Technical Analysis for 2nd September 2025

Nifty, Bank Nifty & Sensex Predictions

Indian equity markets displayed positive momentum on September 1, 2025, with all three major indices witnessing buying interest after consolidation.

NIFTY 50 closed at 24,625.05 (+0.81%), Bank NIFTY settled at 54,002.45 (+0.65%), and SENSEX ended at 80,364.49 (+0.70%), marking a recovery session with improved volumes. This comprehensive technical analysis for 2nd Sep 2025 provides detailed Nifty predictions, Bank Nifty predictions, and Sensex predictions with precise support and resistance levels for tomorrow's trading session.

Key Observations of Today's Market Closing

The Indian Stock Market showcased positive sentiment on September 1, 2025, as investors showed renewed confidence with broad-based buying across sectors. NIFTY 50 opened at 24,432.70 and maintained upward momentum throughout the session, touching an intraday high of 24,634.65 before closing near highs. The index formed a strong bullish candle pattern with healthy volumes, indicating positive momentum after previous consolidation.

Bank NIFTY demonstrated resilient performance, opening at 53,658.15 and recovering steadily to touch 54,029.40 during the session. The banking index witnessed improved participation with a controlled trading range, indicating renewed buying interest. The sector benefited from improved banking sentiment and supportive credit growth data that boosted investor confidence.

SENSEX reflected broader market optimism, opening at 79,828.99 with a gap-up and sustaining above the crucial 80,000 psychological level throughout the session. The index formed a bullish engulfing pattern on daily charts with above-average volumes, suggesting strong momentum continuation. The broader market showed positive trends, with midcap and smallcap indices participating actively in the rally.

Welcome to Option Matrix India's comprehensive

Technical Analysis for September 2nd, 2025. As we analyze the Indian Stock Market movements, today's closing data reveals positive signals across major indices. Nifty 50 closed at 24,625.05 with a strong gain of 0.81%, while Bank Nifty settled at 54,002.45 up 0.65%, and Sensex ended at 80,364.49 with a 0.70% advance.

This detailed Market Analysis for Tomorrow will provide you with precise Nifty Predictions, Bank Nifty Predictions, and Sensex Predictions based on technical chart patterns, support-resistance levels, and volume analysis.

Support & Resistance Levels

Critical Levels for Tomorrow's Trading

| Index | Support Levels | Resistance Levels |

|---|---|---|

| Nifty 50 | 24,572, 24,504, 24,440 | 24,635, 24,676, 24,757 |

| Bank Nifty | 53,870, 53,720, 53,580 | 54,084, 54,213, 54,365 |

| Sensex | 80,182, 80,023, 79,742 | 80,402, 80,665, 80,951 |

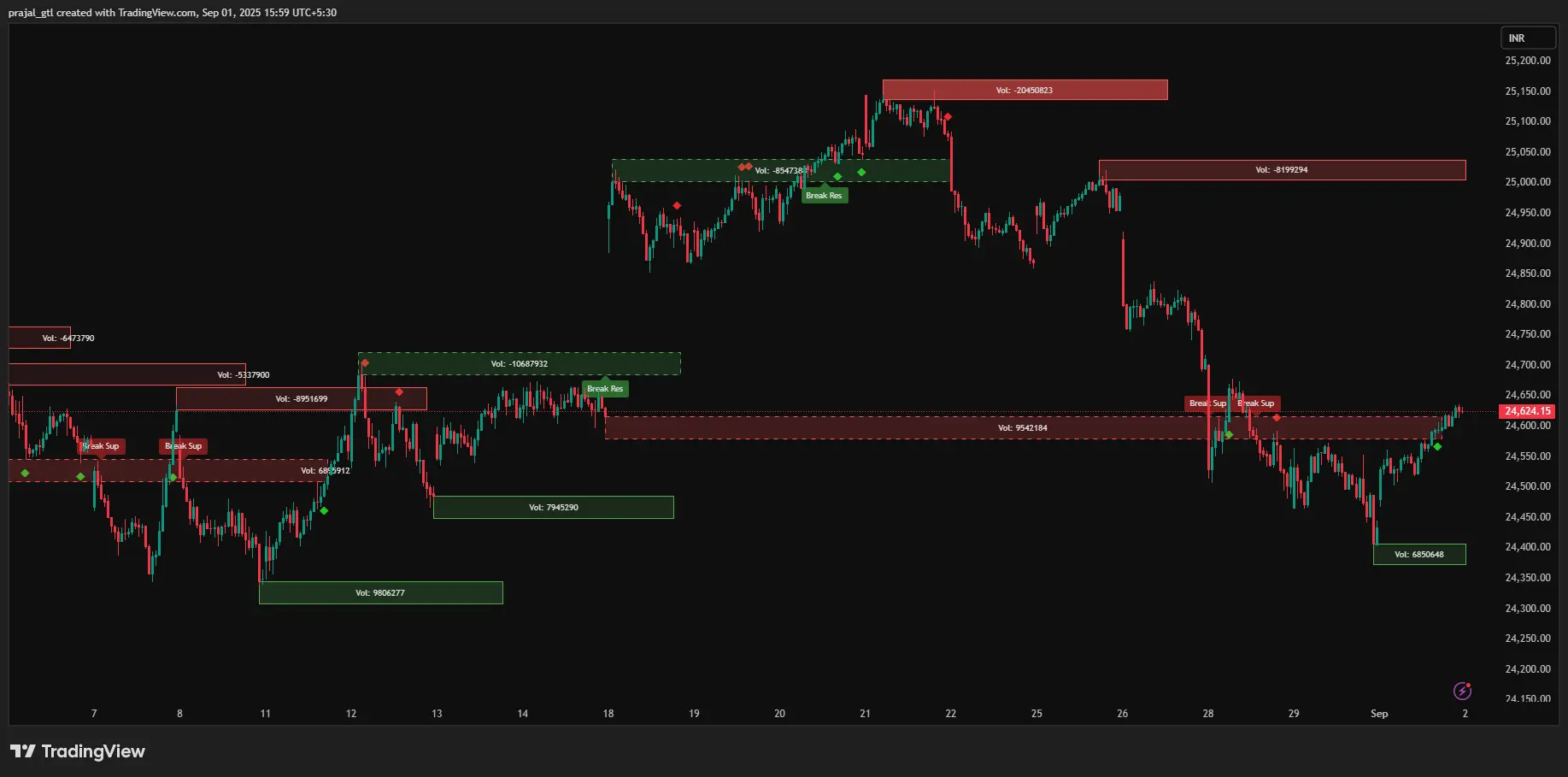

Nifty Predictions – Technical Analysis for Tomorrow

For Nifty predictions on September 2, 2025, the index is positioned in a no-trading zone between 24,572 to 24,635. This critical range will determine the market direction for tomorrow's session.

Bullish Scenario: If a 15-minute candle closes above 24,635, this will trigger fresh buying momentum with targets at 24,676 (1st target), 24,757 (2nd target), and 24,835 (3rd target). However, traders should be cautious of false breakouts - if the index crosses 24,635 but closes below in the same 15-minute timeframe, this indicates weakness with downside targets at 24,570 and secondary target of 24,500.

Bearish Scenario: A 15-minute candle closing below 24,572 will confirm the bearish momentum, opening doors for further decline toward 24,504 (1st target), 24,440 (2nd target), and 24,337 (3rd target). The key moving averages are providing support, but a decisive break could trigger medium-term correction.

Recovery Pattern: If the index crosses below 24,572 but manages to close above it within the 15-minute timeframe, this could trigger a short-covering rally toward 24,650 (1st target) and 24,730 (2nd target). The options data suggests strong support building around 24,600 levels with call writing visible.

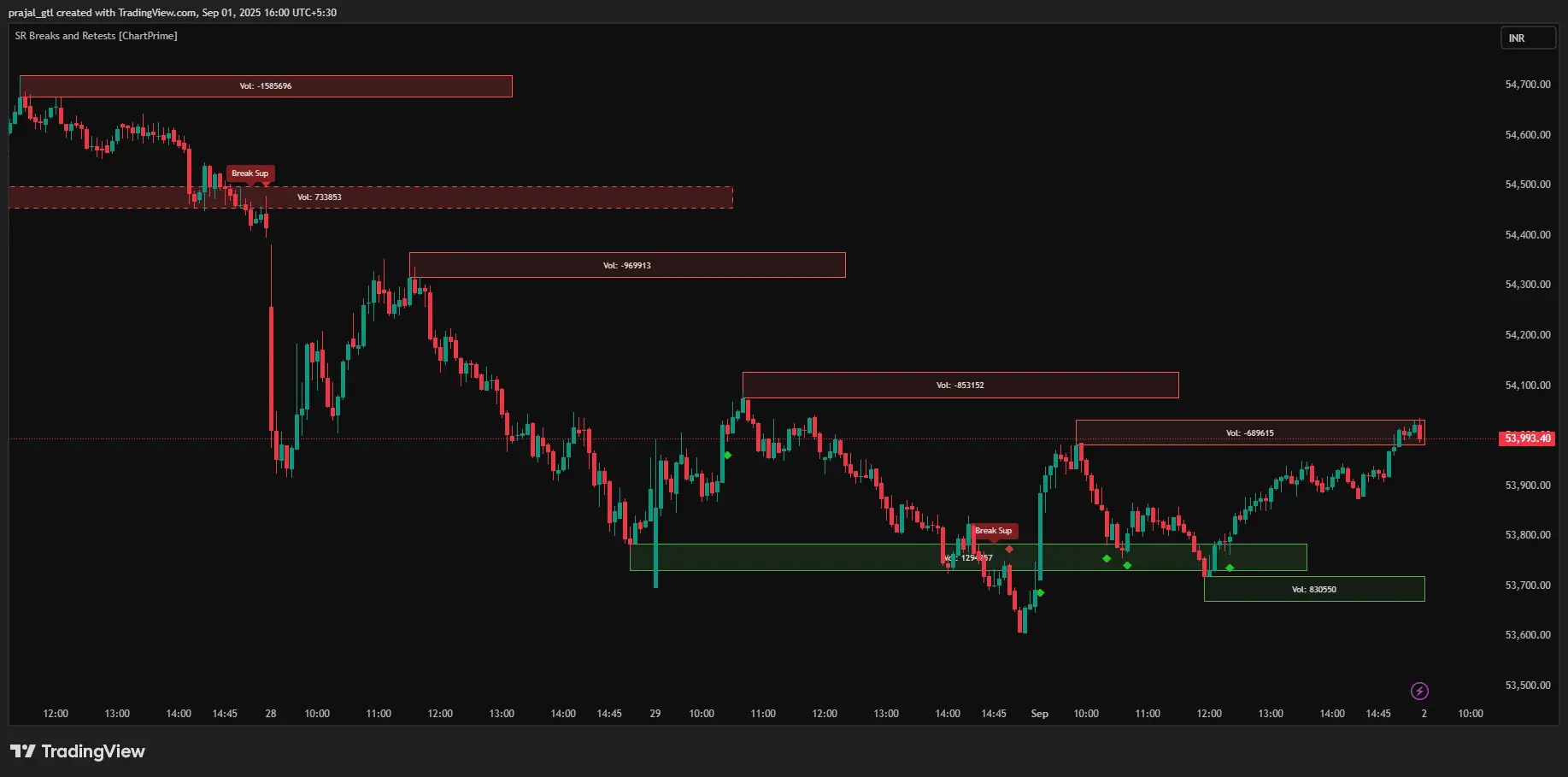

Bank Nifty Predictions – Technical Analysis

Bank Nifty predictions for September 2, 2025, indicate the index is trading within a critical no-trading zone from 53,870 to 54,084. The banking sector shows improved sentiment following today's recovery and positive credit data.

Bullish Breakout: A 15-minute candle closing above 54,084 will signal fresh buying interest with upside targets at 54,213 (1st target), 54,365 (2nd target), and 54,500 (3rd target). The sector shows potential for continued outperformance with improving fundamentals supporting the move.

Bearish Breakdown: If a 15-minute candle closes below 53,870, this confirms the consolidation continuation with targets at 53,720 (1st target), 53,580 (2nd target), and 52,450 (3rd target). The technical indicators are showing improving momentum, but global banking cues remain crucial.

False Breakout Strategy: Traders should watch for false moves - if Bank Nifty crosses 54,084 but fails to sustain and closes below within 15 minutes, short positions can be initiated with targets at 53,870 and 53,580. Conversely, if it crosses below 53,870 but recovers to close above, upside targets include 54,020 and 54,200.

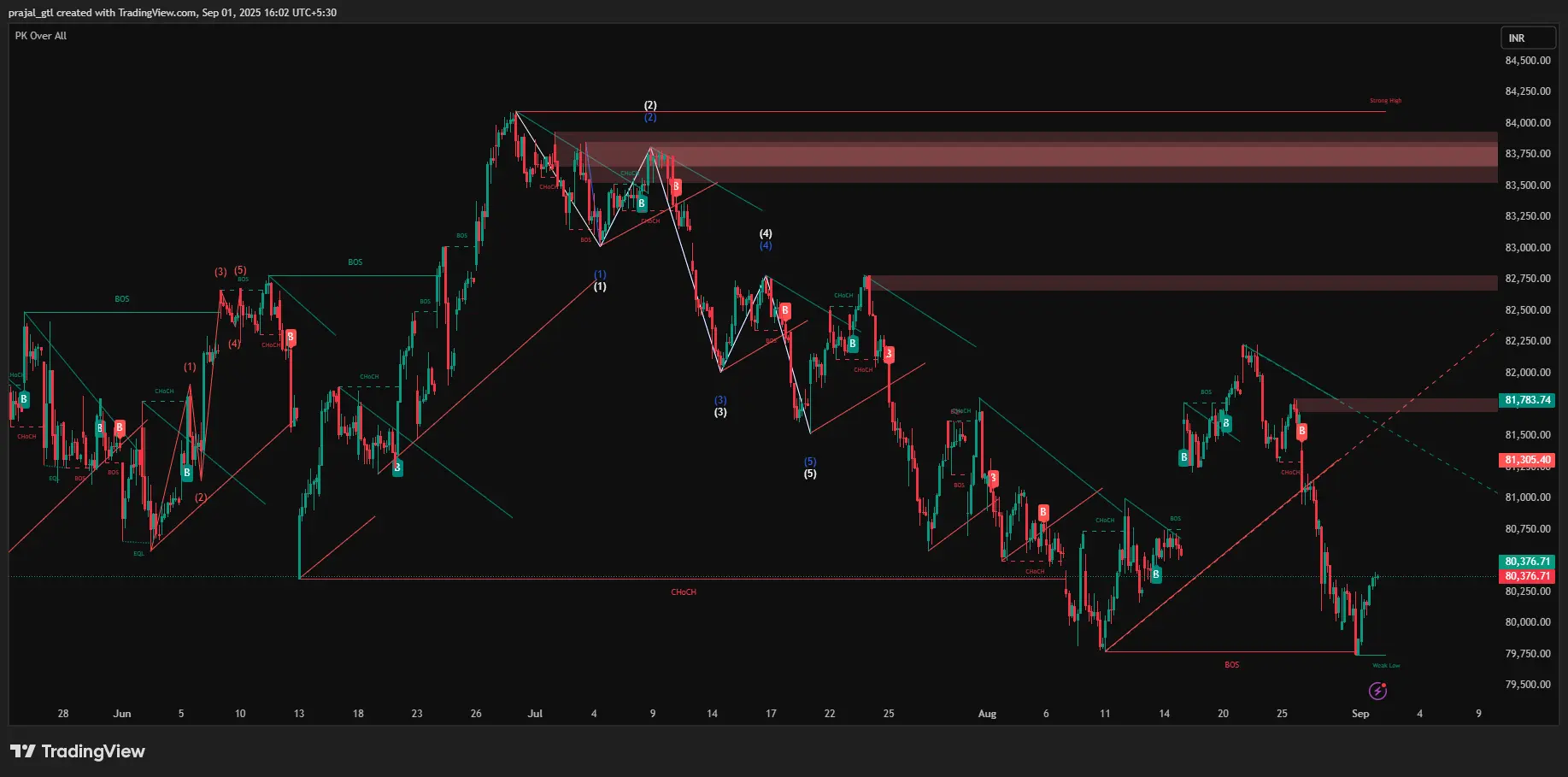

Sensex Predictions – Technical Analysis

Sensex predictions for tomorrow focus on the critical no-trading zone between 80,182 to 80,402. The psychological 80,400 level acts as immediate resistance, while the successful defense of 80,000 levels today shows underlying strength.

Upside Targets: A 15-minute candle closing above 80,402 will trigger buying momentum toward 80,665 (1st target), 80,951 (2nd target), and 81,212 (3rd target). The index needs to sustain above 80,400 decisively to resume the upward momentum toward previous highs.

Downside Risk: A 15-minute candle closing below 80,182 opens the path for further decline toward 80,023 (1st target), 79,742 (2nd target), and 78,965 (3rd target). However, today's positive close above 80,000 reduces immediate downside pressure.

Tactical Trading: For false breakout patterns, if Sensex crosses 80,402 but closes below within 15 minutes, short targets include 80,200 and 80,023. On the recovery side, if it breaks below 80,182 but manages to close above, upside targets are 80,370 and 80,500.

Tomorrow's Market Prediction (2nd September 25)

Based on comprehensive market analysis for Tuesday, the Indian Stock Market outlook remains cautiously optimistic following today's positive performance. Multiple factors are creating a supportive scenario including global market stability, improved domestic sentiment, and technical breakout signals.

Key Market Drivers: The upcoming US manufacturing data, crude oil stability, and continued FII buying will be crucial in determining market direction. Sectoral momentum is expected to continue with banking and IT showing relative strength while metal and energy sectors await global cues.

Volatility Expectations: With the VIX levels declining, we expect controlled volatility with potential for trending moves. The options chain data suggests maximum pain around Nifty 24,650 and Bank Nifty 54,100, which could act as magnetic levels for tomorrow's session.

Final Verdict

Our Technical Analysis for 2nd Sep 2025 suggests a cautiously optimistic outlook for the Indian Stock Market following today's positive recovery. The combination of bullish price action, improving technical setup, and volume confirmation across all major indices indicates potential for continued momentum.

Trading Strategy: Focus on momentum trades above the defined no-trading zones with proper risk management. The market's response to critical resistance levels - NIFTY's 24,635 level, Bank NIFTY's 54,084 zone, and SENSEX's 80,402 band - will determine the sustainability of the current rally.

Key Recommendation: Maintain trailing stop-losses as per the levels mentioned above and avoid trading within the no-trading zones. Wait for decisive 15-minute candle closures above resistance levels before initiating fresh long positions. Today's positive momentum provides better probability for upside moves.

Risk Management: Given the current improving environment with positive technical indicators and supportive global cues, position sizing can be moderately increased with emphasis on momentum stocks. Monitor sectoral leadership and global developments closely as they continue to influence overall market sentiment.

Disclaimer: This analysis is for educational purposes only and should not be considered as investment advice. Please consult your financial advisor before making any trading or investment decisions. Past performance does not guarantee future results.