 months post major FII exits, driven by domestic support.

Future Outlook and Recovery Catalysts

Potential drivers for FII return:

- US Fed rate cuts in late 2025/early 2026

- India’s projected 6.5–7% GDP growth

- Valuation corrections creating attractive entry points

Risks:

- Ongoing geopolitical tensions

- Currency volatility

- Competition from Chinese markets

Article by Option Matrix India | Data and analysis current as of August 2025