Technical Analysis for 12th Feb 2026

Nifty Predictions, Bank Nifty Predictions & Sensex Predictions

The Indian Stock Market closed on a subdued note on February 11, 2026, amid sideways consolidation and anticipation of Sensex expiry. Nifty 50 settled at 25,953, marginally up . Bank Nifty ended at 60,745.Sensex closed lower at 84,233.

This Technical Analysis for 12th Feb 2026 is based on the latest 15-minute TradingView charts & derivative data insights indicating flat to small gap-up open with high sideways probability (60%).

Key Observations of Today’s Derivative Market Data

The session remained range-bound for the third straight day, with option sellers pinning indices in no-trade zones. Gift Nifty held key supports, but trendline breakdown lacked follow-through lower lows.

- Nifty 50: Open 25,945 | High 26,001 | Low 25,901 | Close 25,953

- Bank Nifty: Open 60,670 | High 60,751 | Low 60,650 | Close 60,745

- Sensex: Open 84,339 | High 84,487 | Low 84,200 | Close 84,233

Candle Pattern Explanation: Neutral doji formations on daily charts signal indecision. 15-minute charts show repeated pivot tests without breaks, aligning with double-top patterns and sideways bias. Bearish pressure eased, but no bullish momentum yet.

Support & Resistance Levels

Derived from pivots, VWAP, high OI strikes, and video analysis:

Nifty Support & Resistance

- Support: 25,880, 25,500, 25,000

- Resistance: 26,000, 26,100, 26,200

Bank Nifty Support & Resistance

- Support: 60,650, 60,400, 60,000

- Resistance: 60,740, 60,800, 61,000

Sensex Support & Resistance

- Support: 84,000, 83,800, 83,500

- Resistance: 84,500, 84,700, 85,000

Nifty Predictions – Technical Analysis for Tomorrow

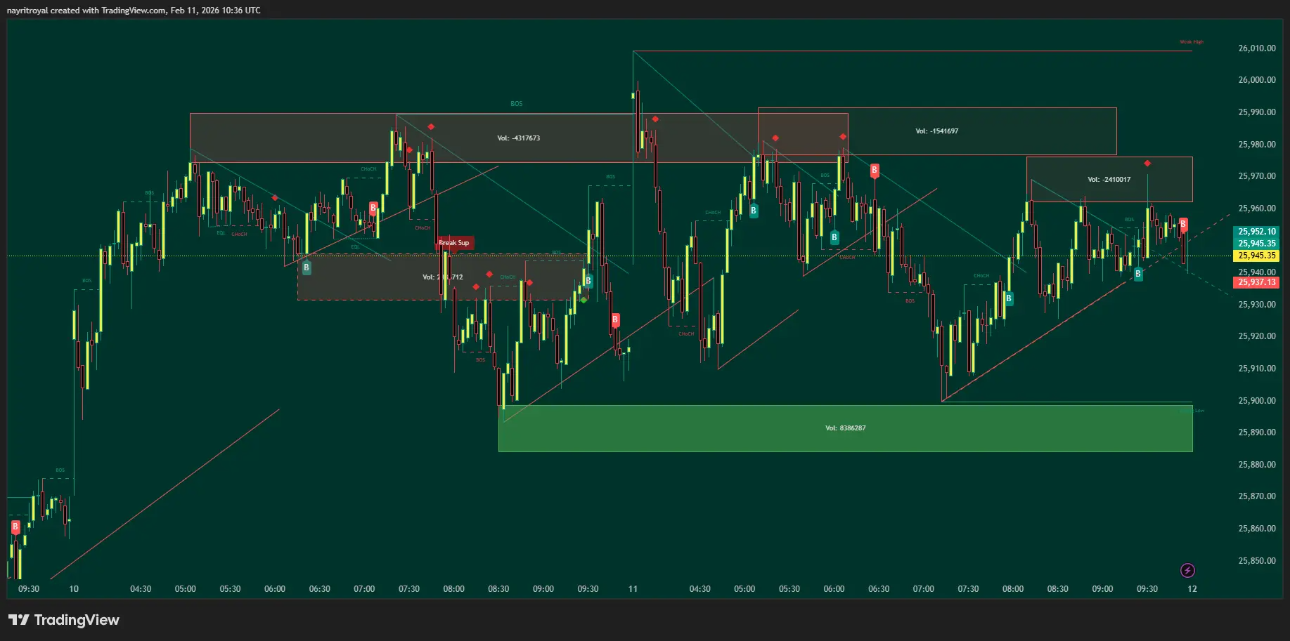

Caption: Real TradingView snapshot of Nifty 50 15-Minute Chart (Feb 11, 2026 close) – Consolidation flag between 25,900-26,000. S/R at 25,880 (support), 26,000 (resistance), RSI neutral at 50. High OI pins at key strikes.

Caption: Real TradingView snapshot of Nifty 50 15-Minute Chart (Feb 11, 2026 close) – Consolidation flag between 25,900-26,000. S/R at 25,880 (support), 26,000 (resistance), RSI neutral at 50. High OI pins at key strikes.

Our Opinion: Sideways with 60% probability in no-trade zone. 15m chart shows indecision post-trendline break; await breakout. Flat/small gap-up open expected.

- Bullish Scenario (Sustain >26,000): Targets 26,100-26,200. Entry: 26,010 | Stop-loss: 25,980 | Strategy: Buy calls on 15m close above.

- Bearish Scenario (Break <25,880): Targets 25,500-25,000. Entry: 25,870 | Stop-loss: 25,910.

- Trading Zones: Dips to 25,900-25,880 buy; rallies to 26,000 sell. Avoid middle until direction.

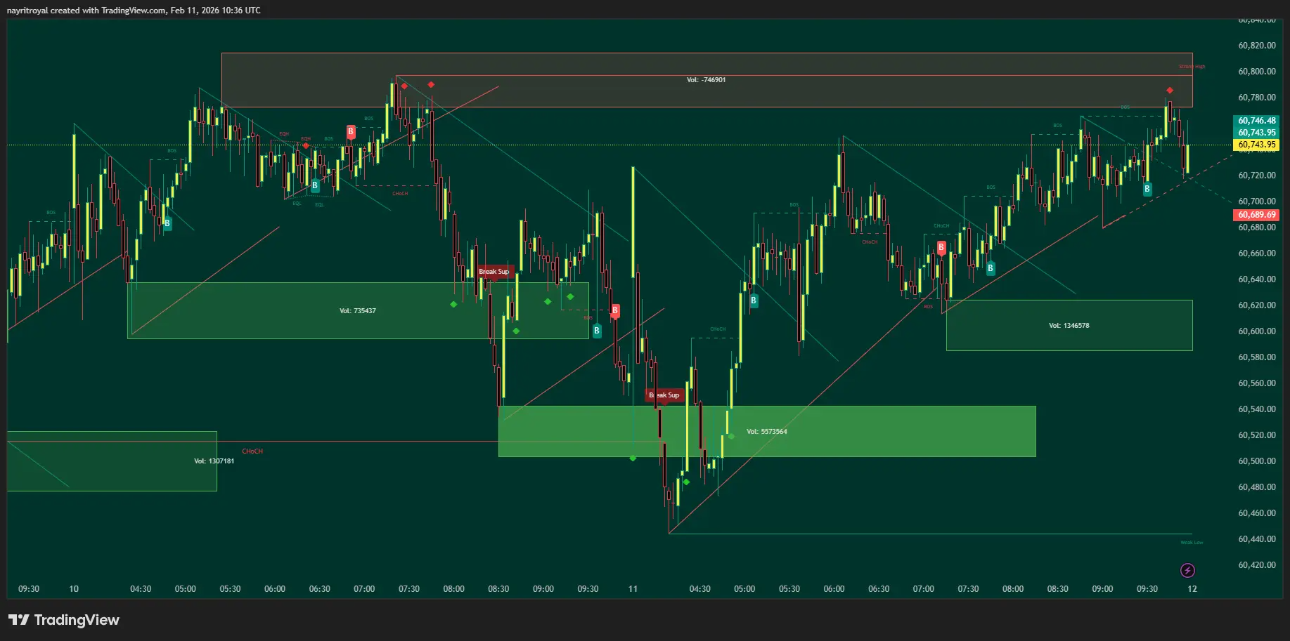

Bank Nifty Predictions – Technical Analysis

Our Opinion: Strongest upside potential among indices. 15m shows momentum build-up; fast moves expected on breakout above 60,740. Slow downside due to supports.

- Bullish Scenario (Break >60,740): Targets 60,800-61,000. Entry: 60,750 | Stop-loss: 60,650 | Strategy: Call buying on volume surge.

- Bearish Scenario (Below 60,650): Targets 60,400. Entry: 60,640 | Stop-loss: 60,700. (Low probability)

- Trading Zones: Accumulate 60,670-60,650; trail on upside.

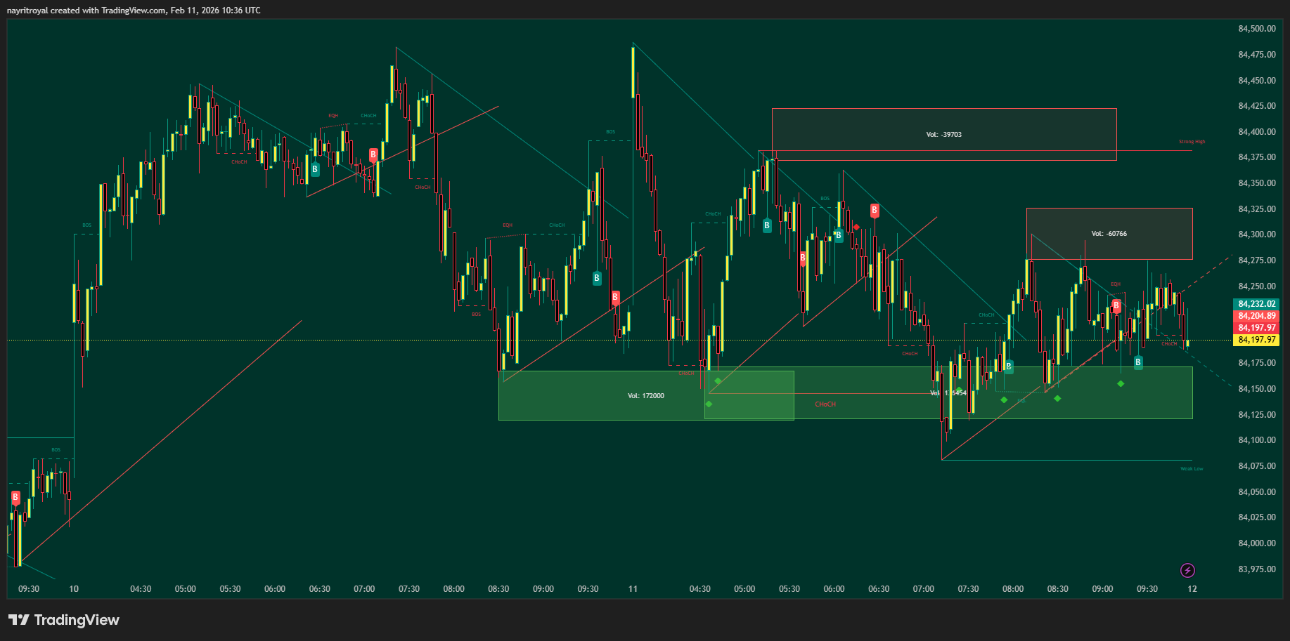

Sensex Predictions – Technical Analysis

Our Opinion: Pure sideways play ahead of expiry. 15m respects 500-point zone; no-trade middle (84,000-84,500). Puts active below 84,700 if break.

- Bullish Scenario (Above 84,500): Targets 84,700-85,000. Entry: 84,520 | Stop-loss: 84,450.

- Bearish Scenario (Below 84,000): Targets 83,800. Entry: 83,980 | Stop-loss: 84,050.

- Trading Zones: Range trade only; option sellers favored.

Tomorrow’s Market Prediction

Overall Outlook: Sideways (60%+), flat/small gap-up open. Bank Nifty leads mild bullishness; Nifty/Sensex consolidate. Market Prediction: Theta decay benefits sellers unless global triggers. Watch Gift Nifty and 15m breakouts for Indian Stock Market direction.

Final Verdict

Previous calls accurate at 75%+ for ranges. Reconfirm sideways for 12th Feb 2026 – trade breakouts with Support and Resistance Levels.

Disclaimer: This analysis is for educational purposes only. Not investment advice. Please consult your financial advisor before trading.