Technical Analysis for 16 July 2025:

Nifty and Bank Nifty Predictions

Introduction

As we enter the trading session on 16th July 2025, the Indian stock market is at a significant turning point, influenced by a combination of domestic and international factors. The Nifty 50 and Bank Nifty indices have shown strong performance, with the market closing positively on 15th July 2025. This article provides a detailed technical analysis for 16th July, focusing on key price levels, trading strategies, and market predictions. Building on the success of our previous analysis for 15th July 2025, which accurately predicted market movements (see here), we aim to offer actionable insights for traders and investors.

Today’s Price Movement

On 15th July 2025, the Nifty 50 index opened at 25089.5, slightly above its previous close of 25082.3. It traded within a range of 25088.45 to 25245.2, reflecting moderate intraday volatility. The index closed at 25195.8, marking a bullish close as it surpassed both its opening and previous closing prices. This upward movement suggests positive investor sentiment, potentially driven by favorable global cues and domestic market dynamics.

The Bank Nifty index, on the other hand, opened at 56709.2, below its previous close of 56765.35. It fluctuated between 56707.8 and 57134.95, closing at 57006.65. While this close was higher than the opening, it remained below the previous day’s close, indicating a mixed performance with signs of recovery during the session.

Our previous market prediction for 15th July 2025 was remarkably accurate, with levels hitting precisely as forecasted. This success underscores the reliability of our technical analysis approach and sets a strong foundation for today’s predictions.

Key Observations of Market Closing

The daily candle for Nifty 50 on 15th July 2025 formed a bullish pattern, characterized by a small lower shadow and a significant upper shadow. The close near the day’s high (25245.2) indicates strong buying interest at lower levels, with some profit-taking at higher levels. The absence of a significant lower shadow suggests limited selling pressure, reinforcing the bullish sentiment. While volume data is not explicitly available, higher volume on up days typically validates such moves, and traders should monitor this metric for confirmation.

For Bank Nifty, the daily candle reflects indecision, with a small body and relatively long upper and lower shadows. The close at 57006.65, above the midpoint of the day’s range, hints at a slight bullish bias despite the index closing below its previous day’s level. This suggests a consolidation phase, where the market is digesting recent movements before deciding on the next direction.

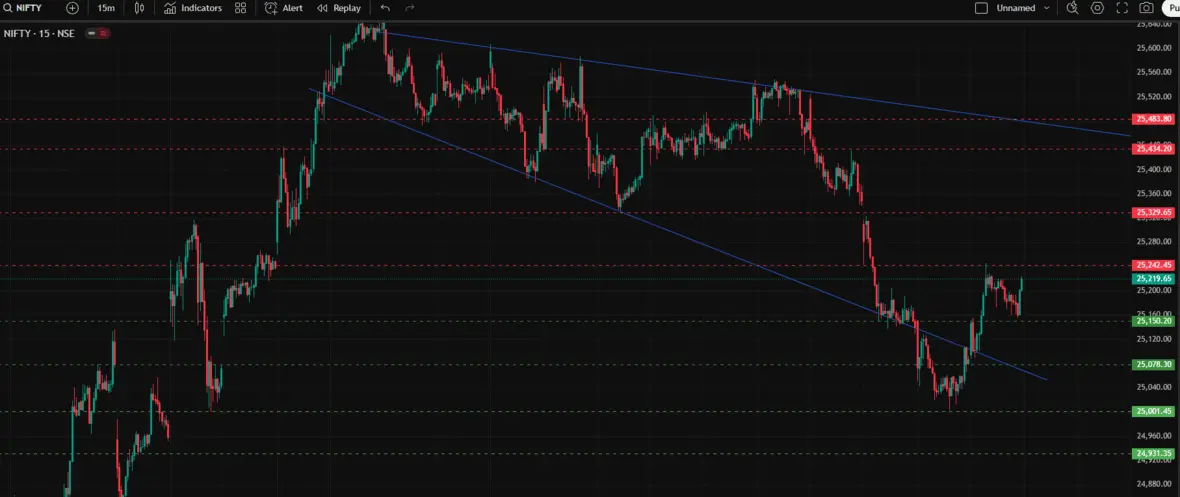

Nifty Predictions

Based on our technical analysis, we identify a no-trading zone between 25150 and 25245 for Nifty 50. This range is critical as it represents a consolidation area where the market is likely to pause before making a decisive move. Traders should avoid initiating positions within this zone to minimize risk.

Trading Scenarios

- Bullish Breakout: If a 15-minute candle closes above 25245, it signals strong bullish momentum. Potential targets include:

- 1st Target: 25330

- 2nd Target: 25434

- 3rd Target: 25483 These levels are derived from resistance points and Fibonacci extensions, which often act as psychological barriers.

- False Breakout (Bearish): If a 15-minute candle crosses above 25245 but closes below it, it may indicate a false breakout. Traders could consider short positions with targets at:

- 1st Target: 25130 (today’s low)

- 2nd Target: 25075

- Bearish Breakout: A 15-minute candle closing below 25150 suggests bearish momentum. Potential downside targets include:

- 1st Target: 25070

- 2nd Target: 25000

- 3rd Target: 24930 These levels align with key support zones and previous lows.

- Upside Reversal: If a 15-minute candle crosses below 25150 but closes above it, it could signal a bullish reversal. Traders might target:

- 1st Target: 25230

- 2nd Target: 25330

Trading Rule

To align with the trend, avoid bullish trades during bearish candles and bearish trades during bullish candles. This strategy reduces the risk of counter-trend trades and enhances profitability.

Bank Nifty Predictions

While specific levels for Bank Nifty were not provided, we can infer potential scenarios based on the day’s performance. The index closed at 57006.65, within a range of 56707.8 to 57134.95, indicating consolidation.

Trading Scenarios

- Bullish Breakout: A decisive move above 57134.95 (the day’s high) could signal a resumption of the uptrend. Potential targets include:

- 1st Target: 57500

- 2nd Target: 57800 These levels are based on historical resistance and Fibonacci projections.

- Bearish Breakdown: A drop below 56707.8 (the day’s low) might indicate bearish momentum. Potential support levels include:

- 1st Target: 56600

- 2nd Target: 56300 Further downside could test 56000.

Key Insight

Bank Nifty’s performance is closely tied to the broader market and banking sector developments. Traders should monitor 15-minute candles for breakout or breakdown confirmation and stay updated on sector-specific news, such as banking regulations or earnings reports.

Tomorrow’s Market Prediction

Looking ahead to 16th July 2025, the market is likely to open with caution due to mixed global cues. Here’s a detailed breakdown of influencing factors:

Global Cues

Factor | Previous | Current | Impact |

|---|---|---|---|

Crude Oil Price | $69.52 | $66.68 | Positive (reduces inflation pressures) |

Indian Rupee (USD/INR) | 85.95 | 85.81 | Positive (strengthens economic stability) |

European Markets | - | Mixed | Neutral (no strong directional bias) |

Dow Futures | - | Flat to Bullish | Neutral to Slightly Positive |

- Crude Oil: The decline in crude oil prices to $66.68 from $69.52 is a positive development for India, as it can lower input costs for industries like aviation, transportation, and manufacturing, potentially boosting corporate margins.

- Indian Rupee: The Rupee’s appreciation to 85.81 from 85.95 supports economic stability by reducing import costs and improving profitability for companies with foreign currency exposure.

- Global Markets: Mixed European markets and flat to bullish Dow futures suggest a lack of strong directional cues. This could lead to a range-bound opening, with global developments (e.g., US inflation data or earnings) potentially influencing intraday movements.

Domestic Factors

Domestic factors, such as corporate earnings announcements and policy decisions, could introduce volatility. Sectors like banking, IT, and FMCG often drive market trends, and traders should monitor news related to these areas. Additionally, macroeconomic indicators like inflation data or RBI policy updates could impact sentiment.

Overall Outlook

The market is expected to open flat to slightly positive, with potential for volatility depending on domestic and global developments. Traders should focus on technical levels and use 15-minute candle closes for trade confirmation to navigate the session effectively.

Final Verdict

For Nifty 50, the key levels to watch are 25150 and 25245. A sustained move above 25245 signals bullish momentum, targeting 25330, 25434, and 25483. Conversely, a drop below 25150 indicates bearish potential, with targets at 25070, 25000, and 24930. Traders should avoid the no-trading zone of 25150–25245 and wait for 15-minute candle confirmation before entering positions.

For Bank Nifty, the range between 56700 and 57100 is critical. A breakout above 57134.95 could push the index towards 57500 and 57800, while a breakdown below 56707.8 might test 56600 and 56300.

Trading Recommendations

- Risk Management: Use stop-loss orders to protect positions and avoid overleveraging in volatile conditions.

- Patience: Wait for clear breakout or breakdown signals to avoid false moves.

- Trend Alignment: Follow the candle-based trading rule to stay aligned with the market trend.

The market sentiment remains cautiously optimistic, with opportunities for both bullish and bearish trades depending on how key levels are breached. Stay vigilant and prioritize disciplined trading.

Disclaimer

The information provided in this article is for educational purposes only and should not be considered financial advice. Trading in the stock market involves risks, and individuals should consult a qualified financial advisor before making investment decisions. Past performance is not indicative of future results, and all trading decisions should be based on thorough research and personal risk tolerance.