Technical Analysis for 4th Sept 2025 :

Nifty Predictions, Bank Nifty Predictions & Sensex Predictions

The Indian Stock Market wrapped up September 3rd, 2025, with mixed signals across major indices. Nifty 50 closed at 24,715.05, marking a 0.55% gain. Bank Nifty ended at 54,067.55, up by 0.76%, while Sensex finished at 80,567.71, reflecting a 0.51% increase. This Technical Analysis for 4th Sept 2025 provides detailed Nifty Predictions, Bank Nifty Predictions, and Sensex Predictions to help traders anticipate tomorrow's movements in the Indian Stock Market.

Key Observations of Today’s Market Closing

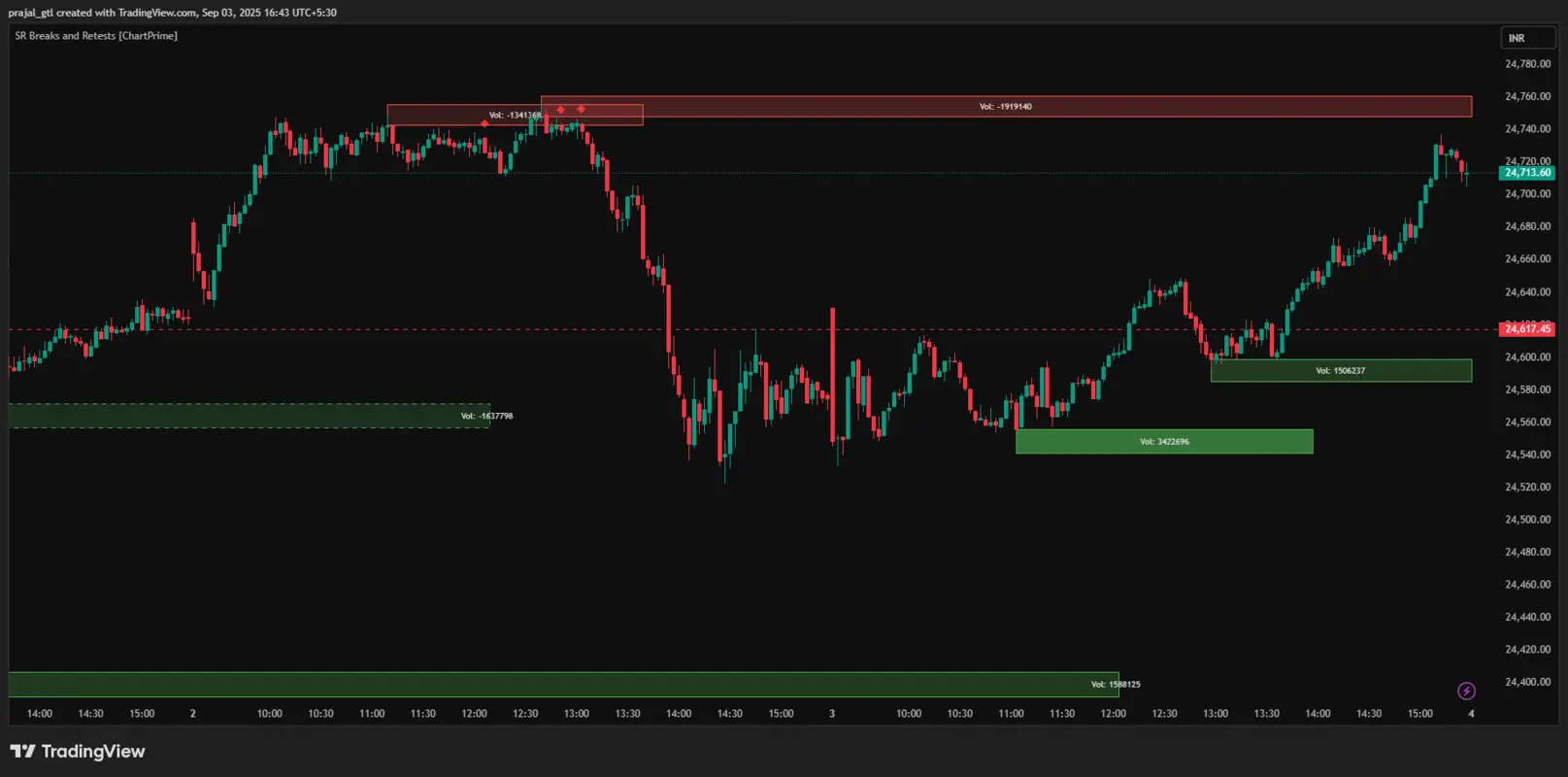

Today's session showed moderate volatility with upward momentum in the latter half. For Nifty 50, the index opened at 24,616.50, reached a high of 24,735.60, dipped to a low of 24,535.10, and closed at 24,715.05 with a volume of 339.26M. The daily candle formed a bullish engulfing pattern, indicating potential buying interest overpowering early selling pressure.

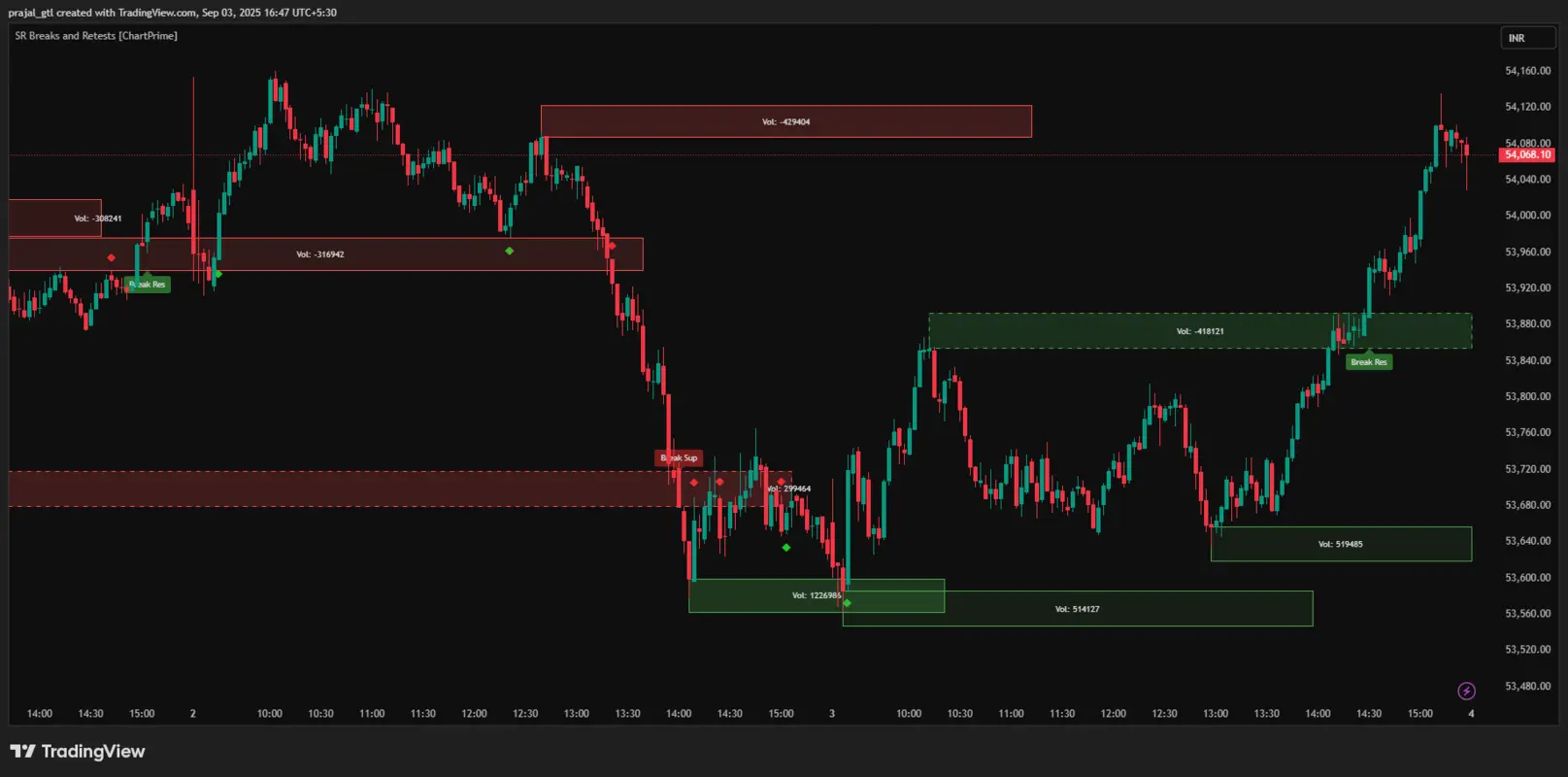

Bank Nifty opened at 53,630.75, hit a high of 54,132.40, low of 53,569.95, and closed at 54,067.55 on 100.05M volume. It displayed a bullish hammer candle, suggesting reversal from intraday lows and buyer dominance.

Sensex started at 80,295.99, peaked at 80,458.60, bottomed at 80,010.65, and settled at 80,567.71 with 15.37M volume. The candle was a small-bodied doji with a bullish bias, reflecting indecision but closing higher amid balanced trading.

Over the last five days, Nifty ranged from 24,404.70 to 24,754.65, Bank Nifty from 53,569.95 to 54,382.25, and Sensex from 79,741.76 to 80,775.71, highlighting a consolidating market with slight upward tilt.

Support & Resistance Levels

Understanding support and resistance is crucial for effective Market Prediction. Here are the major zones for tomorrow:

- Nifty 50: Support at 24,595, 24,520, 24,465; Resistance at 24,757, 24,840, 24,922.

- Bank Nifty: Support at 53,862, 53,647, 53,515; Resistance at 54,160, 54,355, 54,685.

- Sensex: Support at 80,354, 80,018, 79,742; Resistance at 80,759, 81,068, 81,445.

These levels, derived from recent highs, lows, and pivot points, serve as key markers in our Nifty Technical Analysis, Bank Nifty Technical Analysis, and Sensex Technical Analysis.

Nifty Predictions

In our Nifty Predictions, we identify a no-trading zone between 24,595 and 24,757. This range suggests consolidation; avoid trades here to minimize whipsaws.

If a 15-minute candle closes above 24,757, expect bullish momentum with the 1st target at 24,840, 2nd at 24,922, and 3rd at 25,022. However, if it crosses 24,757 but closes below on a 15-minute candle, shift to short side: 1st target 24,650, 2nd 24,580.

On the downside, a 15-minute close below 24,595 signals bearish pressure: 1st target 24,520, 2nd 24,465, 3rd 24,337. If it crosses 24,595 but closes above, go long: 1st target 24,650, 2nd 24,730.

This strategy aligns with today's bullish candle, favoring upside breaks in tomorrow's Market Analysis for Tomorrow.

Bank Nifty Predictions

For Bank Nifty Predictions, the no-trading zone spans 53,862 to 54,160. Stay sidelined here for optimal risk management.

A 15-minute candle close above 54,160 indicates bullish entry: 1st target 54,355, 2nd 54,685, 3rd 55,019. If it crosses but closes below 54,160 on a 15-minute candle, target shorts: 1st 54,000, 2nd 53,860.

Below 53,862 on a 15-minute close, bearish targets: 1st 53,647, 2nd 53,515, 3rd 53,365. If crosses 53,862 but closes above, upside: 1st 54,000, 2nd 54,200.

Given today's hammer candle, Bank Nifty Technical Analysis points to potential sector strength if resistance breaks.

Sensex Predictions

Sensex Predictions highlight a no-trading zone from 80,354 to 80,759. This buffer zone helps filter noise in the broader Indian Stock Market.

If a 15-minute candle closes above 80,759, bullish targets: 1st 81,068, 2nd 81,445, 3rd 81,798. Crossing but closing below triggers shorts: 1st 80,500, 2nd 79,350.

A 15-minute close below 80,354: downside 1st 80,018, 2nd 79,742, 3rd 79,525. If crosses 80,354 but closes above, long: 1st 80,750, 2nd 81,000.

Sensex Technical Analysis reflects today's doji, suggesting caution but upside bias on confirmation.

Tomorrow's Market Prediction (4th September)

Based on our comprehensive Technical Analysis, we expect: Market Outlook: Cautiously Optimistic

- Nifty: Likely to test resistance at 24,757. Break above could trigger momentum towards 24,840+

- Bank Nifty: Banking sector shows strength. Watch for 54,160 breakout for bullish continuation

- Sensex: Consolidation expected within 80,354-80,759 range initially

Key Trading Tips for Tomorrow:

- Wait for clear breakouts from defined ranges

- Use 15-minute candle closures for confirmation

- Maintain strict stop-losses below support levels

- Volume confirmation essential for sustained moves

Final Verdict

Our Market Analysis for Tomorrow suggests a mixed to positive outlook for the Indian Stock Market. The indices are consolidating near resistance levels, and clear directional moves depend on breaking out of the defined ranges.

Key Focus Areas:

- Nifty above 24,757 for bullish momentum

- Bank Nifty sustaining above 54,160

- Sensex breaking 80,759 for upward acceleration

Risk management remains crucial as markets navigate through current consolidation phases.

Disclaimer

This analysis is for educational purposes only. Not investment advice. Please consult your financial advisor before trading.