Technical Analysis for 17th Sept 2025 and Market Forecast

The Indian Stock Market continues to showcase strong momentum ahead of the trading session on September 17, 2025. Our Technical Analysis offers detailed insights into Nifty Predictions, Bank Nifty Predictions, and Sensex Predictions, with actionable intraday trading strategies based on the 15-minute timeframe. This analysis highlights crucial support and resistance levels, entry and exit strategies, and risk management guidelines to help traders prepare for tomorrow’s market session.

Current Market Overview and Key Technical Levels

Market Performance Summary

Indian equity indices closed Monday's session with mixed sentiment, creating an intriguing technical setup for Tuesday's trading. Nifty 50 settled at 25,239.10 with a gain of 169.9 points (0.68%), while Bank Nifty demonstrated exceptional strength, closing at 55,147.60 with an impressive gain of 259.75 points (0.47%). Sensex showed consolidation behavior, ending at 82,380.74 with gain percentage 0.71%.

Technical Analysis Framework for 15-Minute Timeframe

Our comprehensive technical analysis incorporates multiple analytical approaches including pivot point calculations, RSI analysis, support and resistance identification, and volume analysis specifically tailored for 15-minute timeframe trading strategies.

Technical Analysis and Nifty Predictions

Current Technical Setup

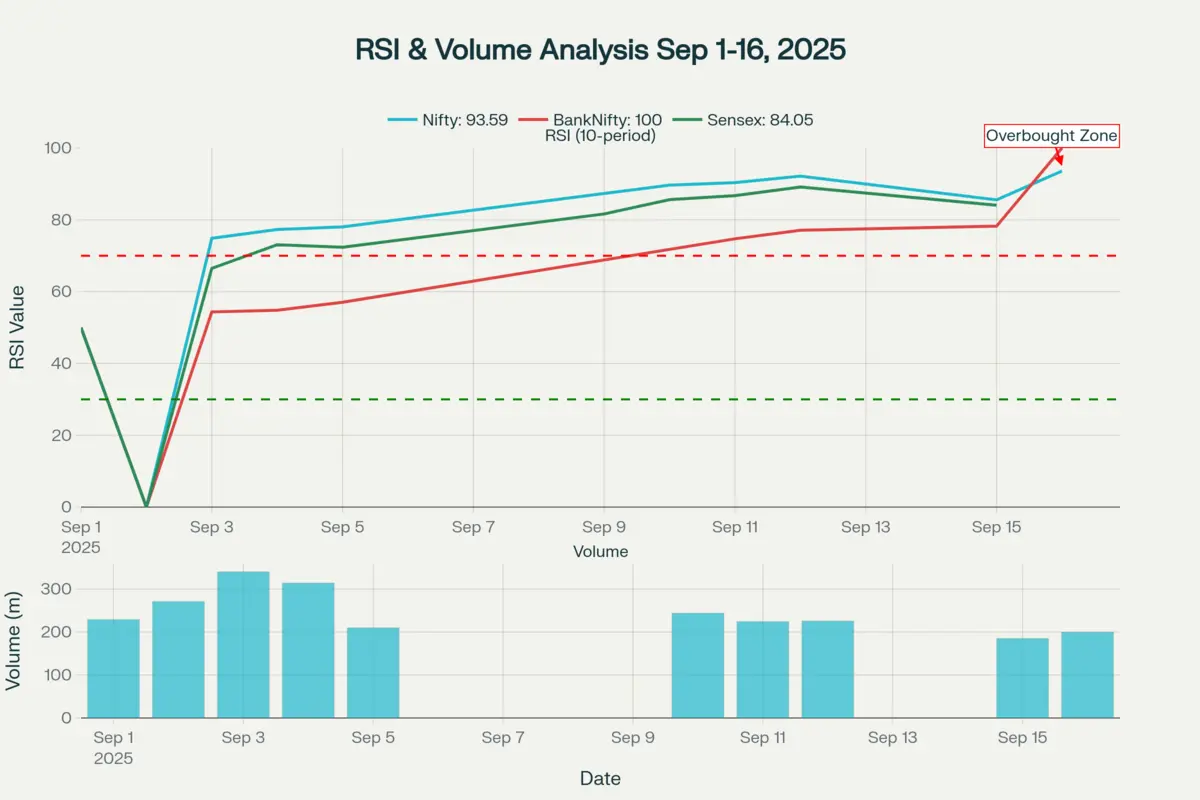

Nifty 50 has shown remarkable resilience, maintaining positions above all key exponential moving averages (20, 50, 100, 200-day EMAs). The index currently trades with an RSI of 93.59, indicating overbought conditions that require careful monitoring. The formation of a small reversal candle on the daily chart suggests potential consolidation before the next directional move.

Critical Support and Resistance Levels

Immediate Resistance Levels:

- Primary Resistance: 25,150 - 25,200 (Critical breakout zone, Already break)

- Secondary Resistance: 25,250 - 25,320

- Major Resistance: 25,400 - 25,500

Strong Support Levels:

- Immediate Support: 25,000 - 25,050

- Critical Support: 24,900 - 24,950

- Major Support: 24,800 - 24,850

Nifty Trading Strategy for September 17, 2025

Bullish Scenario - Buy Strategy

- Entry Criteria: 15-minute candle close above 25,260

- First Target: 25,323

- Second Target: 25,355

- Third Target: 25,400

- Stop Loss: 24,920

- Risk-Reward Ratio: 1:2.5

Bearish Scenario - Sell Strategy

- Entry Criteria: 15-minute candle close below 25,035

- First Target: 24,975

- Second Target: 24,886

- Third Target: 24,750

- Stop Loss: 25,100

- Risk-Reward Ratio: 1:2.2

Technical Analysis and Bank Nifty Predictions

Exceptional Momentum Analysis

Bank Nifty continues to outperform broader indices, displaying textbook ascending channel formation with sustained buying interest. The index trades with an RSI of 100.00, indicating extreme overbought conditions that require strategic position management.

Key Technical Levels for Bank Nifty

Critical Resistance Zones:

- Immediate Resistance: 55,100 - 55,200 (Major supply zone)

- Breakout Target: 55,300 - 55,500

- Extended Target: 55,600 - 56,000

Crucial Support Areas:

- Primary Support: 54,600 - 54,700

- Strong Support: 54,400 - 54,500

- Critical Support: 54,200 - 54,300

Bank Nifty Trading Strategy for September 17, 2025

Bullish Scenario - Long Setup

- Entry Criteria: 15-minute sustenance above 55,200

- Target 1: 55,300

- Target 2: 55,400

- Target 3: 55,500

- Stop Loss: 54,700

- Risk-Reward Ratio: 1:2.0

Bearish Scenario - Short Setup

- Entry Criteria: 15-minute close below 54,750

- Target 1: 54,576

- Target 2: 54,352

- Target 3: 54,086

- Stop Loss: 55,000

- Risk-Reward Ratio: 1:2.6

Technical Analysis and Sensex Predictions

Consolidation Phase Analysis

Sensex exhibits classic sideways consolidation behavior with an RSI of 84.05, suggesting the index is approaching overbought territory while maintaining structural strength above key moving averages.

Sensex Technical Levels

Resistance Framework:

- Immediate Resistance: 82,400 - 82,450

- Major Resistance: 83,000 - 83,200

- Breakout Target: 83,000 - 83,200

Support Structure:

- Immediate Support: 81,700 - 82,000

- Strong Support: 81,200 - 81,400

- Critical Support: 80,800 - 81,000

Sensex Trading Strategy for September 17, 2025

Bullish Scenario - Buy Strategy

- Entry Criteria: 15-minute breakout above 82,450

- Target 1: 82,780

- Target 2: 83,030

- Target 3: 83,200

- Stop Loss: 82,000

- Risk-Reward Ratio: 1:2.1

Bearish Scenario - Sell Strategy

- Entry Criteria: 15-minute breakdown below 81,600

- Target 1: 81,200

- Target 2: 81,000

- Target 3: 80,700

- Stop Loss: 82,000

- Risk-Reward Ratio: 1:2.3

Market Catalysts and Risk Factors

Institutional Flow Analysis

Foreign Institutional Investors (FIIs) continued net selling with ₹1,268.59 crore outflow, while Domestic Institutional Investors (DIIs) maintained strong buying momentum with ₹1,933.33 crore inflow on the last trading session. This divergence creates interesting technical setups.

Global Cues Impact

The U.S. Federal Reserve policy decision scheduled for this week remains a critical catalyst. Market consensus expects a 25 basis point rate cut, which could trigger fresh foreign inflows and support ongoing bullish momentum.

Options Data Insights

Nifty Options Analysis:

- Maximum Call OI: 25,100 strike (1.86 crore contracts) - Key resistance

- Maximum Put OI: 25,000 strike - Strong support

- Put-Call Ratio: 1.0308 indicates neutral to slightly bullish sentiment

Bank Nifty Options Analysis:

- Strong Put writing at 54,500 levels confirms support

- Call writing concentration at 55,200 suggests resistance

Risk Management and Trading Guidelines

Position Sizing Strategy

For 15-minute timeframe trading:

- Risk per trade: 1-2% of capital

- Position size calculation based on stop-loss distance

- Maximum 3 simultaneous positions across indices

No Trading Zones

Critical No-Trade Zones to avoid whipsaws:

- Nifty: 25,035 - 25,153

- Bank Nifty: 54,750 - 55,050

- Sensex: 81,600 - 82,000

Market Outlook and Strategic Recommendations

Short-Term Technical Outlook

Technical analysis suggests a bullish to neutral bias across Indian indices, with Bank Nifty leading the momentum. The market structure indicates:

- Trend Continuation: Sustained institutional buying supports higher levels

- Volatility Expansion: Expected around key resistance breakouts

- Sector Rotation: Banking sector outperformance likely to continue

Key Monitoring Points for September 17, 2025

Pre-Market Checklist:

- Global cues from Asian markets

- SGX Nifty indication and premium/discount

- FII/DII flow updates

- Corporate announcements impact

Intraday Monitoring:

- Volume confirmation at breakout levels

- 15-minute candle closures for entry signals

- Options unwinding patterns

- Sector performance divergence

Conclusion and Final Recommendations

Based on comprehensive technical analysis of 15-minute charts, the Indian stock market presents compelling trading opportunities for September 17, 2025. Bank Nifty emerges as the strongest performer with clear bullish momentum, while Nifty 50 requires breakout confirmation above 25,150 for sustained upward movement. Sensex remains in consolidation mode, requiring patience for directional clarity.

Key Success Factors:

- Strict adherence to stop-loss levels

- Volume confirmation for all breakouts

- Avoiding trades within no-trading zones

- Maintaining risk-reward ratio minimum of 1:2

Trading Discipline: Wait for clear 15-minute candle closures beyond defined levels before initiating positions. The market's current technical structure favors momentum-based strategies with proper risk management protocols.

Disclaimer: This technical analysis is for educational purposes only and should not be considered as investment advice. Always consult your financial advisor and conduct your own research before making trading decisions. Past performance does not guarantee future results.