Technical Analysis for 19th Sept 2025:

Nifty, Bank Nifty & Sensex Prediction

By Option Matrix India | Your Trusted Technical Analysis Partner

Published: 18th September 2025

Are you ready for tomorrow’s market moves? As trading wraps up on September 18th, 2025—with Nifty closing at 25,236.60, Bank Nifty at 55,727.45, and Sensex at 83,013.96—the focus now shifts decisively to what lies ahead on Friday, September 19th. At Option Matrix India, we cut through the noise to deliver crystal-clear, actionable insights for traders and investors. This is your definitive guide to Nifty Prediction, Bank Nifty Prediction, and Sensex Prediction—complete with critical Support and Resistance Levels, no-trade zones, and precise targets based on support & resistance level.

Technical Analysis: What to Expect on 19th September 2025

The market ended Thursday with a mild positive bias, showing consolidation near recent highs. Global sentiment remains supportive, but domestic technical structure will drive Friday’s momentum. September 19th is shaping up as a pivotal session—potentially setting the tone for the coming week.

Hey there, intraday traders! Have you heard about the magic of the 15-minute candle close? Unlike those quick price ticks or wild swings, a solid 15-minute candle close above or below important levels gives you trustworthy trade signals. It helps you tune out the market chatter and spot real momentum—making it a key part of our trading approach!

Nifty Predictions: Master the 25,331 – 25,442 No-Trade Zone

Nifty closed near its intraday high, showing underlying strength but also signs of consolidation. For Friday, the most critical area to watch is the no-trade zone between 25,331 and 25,442. Trading inside this range is discouraged—it’s a zone of indecision where false breakouts are common.

✅ Bullish Breakout Scenario

If price closes above 25,442 on a 15-minute candle:

→ First Target: 25,550

→ Second Target: 25,647

→ Third Target: 25,720

This confirms bullish control and opens the door for aggressive long positions.

⚠️ False Breakout / Bearish Rejection

If price spikes above 25,442 but closes below it on a 15-minute candle:

→ First Downside Target: 25,350

→ Second Downside Target: 25,270

This indicates seller dominance—ideal for short setups or profit booking.

🔻 Bearish Breakdown Scenario

If a 15-minute candle closes below 25,331:

→ First Support: 25,255

→ Second Support: 25,148

→ Third Support: 25,038

A confirmed breakdown here signals deeper correction—prepare for defensive or short-side trades.

🔺 Bullish Recovery Scenario

If price dips below 25,331 but then closes back above it on a 15-minute candle:

→ First Upside Target: 25,345

→ Second Upside Target: 25,421

This shows strong support—ideal for bounce trades with tight risk management.

Bank Nifty Predictions: Trade Smart Around 55,482 – 55,832

Bank Nifty mirrored the broader market’s consolidation, closing near its high. The key battleground for Friday is the no-trade corridor between 55,482 and 55,832. Respect this zone—it’s where traps are set and fortunes are made or lost.

✅ Bullish Confirmation

Close above 55,832 on a 15-minute candle:

→ First Target: 55,995

→ Second Target: 56,160

→ Third Target: 56,490

Strong breakout—ride the momentum with trailing stops.

⚠️ Bearish Fakeout

Price breaches 55,832 but closes below it on 15-minute candle:

→ First Target Down: 55,600

→ Second Target Down: 55,480

Trap for bulls—perfect setup for counter-trend shorts.

🔻 Breakdown Trigger

Close below 55,482 on 15-minute candle:

→ First Support: 55,032

→ Second Support: 54,780

→ Third Support: 54,396

Confirms bearish momentum—avoid catching falling knives.

🔺 Bounce Play

Price dips below 55,482 but closes above it on 15-minute candle:

→ First Recovery Target: 55,650

→ Second Recovery Target: 55,830

Strong rejection of lows—ideal for intraday longs.

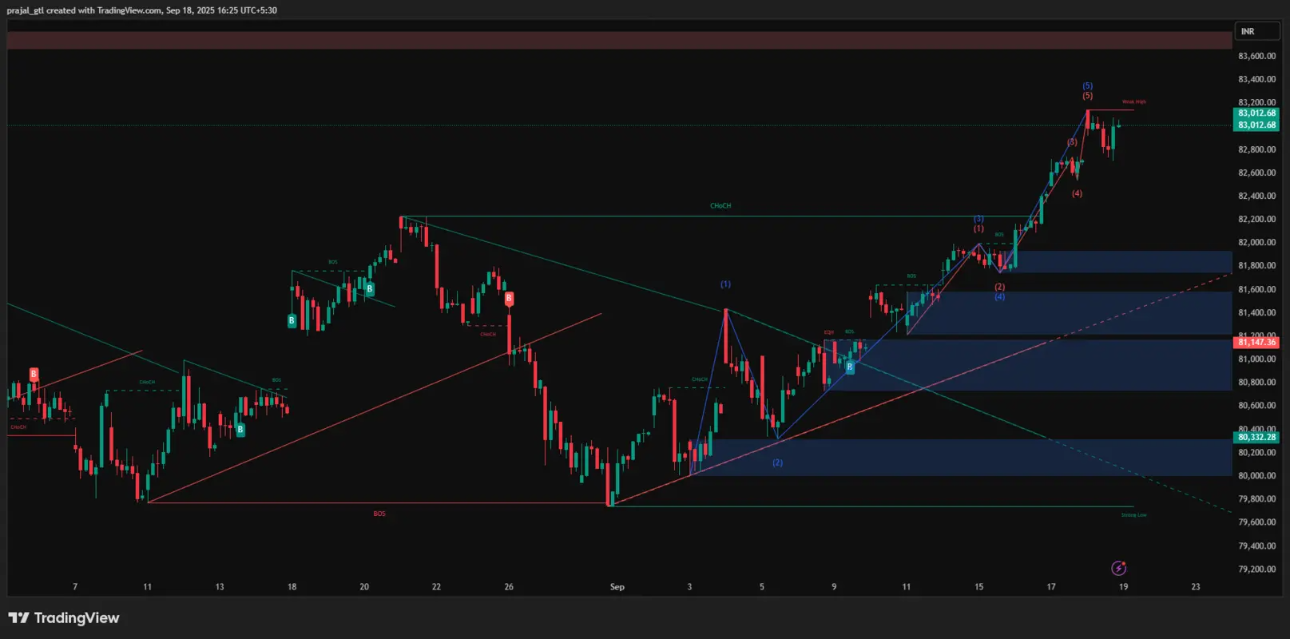

Sensex Predictions: Navigate the 82,698 – 83,115 Decision Zone

Sensex ended strong, holding near its peak. For Friday, the decisive range is 82,698 to 83,115. This is your decision-making zone—enter only after confirmation.

✅ Upside Breakout

Close above 83,115 on 15-minute candle:

→ First Target: 83,419

→ Second Target: 83,769

→ Third Target: 84,097

Powerful bullish signal—add to longs or initiate fresh positions.

⚠️ Rejection Signal

Price crosses 83,115 but closes below it:

→ First Down Target: 82,800

→ Second Down Target: 82,698

Sellers stepping in—ideal for short entries or exiting longs.

🔻 Bearish Breakdown

Close below 82,698 on 15-minute candle:

→ First Support: 82,441

→ Second Support: 82,086

→ Third Support: 81,753

Confirms downtrend—switch to defensive mode or short-side strategies.

🔺 Support Hold Play

Price tests 82,698, dips below, but closes above:

→ First Upside: 82,950

→ Second Upside: 83,141

Strong base formation—look for quick intraday long opportunities.

Market Prediction Summary

For September 19, 2025:

- NIFTY 50: Range-bound trading expected between 25,331-25,442. Breakout above 25,442 could trigger rally toward 25,550-25,720 levels.

- Bank Nifty: Momentum favors upside with 55,832 as key resistance. Sustaining above this level opens doors for 56,000+ targets.

- Sensex: Critical juncture at 82,698-83,115 range. Clear breakout in either direction will determine next major move.

The overall technical setup suggests cautious optimism, with key levels acting as decisive factors for directional moves. Traders should monitor 15-minute candle closures at these critical levels for high-probability setups. The combination of improving global cues, domestic policy support expectations, and technical breakout patterns creates a favorable environment for continued upside, provided key resistance levels are convincingly breached.

Market Analysis for Tomorrow: Final Takeaways for Traders

Your Market Prediction for 19th September 2025 boils down to one rule: Wait for the 15-minute candle close.

- Don’t trade inside the no-trade zones (Nifty: 25,331–25,442 | Bank Nifty: 55,482–55,832 | Sensex: 82,698–83,115).

- Use candle closes as your entry trigger—not spikes or wicks.

- Always set stop-losses just outside the opposite side of the breakout/breakdown level.

- Targets are progressive—book partial profits at each level.

Whether you’re focused on Nifty Prediction, Bank Nifty Prediction, or Sensex Prediction, this framework gives you a structured, disciplined approach. The Indian Stock Market rewards patience and precision—not impulsive reactions.

📌 Pro Tip: Save this analysis. Refresh this page before market open on Friday. Watch the first few 15-minute candles like a hawk. Let price confirm the direction—then strike with confidence.

Trade smart. Trade safe. Let the charts lead.

Disclaimer: This analysis is for educational purposes only and should not be considered financial advice. The stock market involves significant risk. Always conduct your own research and consult with a qualified financial advisor before making any trading decisions. Past performance is not indicative of future results.