India's Semiconductor Revolution: Achieving Atmanirbhar Bharat Through Vikram Chip and $110B Market Growth

Introduction: India's Semiconductor Breakthrough

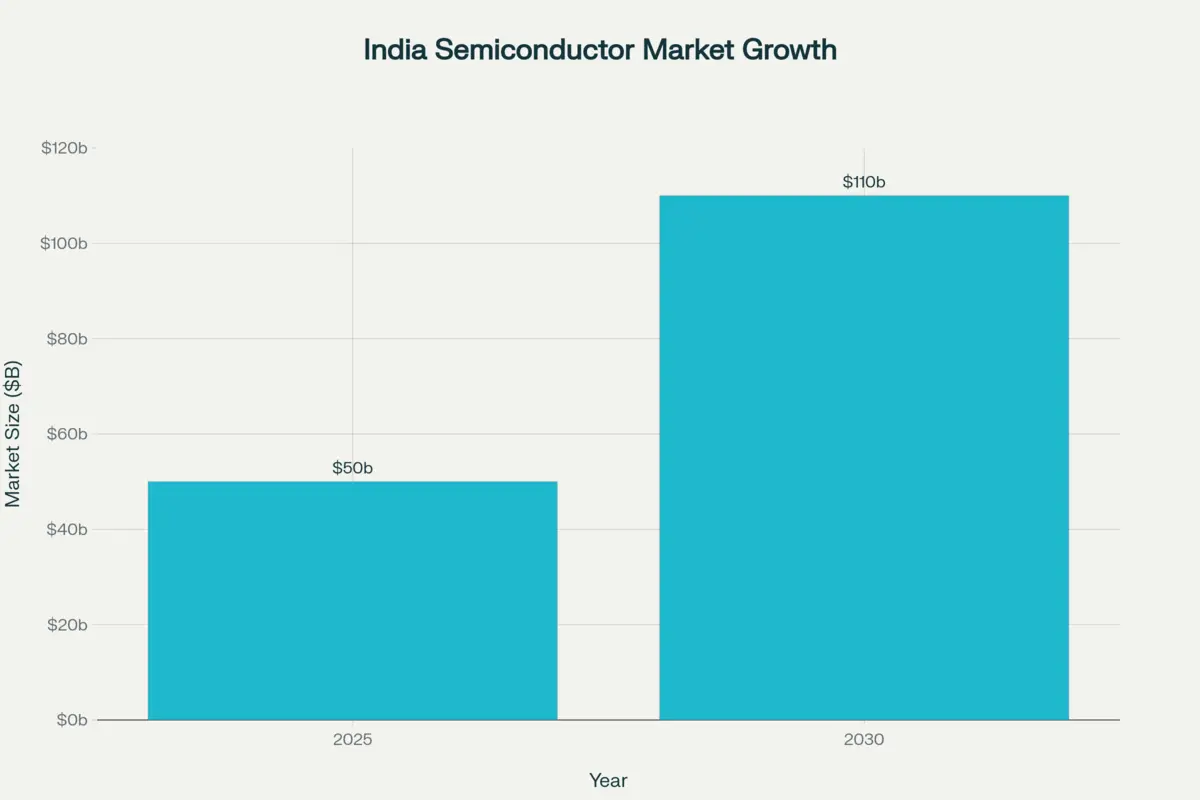

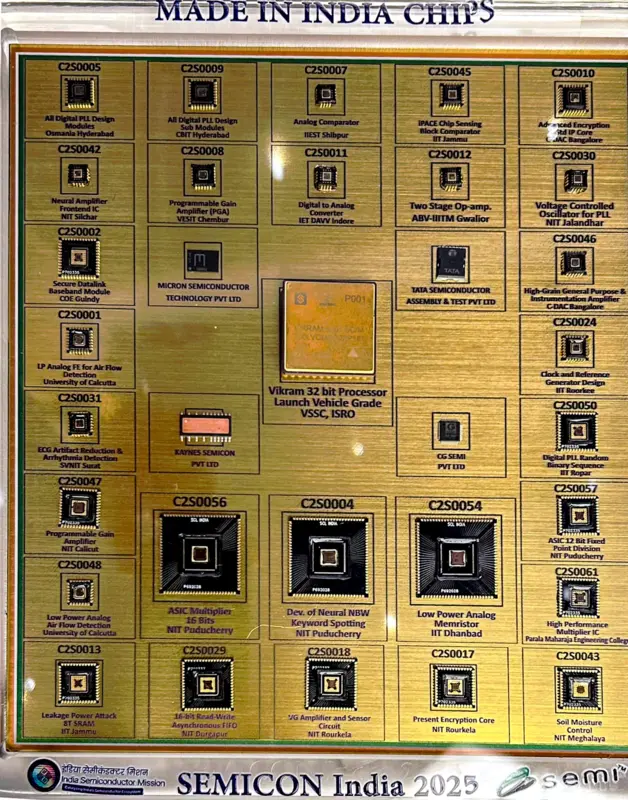

India has achieved an extraordinary technological milestone with the presentation of the country's first Made-in-India semiconductor chip to Prime Minister Narendra Modi at SEMICON India 2025. The groundbreaking Vikram 32-bit processor, developed by ISRO's Semiconductor Laboratory, represents a transformative moment in India's journey from semiconductor consumer to global manufacturing powerhouse. With India's semiconductor market projected to explode from $50 billion in 2025 to $110 billion by 2030, representing a remarkable 17% CAGR, the nation is rapidly establishing itself as a critical player in the global semiconductor industry through strategic government initiatives and substantial private investments.

India Semiconductor Mission: Foundation of Technological Growth

Government Commitment and PLI Scheme

The India Semiconductor Mission (ISM), launched in 2021, has become the cornerstone of India's semiconductor manufacturing ambitions. The government's massive ₹76,000 crore commitment through the Production Linked Incentive (PLI) scheme demonstrates unprecedented support for domestic semiconductor manufacturing. Nearly ₹65,000 crores has already been allocated to approved projects, accelerating India's semiconductor fabrication capabilities.

Approval Framework and Manufacturing Ecosystem

Companies establishing semiconductor fabrication facilities with 28-nanometer or lower chip production capabilities qualify for 50% government funding of project costs. This substantial financial backing has attracted both domestic conglomerates and international technology partners to establish manufacturing facilities across India, creating a comprehensive semiconductor ecosystem.

Top 3 Semiconductor Stocks for Investment Portfolio

1. CG Power & Industrial Solutions: Semiconductor Manufacturing Pioneer

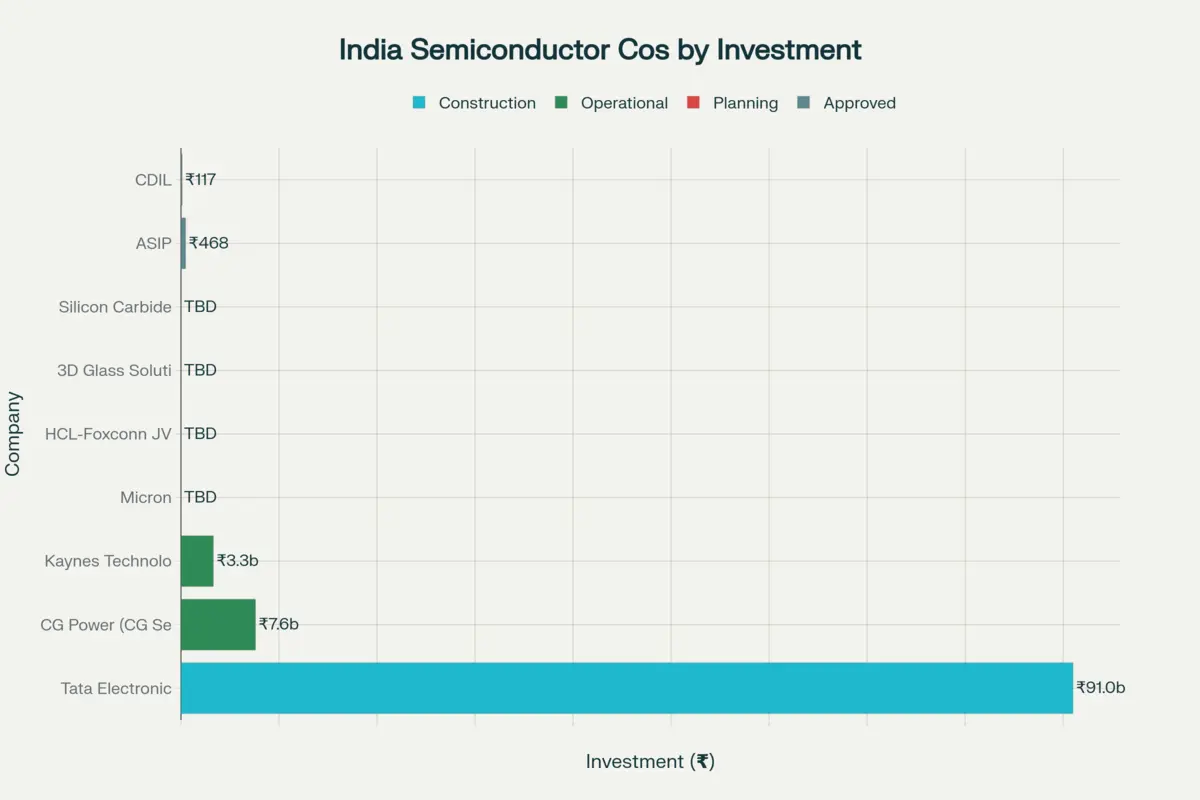

CG Power has emerged as India's semiconductor trailblazer through its subsidiary CG Semi Private Limited, which launched the country's first end-to-end OSAT facility in Sanand, Gujarat. The company's strategic ₹7,600 crore investment over five years encompasses two advanced facilities designed to revolutionize India's chip assembly and testing capabilities.

Key Investment Highlights:

- G1 Facility: Operational since August 28, 2025, with 0.5 million units daily capacity

- Commercial Production: Expected commencement by calendar year 2026

- G2 Facility: Under construction targeting 14.5 million units daily by 2026

- Strategic Partnerships: Joint ventures with Renesas Electronics Corporation and Stars Microelectronics

Financial Performance:

The company's stock has demonstrated impressive momentum, gaining 12% over three trading sessions in early September 2025, reaching an intraday high of ₹742.75. CG Power's funding strategy combines Qualified Institutional Placement at ₹660 per share with strong internal cash generation, delivering ₹441 crores operating cash flow in Q1 FY26.

2. Kaynes Technology Limited: Rapid Execution Specialist

Kaynes Technology has distinguished itself through exceptional execution speed, moving from government approval in September 2024 to first chip delivery scheduled for October 2025 – achieving what CEO Raghu Panicker describes as "record time."

Competitive Advantages:

- Investment Security: ₹3,300 crores with unprecedented 70% government funding

- Capacity Utilization: 100% capacity secured with global and Indian clients

- Production Timeline: First samples delivered to anchor clients September 2025

- Client Diversity: Three secured anchor clients plus MOUs with four additional clients

Market Performance:

Kaynes Technology shares gained 2.74% on September 3, 2025, trading at ₹6,753, with impressive gains of 9.01% weekly and 16.67% over three months. The company demonstrates strong financial fundamentals with 57% top-line growth and 92% profit after tax CAGR.

3. Larsen & Toubro (L&T): Semiconductor Design Powerhouse

While awaiting government approval for semiconductor manufacturing, L&T's subsidiary L&T Semiconductor Technologies (LTSCT) is building a formidable presence in chip design and development through strategic acquisitions and innovative product development.

Strategic Developments:

- Recent Acquisition: Power module design assets from Fujitsu General Electronics (September 2025)

- Market Expansion: China entry planned by FY27 with local production partnerships

- Revenue Targets: $1 billion threshold to unlock $10 billion investment plans

- Design Focus: Concentrating on chip design rather than fabrication

Investment Appeal:

L&T trades at attractive valuations with current PE ratio of 31 (below 3-year median of 33.6), offering diversified risk exposure through its conglomerate structure while maintaining significant semiconductor upside potential.

SEMICON India 2025: Watershed Moment for Indian Semiconductor Industry

Historic Achievements and Global Recognition

The SEMICON India 2025 event (September 2-4, 2025) showcased India's semiconductor achievements to a global audience. Prime Minister Modi's presentation of the Vikram 32-bit processor symbolized India's entry into the elite club of semiconductor-manufacturing nations, attended by over 20,750 participants from 48+ countries.

Manufacturing Progress and Geographical Distribution

Gujarat has established itself as India's primary semiconductor manufacturing hub, hosting facilities from CG Power, Kaynes Technology, Tata Electronics, and Micron. The Sanand cluster specifically has become synonymous with India's OSAT capabilities, while Tata Electronics constructs India's first semiconductor fabrication facility in Dholera with ₹91,000 crores investment.

Investment Analysis and Valuation Metrics

Comprehensive Stock Valuation Assessment

CG Power Valuation Metrics:

- Current PE Ratio: Above 100 (versus 3-year median of 67)

- EV/EBITDA: 79 (versus median of 63)

- Investment Rationale: Premium pricing justified by semiconductor business potential

Kaynes Technology Valuation Analysis:

- Current PE Ratio: 129 (aligned with 3-year median of 130)

- EV/EBITDA: 89 (versus median of 87)

- Growth Justification: Strong order book expansion from ₹538 crores to ₹7,400 crores

L&T Investment Appeal:

- Current PE Ratio: 31 (below historical averages)

- Risk Management: Diversified business model reduces semiconductor-specific exposure

- Upside Potential: Significant growth opportunity in semiconductor design segment

Risk Assessment and Mitigation Strategies

Key Risk Factors

- Valuation Risk: Premium valuations based on future earnings potential create vulnerability to execution delays

- Technology Dependency: Success requires successful partnerships and technology transfer

- Geopolitical Factors: Global supply chain tensions could impact international operations

- Execution Risk: Semiconductor manufacturing requires precise execution with minimal margin for error

Government Policy Support Advantages

The Production Linked Incentive (PLI) scheme provides substantial competitive advantages:

- Reduced Capital Requirements: Government funding minimizes upfront investment needs

- Enhanced Profitability: Lower capital costs translate to superior margins

- Technology Access: Government backing facilitates international partnerships

- Market Confidence: Approval signals credibility to global clients and partners

Future Growth Trajectory and Market Opportunities

Semiconductor Demand Projections

India's semiconductor consumption is projected to reach $100-120 billion by 2030, driven by massive digitalization across automotive, telecommunications, and artificial intelligence sectors. This unprecedented demand creates substantial opportunities for domestic manufacturers across the value chain.

Primary Growth Drivers:

- 5G Infrastructure: Increased demand for advanced communication chips

- Electric Vehicles: Growing need for power management semiconductors

- Data Centers: Rising demand for high-performance computing chips

- IoT Expansion: Proliferation of connected devices requiring specialized chips

Employment Generation and Skill Development

The semiconductor ecosystem is expected to generate over 5,000 direct and indirect jobs from current approved projects alone. Companies are investing heavily in workforce development through international training programs for Indian engineers and technicians, creating a sustainable talent pipeline.

Investment Strategy and Portfolio Recommendations

Diversified Semiconductor Exposure Approach

Strategic Allocation Framework:

- CG Power: Direct exposure to OSAT manufacturing with operational facilities

- Kaynes Technology: High-growth OSAT player with strong order visibility

- L&T: Design-focused approach with potential for large-scale manufacturing

Risk-Managed Investment Implementation

- Phased Entry Strategy: Consider staggered investments given current premium valuations

- Long-term Horizon: Semiconductor investments require 3-5 year timeframe for full potential realization

- Sector Allocation: Limit semiconductor exposure to appropriate portfolio percentage

- Active Monitoring: Track execution milestones and government policy developments

Critical Performance Metrics

Operational Parameters to Monitor:

- Production ramp-up schedules and capacity utilization rates

- Client acquisition and order book growth patterns

- Technology partnership developments and milestones

- Government approval status for new projects and expansions

Financial Metrics for Evaluation:

- Revenue contribution from semiconductor business segments

- Margin expansion from government-supported projects

- Capital allocation efficiency and ROI improvements

- Cash flow generation and reinvestment rates

Conclusion: India's Semiconductor Investment Opportunity

India's semiconductor revolution represents more than industrial policy – it embodies the nation's commitment to technological sovereignty and economic security. The convergence of substantial government support, private sector investment, and international partnerships has created a foundation for sustained growth in this critical sector.

The three highlighted stocks – CG Power, Kaynes Technology, and L&T – offer distinct risk-reward profiles for investors seeking exposure to India's semiconductor boom. CG Power leads with operational facilities, Kaynes Technology offers rapid execution with strong government backing, while L&T provides diversified exposure with significant upside potential.

Investment Thesis Summary:

- Market Opportunity: 17% CAGR growth to $110 billion by 2030

- Government Support: Unprecedented PLI scheme backing with 50-70% funding

- Execution Progress: Multiple facilities becoming operational in 2025-2026

- Strategic Importance: Critical for India's technological self-reliance and national security

As India transitions from semiconductor consumer to producer, these investments represent participation in a generational shift toward technological independence. Investors should carefully consider premium valuations and execution risks while maintaining a long-term investment horizon to capture the full potential of India's semiconductor revolution.

Disclaimer: This analysis represents informational content only and should not be considered investment advice. Potential investors should conduct thorough due diligence and consult with qualified financial advisors before making investment decisions. Past performance does not guarantee future results, and semiconductor stocks carry inherent risks related to technology development, execution capabilities, and market volatility.