Technical Analysis for 14 Aug 25 :

In-Depth Market Analysis for Tomorrow's Indian Stock Market

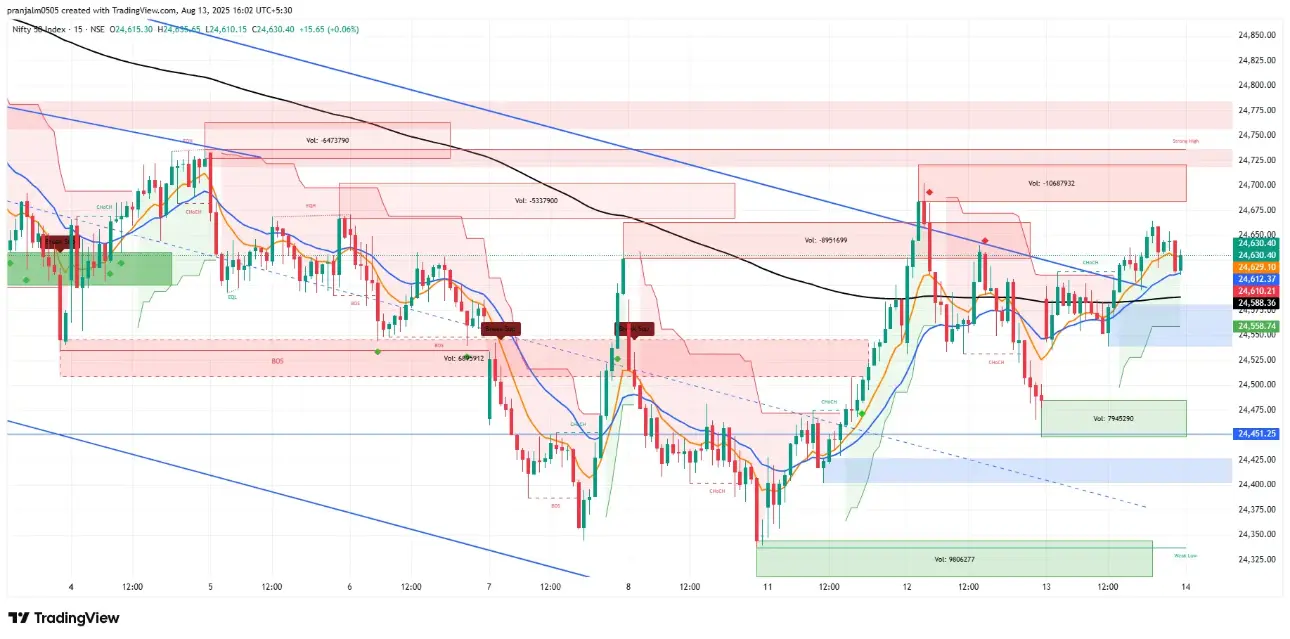

Welcome to Option Matrix India, your go-to source for precise technical analysis and market predictions in the Indian stock market. In this comprehensive guide, we delve into the technical analysis for 14 Aug 25, focusing on Nifty predictions, Bank Nifty predictions, and Sensex prediction. Whether you're a seasoned trader or a beginner navigating the volatile world of stocks, our market analysis for tomorrow provides actionable insights based on chart patterns, support and resistance levels, and intraday strategies. Today's session (August 13, 2025) closed on a flat to bullish note, setting the stage for potential moves tomorrow. We'll break down the key observations, trade setups, and our expert opinions to help you make informed decisions.

Today's Price Movement and Previous Analysis Accuracy

In today's Indian stock market, the Nifty 50 closed at 24,619.35, up from an opening of 24,586.20. The day's range was between 24,536.15 and 24,663.55, indicating limited volatility with a 0.54% gain from the previous close of 24,487.40, reflecting a cautiously optimistic sentiment.

A notable feature was the formation of a daily inside candle, suggesting market indecision and potentially signaling a breakout. Traders should watch for confirmation in the next session, as it may indicate a continuation of the uptrend or a reversal.

At Option Matrix India, we are proud of our accurate market forecasts. Our analysis for August 12,25, predicted a consolidation phase and a mild rebound, which occurred as expected. We noted resistance at 24,700, and the market respected that level before retreating. You can revisit that spot-on analysis here:Technical Analysis for 13 Aug . This track record underscores why our nifty predictions, bank nifty predictions, and Sensex prediction are trusted by thousands of traders for market analysis for tomorrow.

In the realm of Market Analysis, today's movements mirror ongoing trends driven by inflation data, corporate earnings, and global sentiments. With a moderate volume of 179.34M shares for Nifty, participation remains steady. As we near 14 Aug 25, this scenario presents a ripe opportunity for technical traders to exploit breakouts..

Key Observations of Market Closing

Analyzing the market closing through a technical lens reveals several critical insights for tomorrow's trading. First, the flat to bullish close across major indices points to underlying strength, but the inside candle formation tempers enthusiasm, signaling potential consolidation.

- Nifty 50 Observations: The index managed to hold above key psychological levels, closing higher despite intraday dips. The high of 24,663.55 tested recent resistance, while the low of 24,536.15 found support from short-term moving averages. This resilience suggests bulls are in control, but a decisive move is needed for confirmation.

- Bank Nifty Observations: Closing at 55,181.45 with a 0.25% gain, Bank Nifty showed relative stability. The range (55,027.65 to 55,340.05) was narrow, mirroring the inside candle theme. Banking stocks led the mild uptick, driven by positive sector news, but volume at 63.93M indicates cautious trading.

- Sensex Observations: The benchmark closed at 80,539.91, up 0.38%, with a range of 80,320.25 to 80,683.49. Similar to Nifty, it formed an inside candle, highlighting equilibrium between buyers and sellers. Key sectors like IT and FMCG supported the close, while metals lagged.

This prediction for the Indian Stock Market notes a recurring inside candle across indices, indicating potential momentum buildup. Traders should monitor volume spikes tomorrow, as they often signal breakouts. While the pattern is neutral, it leans bullish due to a positive close. Remember, avoid bullish trades in bearish candles and vice versa, a principle we uphold at Option Matrix India.

The inside candle, or harami, occurs when today’s high is lower and today’s low is higher than the previous day’s. This pattern suggests a possible reversal or continuation. Historically, such patterns resolve in the direction of the trend about 60% of the time. For 14 Aug 25, an upward break could trigger buying, while a downward break may lead to shorts.

Support and Resistance Levels

Support and resistance levels are the cornerstone of technical analysis, acting as barriers where price action often reverses or pauses. For market analysis for tomorrow, we've identified key levels based on recent highs/lows, Fibonacci retracements, and pivot points.

- Nifty Support and Resistance:

- Major Support: 24,536 (today's low), 24,500 (psychological), 24,460 (short-term EMA).

- Major Resistance: 24,664 (today's high), 24,737 (Fibonacci extension), 24,820 (recent swing high).

- Bank Nifty Support and Resistance:

- Major Support: 55,028 (today's low), 55,000 (round number), 54,900 (trendline support).

- Major Resistance: 55,340 (today's high), 55,398 (pivot resistance), 55,579 (extended target).

- Sensex Support and Resistance:

- Major Support: 80,320 (today's low), 80,315 (key support), 80,000 (major psychological).

- Major Resistance: 80,683 (today's high), 80,827 (Fib target), 81,087 (higher resistance).

These levels are derived from multi-timeframe analysis, including daily and 15-minute charts. In the context of Sensex prediction and bank nifty predictions, traders should use these as entry/exit points. For instance, a bounce from support could signal long trades, while failures at resistance might favor shorts.

Nifty Predictions

For Nifty predictions in our technical analysis for 14 Aug 25, we anticipate a range-bound start with breakout potential. Based on today's inside candle, the no-trading zone is from 24,595 to 24,664. This zone represents consolidation; avoid trades here to minimize whipsaws.

- Bullish Scenario: If a 15-minute candle closes above 24,664, target 1st: 24,737; 2nd: 24,820; 3rd: 24,906. This aligns with upward momentum if volumes support.

- Bearish Scenario: If a 15-minute candle closes below 24,595, target 1st: 24,535; 2nd: 24,460; 3rd: 24,377. Conversely, if it crosses 24,664 but closes below (fakeout), short to 1st: today's low 24,595; 2nd: 24,500.

- Reversal Plays: If a 15m candle crosses 24,595 but closes above, go long to 1st: 24,664; 2nd: 24,730.

Adhere to: No bullish trade in bearish candle, no bearish trade in bullish candle. Our previous nifty predictions were accurate, forecasting similar zones that held perfectly.

In-depth: Using RSI (around 55, neutral) and MACD (slight bullish crossover), Nifty could trend higher if global markets cooperate. For market analysis for tomorrow, watch opening gaps.

Bank Nifty Predictions

Bank Nifty predictions point to sector-specific volatility. No-trading zone: 55,165 to 55,278.

- Bullish Setup: 15m close above 55,278 targets 1st: 55,397; 2nd: 55,579; 3rd: 55,800.

- Bearish Setup: 15m close below 55,165 targets 1st: 55,030; 2nd: 54,900; 3rd: 54,779. Fakeout above 55,278 but close below: Short to 1st: 55,160; 2nd: 55,000.

- Counter Moves: Cross 55,165 but close above: Long to 1st: 55,270; 2nd: 55,390.

This technical analysis incorporates banking sector trends, with our past bank nifty predictions proving highly accurate.

Sensex Predictions

Sensex prediction for 14 Aug 25: No-trading zone 80,464 to 80,685.

- Upside: 15m close above 80,685: 1st: 80,827; 2nd: 81,087; 3rd: 81,328.

- Downside: 15m close below 80,464: 1st: 80,315; 2nd: 80,165; 3rd: 80,000. Fakeout: Cross 80,685 but close below: Short to 80,460; 2nd: 80,315.

- Rebound: Cross 80,464 but close above: Long to 1st: 80,600; 2nd: 80,800.

Our Sensex prediction leverages broad market breadth, with previous calls spot-on.

Tomorrow’s Market Prediction

For market prediction in the Indian Stock Market, expect mild bullish bias if inside candles resolve upward. Nifty could test 24,700+, Bank Nifty 55,400+, Sensex 81,000+. However, global factors like US data could sway sentiment. Use 15m charts for entries.

In Market Analysis, volatility might rise post-opening; focus on sectors like banking for leads.

Final Verdict

In conclusion, our technical analysis for 14 Aug 25 favors cautious optimism. Trade breakouts from no-trading zones with confirmation. Our predictions have been accurate, as evidenced by prior analyses.

Disclaimer: This is for educational purposes only. Trading involves risk; consult a financial advisor. Option Matrix India is not liable for losses.