What is CPR

(Central Pivot Range)

Central Pivot Range, or CPR, is a powerful intraday trading tool used by traders to determine key price levels. It is formed using three key levels:

- TC (Top Central) = (Pivot + High + Low) / 3

- Pivot Point (Central Pivot) = (High + Low + Close) / 3

- BC (Bottom Central) = (Pivot + Low + Close) / 3

CPR acts as a price zone that helps traders understand market sentiment—whether it's bullish, bearish, or sideways. It works well in Nifty, Bank Nifty, and stock options trading, especially for intraday price action traders.

What is a Pivot Point in Trading?

A Pivot Point is a technical analysis indicator used to determine overall market trend across different time frames. It uses the previous day’s high, low, and close to forecast support and resistance levels.

Formula for Classic Pivot Point:

- Pivot (P) = (High + Low + Close) / 3

-

Support and Resistance Levels:

- S1 = (2 * P) - High

- R1 = (2 * P) - Low

- S2 = P - (High - Low)

- R2 = P + (High - Low)

Pivot Points are highly effective for intraday trading, helping to spot key reversal or breakout zones.

Relationship Between CPR and Pivot Points

Though CPR and Pivot Points may seem similar, they serve slightly different purposes:

| Feature | CPR | Pivot Points |

|---|---|---|

| Focus | Price zone (range) | Key turning points |

| Type | Dynamic support/resistance | Fixed levels of reversal |

| Best Use | Identifying sideways or trending days | Spotting reversals & breakouts |

| Calculation | Based on 3 levels | Multiple levels (P, S1, R1, S2, R2...) |

Together, they provide a complete picture. When CPR aligns with Pivot Points, it can confirm strong support or resistance levels. Smart traders use both to improve trade entry and exit.

CPR Trading Strategy (Step-by-Step)

1. Narrow CPR = Trending Market

- When the CPR band is narrow, it signals a potential breakout.

- Look for price breaking above TC or below BC with strong volume.

- Use this in Bank Nifty options or Nifty intraday trades.

2. Wide CPR = Sideways Market

- Avoid aggressive trades.

- Wait for clear breakout above R1 or below S1.

3. Price Opening Above or Below CPR

- Above CPR: Market sentiment is bullish. Look for buying at pullbacks.

- Below CPR: Market is bearish. Short at resistance levels.

4. Price Opening Inside CPR

- Be cautious. It indicates a range-bound market.

- Trade breakouts only after confirmation with volume.

Pivot Point Trading Strategy (Step-by-Step)

1. Identify Market Sentiment

- If the price is above the pivot, the market is bullish.

- If below the pivot, it's bearish.

2. Trade Between Levels

- Buy near support (S1, S2) and sell near resistance (R1, R2) with confirmation.

- Use short-term moving averages for better signals.

3. Breakout Strategy

- If price breaks above R1 with volume, target R2.

- Stop-loss below pivot or breakout candle.

4. Combine with CPR for Confirmation

- When pivot level and CPR bottom/top overlap, it becomes a strong zone.

Conclusion: CPR vs Pivot Points – Which is Better?

Both CPR and Pivot Points are essential tools for day traders. Use CPR to understand the market structure and use Pivot Points to time your entry and exit. When used together, they offer powerful insights to make better trading decisions.

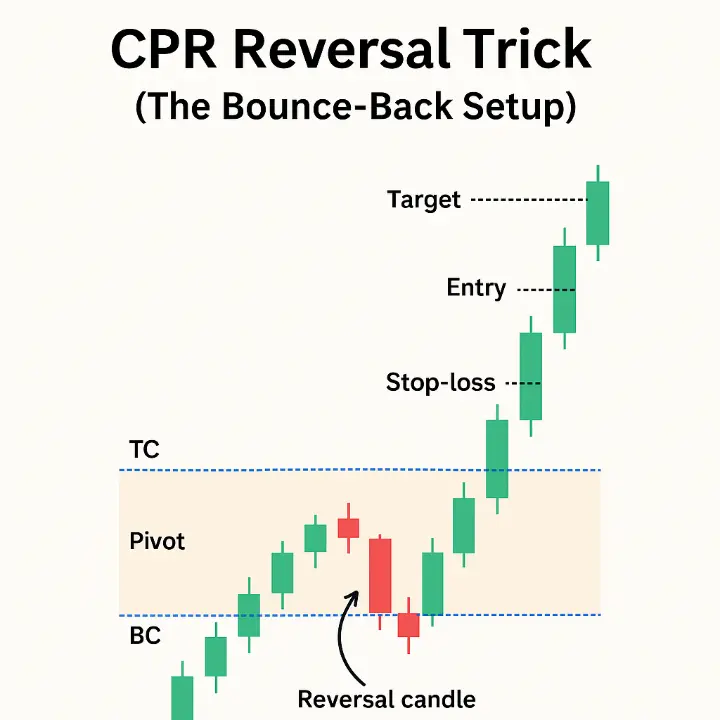

CPR Reversal Trick (The Bounce-Back Setup)

What it is:

The CPR Reversal Trick is used when the price touches or breaks the CPR zone but fails to sustain the breakout and reverses sharply. This behavior creates excellent scalp or reversal trade opportunities.

How it works:

- Price approaches CPR from above or below.

- If it rejects the CPR and moves away quickly with volume, a reversal is likely.

- Entry: After a reversal candle (like a pin bar or engulfing) near CPR.

- Stop-loss: Just beyond the CPR band.

- Target: Previous day's high/low or pivot levels.

When to Use:

- Best used when CPR is wide (indicates sideways market).

- Works well in Nifty, Bank Nifty, and index options.

CPR Opening Trick (First Candle Setup)

What it is:

The CPR Opening Trick is a popular setup based on how the market opens relative to CPR levels and how the first 5 to 15-minute candle behaves.

🔹 Types of Opening:

1. Gap-Up or Gap-Down Above/Below CPR:

- If the market opens far above TC (Top Central) → Bullish.

- If opens far below BC (Bottom Central) → Bearish.

- Entry: After confirmation from the first candle breakout.

- Stop-loss: Low/high of the opening candle.

2. Inside CPR Opening:

- Indicates a sideways or range-bound market.

- Avoid aggressive trades.

- Wait for breakout above TC or below BC with volume.

3. Near CPR Levels Opening:

- Watch price action carefully.

- If price holds CPR, trade with trend.

-

If price rejects CPR, prepare for reversal.

CPR Continuation Trick

What it is:

When price opens above or below CPR and continues in the same direction without testing the CPR zone, it's a sign of strong trend.

How to trade:

- Confirm direction using price action + volume.

- Enter on pullback toward support/resistance (like R1 or S1).

- Works great for momentum traders.

CPR Width Strategy (Narrow vs. Wide CPR)

1. Narrow CPR (Compression = Explosion)

- Indicates potential breakout or trending day.

- Ideal for option buyers and breakout traders.

2. Wide CPR

- Market may stay range-bound.

-

Use reversal tricks near CPR boundaries.

Pro Tip: Combine CPR with Indicators

- Use Volume + CPR: Rejections with volume = stronger signal.

- Combine with VWAP or EMA 20 for trend confirmation.

- Mark previous day's high/low + CPR for confluence zones.

Conclusion: Why Learn CPR Tricks for Intraday Trading

Understanding CPR tricks like Reversal, Opening, and Continuation setups helps you read the market structure, recognize trend changes, and spot high-probability trades. These tricks are simple yet powerful, especially for Bank Nifty and Nifty traders.