Technical Analysis for 3rd Nov 2025

Nifty, Bank Nifty & Sensex Predictions

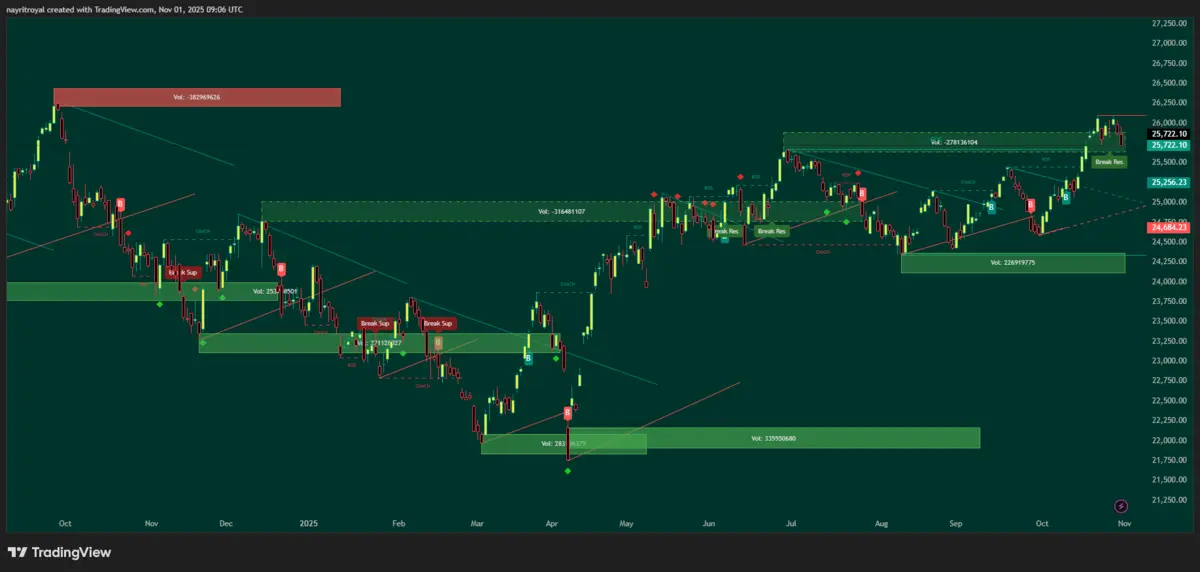

The Indian stock market concluded the last trading session of October on a bearish note, with benchmark indices witnessing sustained selling pressure across key sectors. As we enter the first week of November, technical indicators suggest continued volatility, with critical support and resistance levels determining the direction for Monday's trading session. The Nifty 50 closed at 25,722.10, down by 155.75 points or 0.60%, while the Bank Nifty settled at 57,776.35, losing 254.75 points or 0.44%. The Sensex ended at 83,938.71, declining by 465.75 points or 0.55%. Gift Nifty futures indicated a gap-down opening of approximately 80 points, trading around 25,822 levels on Friday evening, setting the stage for a potentially weak start to Monday's session. The formation of a double top pattern on daily charts for both Nifty and Bank Nifty, combined with rejection candles on weekly timeframes, points toward further downside potential unless key resistance zones are reclaimed.

Key Market Observations from October 31, 2025

The final trading day of October witnessed broad-based weakness across Indian equity markets, with sectoral indices predominantly closing in negative territory. The healthcare sector led the decline, with significant losses recorded across major pharmaceutical and healthcare equipment manufacturers. Financial services and private bank indices fell around 0.7% each, reflecting profit-booking at higher levels and caution regarding interest rate trajectories. IT, FMCG, and auto sectors also witnessed moderate losses, reflecting cautious investor sentiment amid mixed corporate earnings and global headwinds.

On the positive side, PSU Bank stocks bucked the trend, with strong gains in the state-owned banking sector, emerging as the sole outperformer. Nifty Realty also managed to inch up marginally, defying the broader market weakness. Individual stock movements were notable, with select blue-chip stocks posting significant declines on profit-taking, while others demonstrated resilience ahead of quarterly results announcements.

Trading volumes remained elevated at significant levels on both Nifty and Bank Nifty, suggesting active participation despite the downward bias. The closing prices reflected the second consecutive day of losses for both indices, breaking a four-week gaining streak and confirming profit-booking at higher levels.

Support and Resistance Levels for November 3, 2025

Understanding critical support and resistance zones is essential for navigating Monday's trading session. Based on option chain data and technical chart analysis, the following levels warrant close attention:

Nifty 50 Support and Resistance

Support Levels: The primary support for Nifty is positioned at 25,650-25,700 zone, where maximum put writer positions are concentrated with a premium of 52 points at 25,700. If this zone breaks, the next critical support lies at 25,620, followed by 25,569 on the 15-minute chart. A breakdown below 25,619 could trigger further long unwinding, potentially dragging the index toward the 25,500 levels, near a previous gap zone. The closing level of 25,722.10 on October 31 establishes immediate support in the 25,700-25,720 range.

Resistance Levels: On the upside, 25,743 acts as the immediate resistance on the 15-minute timeframe. A decisive 15-minute closing above this level could open opportunities for buying, with targets extending toward 25,827, where call writers have established significant positions. The 25,800-25,850 zone represents a broader resistance band, with heavy call writing observed at 25,800 levels showing 105 points of premium. If the index breaches 25,850, call writers may get trapped, leading to short covering that could propel Nifty toward 25,950.

Bank Nifty Support and Resistance

Support Levels: Bank Nifty's immediate support rests at 57,778, followed by a stronger support zone at 57,656 (previous day's low). A breakdown below this could accelerate the decline toward 57,480, where book profit targets are expected. The next major support is positioned at 57,340, and if the index forms a wick pattern at this level without closing below it, a buying opportunity emerges with targets up to 57,900.

Resistance Levels: The 58,000 round number serves as a critical psychological resistance, reinforced by call writer positions. On the 15-minute chart, 57,900 acts as the first upside target if the index bounces from lower support levels. A breakout above 58,000 could trigger short covering, pushing Bank Nifty toward 58,254 and eventually 58,284, where further call writing is concentrated.

Sensex Support and Resistance

Support Levels: Sensex finds support in the 83,500-83,000 zone, with the immediate floor at 83,500 correlating with Nifty's support levels. The next cushion lies at 83,000, and a sustained break below could test 82,500 levels, aligning with broader market weakness.

Resistance Levels: On the upside, 84,400 (previous close of October 30) represents immediate resistance. Further resistance zones are placed at 84,700 (intraday high from October 31) and 85,000 psychological level. A move above these levels would require significant positive triggers and buying interest across heavyweight stocks.

Nifty Predictions – Technical Analysis for Tomorrow

The Nifty 50 index exhibits a bearish setup heading into Monday's session, characterized by a clear double top formation on the daily chart and a breakdown from key trendline support. The previous day's analysis correctly predicted the 100-point downside move, validating the technical approach. For November 3, the outlook remains tilted toward further downside unless the index shows resilience at identified support zones.

Bearish Scenario: If Nifty opens with a gap-down near the 25,650-25,669 levels and fails to reclaim higher ground, a retracement rally toward 25,700-25,720 could provide an opportunity for fresh shorting. Once the index breaks below 25,619 on a 15-minute closing basis, traders can look for shorting opportunities with targets of 25,500, representing a potential 120-point downside move. The Put-Call Ratio (PCR) currently hovering around 0.5 indicates bearish sentiment, though a minor pullback could normalize this ratio before resuming the decline.

Bullish Scenario: For any upside momentum, Nifty must first establish a 15-minute closing above 25,743. This would open buying opportunities targeting 25,827, with a potential extension to 25,950 if the 25,850 resistance is decisively breached. Such a move would trap call writers at 25,800 levels, triggering short covering and supporting higher prices. However, given the weekly rejection candle and prevailing sentiment, the probability of sustained upside appears limited unless accompanied by strong global cues or positive domestic triggers.

Intraday Strategy: Traders should adopt a wait-and-watch approach if Nifty opens flat or slightly gap-down. Key action zones are below 25,619 for shorts and above 25,743 for longs. Avoid chasing trades in the 25,669-25,743 zone, as this represents a tricky area with limited risk-reward ratios. The 200-point range between 25,650 and 25,850 is expected to contain most of Monday's price action.

Bank Nifty Predictions – Technical Analysis

Bank Nifty mirrors the bearish structure observed in Nifty, with a double top pattern evident on daily charts and failure to sustain above the 58,000 psychological mark. The index has underperformed relative to Nifty in recent sessions, suggesting sector-specific weakness in banking stocks, particularly private sector banks that witnessed profit-booking.

Bearish Outlook: The primary trading strategy for Monday involves monitoring the breakdown of 57,656 (previous low). If this level is breached on a 15-minute closing basis, shorting opportunities emerge with an initial target of 57,480, where maximum quantities should be booked. A further decline could extend toward 57,340, especially if broader market weakness intensifies. The gap zone near 57,470 also represents a probable support area where some consolidation may occur before further downside.

Bullish Reversal: A bullish scenario develops if Bank Nifty approaches the 57,340 support level, forms a wick pattern (indicating rejection), and closes above it. This setup would offer buying opportunities with targets of 57,900 initially, and if momentum sustains, an extension toward 58,284 becomes feasible. The 58,000 round number remains a critical hurdle, and only a decisive break above this level accompanied by short covering from trapped call writers would validate a bullish reversal.

Gap Opening Scenarios: If Bank Nifty opens with a gap-down directly at support levels (57,340-57,480), traders should wait for a retracement toward 57,600-57,700 before considering shorts. Conversely, a gap-up opening toward 58,000-58,200 would require observing rejection candles to initiate short positions targeting 57,778. The tricky nature of gap openings demands patience and confirmation before committing to directional trades.

Sensex Predictions – Technical Analysis

The Sensex closed October on a weak note, losing 465 points and settling at 83,938.71, reflecting broad-based selling across blue-chip stocks. The index's performance closely tracks Nifty's trajectory, with heavyweight stocks dragging the benchmark lower. As markets enter November, the Sensex faces a consolidation phase with a downward bias unless positive catalysts emerge.

Support Analysis: The immediate support for Sensex is placed at 83,500, aligning with the psychological comfort zone for bulls. This level has previously acted as a pivot during intraday swings and is expected to attract some buying interest. If breached, the next support at 83,000 becomes critical, representing a near-term floor for the index. A breakdown below 83,000 could accelerate selling toward 82,500, where longer-term moving averages may provide cushioning.

Resistance Analysis: On the upside, 84,400 (previous close from October 30) serves as the first resistance level. A reclaim of this zone would require buying support from banking, IT, and energy sectors, which constitute significant weightage in the Sensex. The next resistance is positioned at 84,700 (recent intraday high), and a breakout above this could open doors toward the 85,000 psychological milestone. However, achieving these levels demands a shift in sentiment, possibly driven by easing foreign institutional investor (FII) outflows or strong corporate earnings surprises.

Trading Strategy: Given the correlation between Sensex and Nifty, traders should focus on Nifty levels for directional cues. A breakdown in Nifty below 25,619 would likely pull Sensex below 83,500, triggering further weakness. Conversely, strength in Nifty above 25,743 could lift Sensex toward 84,400-84,700. The Sensex's movement will also depend on individual stock performances, particularly in the banking and oil & gas sectors, which showed divergent trends recently.

Monday's Market Prediction

The outlook for Monday, November 3, 2025, leans toward a cautiously bearish to sideways tone, with the probability of downside testing of support levels being higher than an immediate upside breakout. Several factors contribute to this assessment:

- Gift Nifty Indication: Trading approximately 80 points lower at 25,822 suggests a gap-down opening is likely, which could immediately test the 25,700-25,650 support zone for Nifty.

- Technical Patterns: The confirmed double top formations on daily charts for both Nifty and Bank Nifty, combined with weekly rejection candles, indicate distribution and bearish momentum.

- Option Chain Data: The PCR of around 0.5 reflects bearish sentiment, with put writers closing positions and call writers building shorts at higher levels. This configuration typically precedes downward moves unless a sharp reversal occurs.

- Sector Performance: The weakness in heavyweight sectors like banking, IT, and healthcare, coupled with isolated strength in PSU banks, suggests selective participation rather than broad-based buying. This fragmented performance typically characterizes consolidation or corrective phases.

Expected Trading Range:

- Nifty: 25,500 to 25,850 (with a bias toward the lower end)

- Bank Nifty: 57,340 to 58,200 (with focus on support testing)

- Sensex: 82,500 to 84,700 (following Nifty's lead)

Probability Assessment: There is approximately a 60-65% chance of markets testing lower support levels (Nifty below 25,650, Bank Nifty below 57,500) versus a 35-40% probability of an upside breakout above resistance zones. This assessment is based on technical chart patterns, option chain positioning, and prevailing market sentiment.

Final Verdict

The technical analysis for November 3, 2025, presents a predominantly bearish outlook for Indian equity markets, with Nifty, Bank Nifty, and Sensex all positioned below key resistance levels and exhibiting signs of further corrective moves. The previous day's analysis accurately predicted the market's direction and targets, lending credibility to the current assessment.

Key Takeaways:

- Nifty is likely to test the 25,650-25,500 support zone before any meaningful recovery attempt. Traders should watch for breaks below 25,619 for shorting and closes above 25,743 for buying opportunities.

- Bank Nifty faces resistance at 58,000 and is poised to test 57,480-57,340 support levels. The double top pattern suggests further downside unless a strong reversal occurs from lower supports.

- Sensex is expected to follow Nifty's trajectory, with support at 83,500-83,000 and resistance at 84,400-84,700. Sectoral performance, particularly in banking and oil & gas, will influence intraday movements.

The market is at a critical juncture where price action around identified support and resistance levels will determine whether the correction deepens or a consolidation phase begins. Traders should maintain strict risk management, use stop-losses diligently, and avoid aggressive positions until clear directional signals emerge. The option chain data and technical patterns suggest that patience and selective participation will be key to navigating Monday's session successfully.

For longer-term investors, the current correction presents potential accumulation opportunities, especially if indices test the lower end of the support ranges. However, confirmation of stabilization through higher lows and improved breadth will be necessary before committing fresh capital.

Disclaimer

This analysis is prepared for educational purposes only and does not constitute investment advice. The predictions and trading levels mentioned are based on technical analysis of historical price data, option chain positioning, and pattern recognition. Market conditions can change rapidly due to unforeseen events, global developments, or policy announcements. Traders and investors are strongly advised to consult their financial advisors before making any trading or investment decisions. Past performance and technical patterns do not guarantee future results. Always conduct your own research and risk assessment before entering any trade position.