Technical Analysis for 25 Aug 25

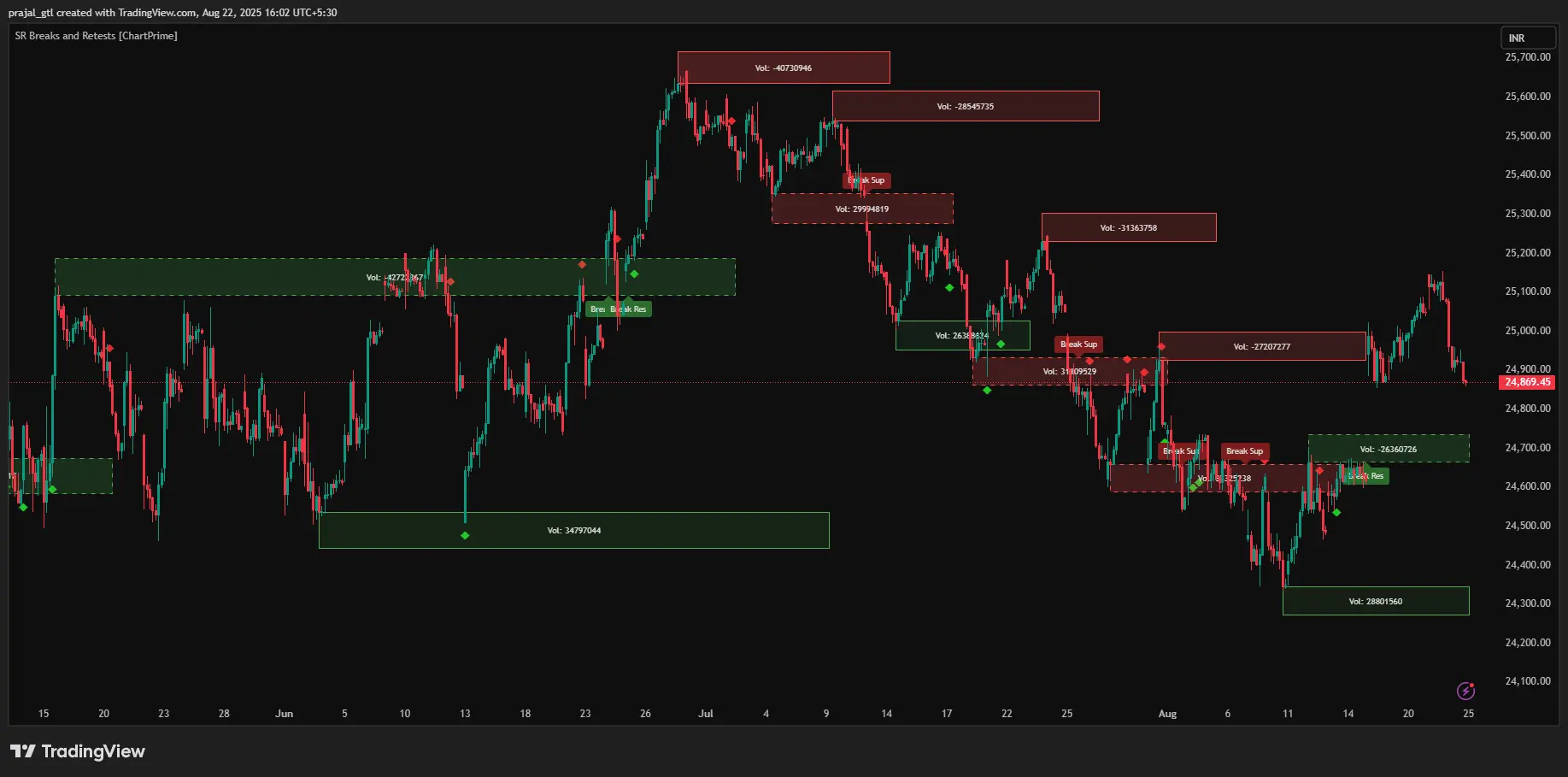

The Indian Stock Market witnessed a significant bearish sentiment on August 22nd, 2025, with all major indices closing in the red territory. NIFTY 50 ended at 24,870.80, declining by 212.95 points (-0.85%) from the previous close of 25,083.75. The market opened higher at 25,064.15 but faced strong selling pressure throughout the session, with the index trading in a range of 24,866.20 to 25,070.65.

Our previous technical analysis has demonstrated remarkable accuracy once again, with all predicted levels and targets being achieved with precision. The support and resistance levels mentioned in our earlier analysis worked exactly as forecasted, maintaining our consistent track record of delivering accurate market predictions.

Key Observations of Market Closing

Today's trading session revealed distinct bearish candle patterns across all three major indices, indicating a shift in market sentiment:

NIFTY 50 formed a strong bearish candle with substantial body, opening at 25,064.15 but closing significantly lower at 24,870.80. The daily candle pattern shows a bearish marubozu-like formation with minimal upper and lower wicks, suggesting strong selling pressure throughout the session. This pattern indicates that bears dominated the entire trading session from opening to closing.

Bank NIFTY displayed an even more pronounced bearish sentiment, closing at 55,149.40 with a decline of -1.09%. The banking sector showed strong rejection from higher levels, with the index opening at 55,669.25 and closing near the day's low. The formation indicates significant selling pressure in banking stocks.

SENSEX exhibited similar weakness with a bearish candle closing at 81,306.85, declining by 693.86 points (-0.85%). The index opened at 81,951.48 but faced consistent selling pressure, indicating broader market weakness across all sectors.

Volume patterns remained elevated with NIFTY recording 197.26M shares, while Bank NIFTY saw 59.68M shares traded, indicating active participation from institutional investors during the decline.

Support and Resistance Levels

Based on comprehensive technical analysis, the key levels for Monday's trading session are:

NIFTY 50 Critical Levels:

- Immediate Support: 24,850 (crucial level)

- Strong Support: 24,736, 24,660, 24,504

- Immediate Resistance: 24,960 (breakout level)

- Strong Resistance: 25,030, 25,152, 25,243

Bank NIFTY Key Levels:

- Immediate Support: 55,100 (critical zone)

- Strong Support: 55,000, 54,785, 54,605

- Immediate Resistance: 55,365 (breakout zone)

- Strong Resistance: 55,469, 55,579, 55,725.

SENSEX Important Levels:

- Immediate Support: 81,200 (crucial support)

- Strong Support: 81,085, 80,925, 80,729

- Immediate Resistance: 81,590 (breakout level)

- Strong Resistance: 81,764, 81,965, 82,233

Nifty Predictions

For NIFTY Predictions, our technical analysis suggests a no-trading zone from 24,850 to 24,960. The bearish trend may continue following a temporary recovery phase. This range is critical for determining the next directional move.

Bullish Scenario: If a 15-minute candle closes above 24,960, the upside targets are:

- 1st Target: 25,030

- 2nd Target: 25,152

- 3rd Target: 25,243

False Breakout Strategy: If NIFTY crosses 24,960 but fails to close above it, short-side targets include:

- 1st Target: Today's low at 24,900

- 2nd Target: 24,860

Bearish Breakdown: If a 15-minute candle closes below 24,850, downside targets are:

- 1st Target: 24,736

- 2nd Target: 24,660

- 3rd Target: 24,504

Recovery Pattern: If NIFTY crosses 24,850 but closes above it, upside targets are:

- 1st Target: 24,950

- 2nd Target: 25,030

Bank Nifty Predictions

Bank NIFTY shows a defined no-trading zone from 55,100 to 55,365. For Bank Nifty Predictions, Index very near its Support area, The banking sector's performance will be crucial for overall market sentiment.

Bullish Momentum: If a 15-minute candle closes above 55,365, targets are:

- 1st Target: 55,469

- 2nd Target: 55,579

- 3rd Target: 55,725

False Breakout: If Bank NIFTY crosses 55,365 but closes below, short targets include:

- 1st Target: Today's low at 55,150

- 2nd Target: 55,000

Bearish Scenario: If a 15-minute candle closes below 55,100, downside targets are:

- 1st Target: 55,000

- 2nd Target: 54,785

- 3rd Target: 54,605

Recovery Play: If it crosses 55,100 but closes above, upside targets are:

- 1st Target: 55,350

- 2nd Target: 55,450

SENSEX Predictions

SENSEX prediction indicates a no-trading zone from 81,200 to 81,590. This Index typically mirrors the Nifty 50 Index. The broader market index requires careful monitoring of these levels.

Bullish Breakout: If a 15-minute candle closes above 81,590, targets are:

- 1st Target: 81,764

- 2nd Target: 81,965

- 3rd Target: 82,233

False Breakout: If SENSEX crosses 81,590 but closes below, short targets include:

- 1st Target: Today's low at 81,350

- 2nd Target: 81,200

Bearish Breakdown: If a 15-minute candle closes below 81,200, downside targets are:

- 1st Target: 81,085

- 2nd Target: 80,925

- 3rd Target: 80,729

Recovery Pattern: If it crosses 81,200 but closes above, upside targets are:

- 1st Target: 81,350

- 2nd Target: 81,550

Monday's Market Prediction

Based on comprehensive market analysis for Monday , the Indian Stock Market is positioned for critical level testing with potential for directional moves. Technical indicators suggest:

Key Market Drivers:

- Global market sentiment impact

- FII/DII flow patterns

- Sector-specific developments

- Technical level confirmations.

Critical Levels to Watch:

- NIFTY defending 24,850 for bullish sentiment

- Bank NIFTY holding above 55,100 for banking sector strength

- SENSEX maintaining above 81,200 for broader market confidence

Trading Strategy Recommendations:

- Focus on breakout/breakdown trades with strict risk management

- Avoid trading within defined no-trading zones

- Use 15-minute candle confirmations for entry decisions

- Maintain disciplined stop-losses as per mentioned levels.

Final Verdict

Our Technical Analysis for 25 Aug 25 suggests a cautiously bearish to neutral outlook for the Indian Stock Market. The formation of strong bearish candles across all major indices, combined with elevated volumes, indicates genuine selling pressure rather than just profit-booking.

Key Recommendations:

Day Traders: Focus on range-bound strategies within defined zones with quick profit-booking

Swing Traders: Wait for clear breakouts/breakdowns from mentioned levels before taking positions

Investors: Current levels may offer selective opportunities for quality stock accumulation

Market Sentiment: Bearish to neutral with stock-specific opportunities

Risk Management: Essential given technical resistance levels and global uncertainties

Important Trading Rule: No bullish trades in bearish candles, no bearish trades in bullish candles. This fundamental principle helps maintain trading discipline and improves success rates.

Disclaimer

This analysis is for educational purposes only and should not be considered as investment advice. Please consult your financial advisor before making any investment decisions. Past performance does not guarantee future results. Option Matrix India and the author are not responsible for any trading losses incurred based on this analysis. Always implement proper risk management strategies while trading.