Union Budget 2026 & Stock Market Crash:

Complete Analysis for Indian Traders & Investors

Published: February 2, 2026 | Reading Time: 12 minutes | Category: Budget Analysis, Stock Market, Trading Education

Executive Summary

The Union Budget 2026, presented by Finance Minister Nirmala Sitharaman on February 1, 2026, triggered the worst market decline on a budget day in 6 years. The Sensex collapsed 1,546.84 points (1.88%) to close at 80,722.94, while the Nifty 50 plunged 495.20 points (1.96%) to end at 24,825.45. Nearly ₹11 lakh crore in market capitalization was wiped out in a single day, with the capital markets, PSU banking, and metal sectors bearing the brunt of the sell-off.

The culprit? A shocking 50-150% hike in Securities Transaction Tax (STT) on derivatives trading, combined with concerns over potential PSU bank mergers and lack of aggressive infrastructure capex allocations.

Budget 2026 at a Glance: What Really Happened?

Market Reaction: A Roller Coaster Day

The markets opened with cautious optimism early in the morning, with early gains driven by positive announcements on cancer drug affordability and Ayurveda sector push. However, when Finance Minister Sitharaman unveiled the STT hike, the mood shifted dramatically.

Key Market Statistics from February 1, 2026:

| Index/Metric | Opening | Intraday Low | Closing | Change % |

| Sensex | 82,269.78 | 79,899.42 | 80,722.94 | -1.88% |

| Nifty 50 | 25,320.65 | 24,571.75 | 24,825.45 | -1.96% |

| Market Cap Loss | N/A | N/A | N/A | -₹11 lakh crore |

| India VIX | Baseline | Peak | Close | +3.53% |

| Advance/Decline | N/A | N/A | 1,673 up / 2,296 down | Heavily negative |

By mid-session, the Sensex had plummeted nearly 2,370 points (2.88%) before recovering marginally into the close—highlighting panic selling followed by late-day bargain hunting.

The STT Shock:

Why Traders & Options Sellers Are in Uproar

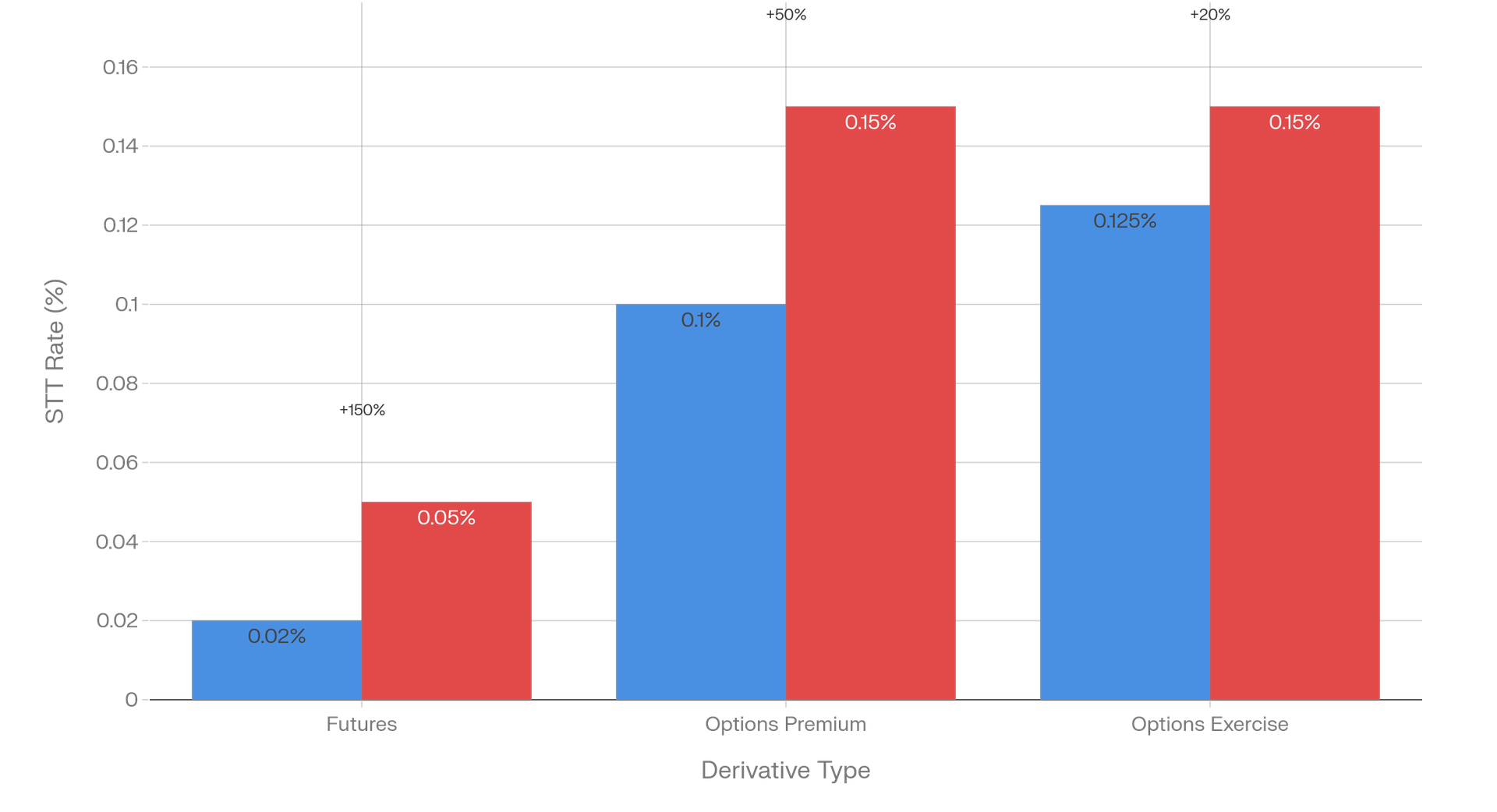

What Changed: The Numbers That Matter

The government's move to increase Securities Transaction Tax on derivatives is arguably the single biggest shocker for F&O traders. Here's what changed:

The New STT Regime (Effective April 1, 2026):

| Transaction Type | Old Rate | New Rate | Increase | Impact |

| Futures (Sale) | 0.02% | 0.05% | +150% | 🔴 Most painful |

| Options Premium (Sale) | 0.1% | 0.15% | +50% | 🔴 Significant |

| Options Exercise (Buy) | 0.125% | 0.15% | +20% | 🟡 Moderate |

| Equity Delivery | 0.1% | 0.1% | 0% | ✅ No change |

| Mutual Funds | 0.001% | 0.001% | 0% | ✅ No change |

Why This Matters:

For options traders, the impact appears manageable. A Nifty 50 options contract (65 lot size, ₹100 premium = ₹6,500 notional) will see STT increase from approximately ₹6-7 to ₹10-12—adding ₹3-4 in costs per trade. This is roughly a ₹4-5 per contract increase, or about a 0.07% impact on the premium.

However, futures traders face a much steeper hill:

A Nifty futures trade at ₹25,000 per share × 25 lot multiplier = ₹6,25,000 contract value. The STT tax jumps from ₹125 to ₹312.50—an increase of ₹187.50 per trade, or roughly 0.03% of the contract value.

The Real Problem: Cumulative Impact

A trader executing 10 round-trip options trades per day loses an additional ₹40-50 in STT costs. Over a month (22 trading days) and 10 daily trades:

- Old cost per month: ~₹3,000-3,500 in STT

- New cost per month: ~₹5,500-6,000 in STT

- Monthly increase: ~₹2,000-2,500

For active futures traders, the monthly impact is even steeper:

- Old cost per month: ~₹27,500 (22 trading days × 1 trade × ₹125)

- New cost per month: ~₹68,750 (22 trading days × 1 trade × ₹312.50)

- Monthly increase: ~₹41,250

This explains the 12% crash in BSE shares, 8%+ drop in Angel One, and 8%+ decline in MCX—brokerages stand to lose significant volumes.

Why Did This Budget Disappoint? A Deeper Analysis

1. The Government's Intentions: Curbing Retail Speculation

The budget speech didn't elaborate extensively, but the Finance Ministry's post-budget clarifications revealed the government's strategy:

- Discouraging excessive speculative trading in the F&O market

- Moderating high-frequency derivatives turnover

- Addressing systemic risk from leveraged positions and excessive retail participation

- Generating additional tax revenue (estimated ₹1,000-2,000 crore annually)

The government wants to cool down the overheated derivatives market, where retail participation has skyrocketed 200-300% over the past 3 years. While noble in intent, the execution via a crude tax hike has angered the trading community.

2. Missing Capex Push: The Real Disappointment

Here's what traders and investors expected but didn't get:

Infrastructure Capex Disappointment:

- No major announcement of new highway projects

- Limited urban metro expansion plans

- Most capex initiatives delegated to private partnerships (Data Centers, Foreign Direct Investment)

- Government direct capex spending was not significantly increased

What This Means for PSU Stocks:

SBI and other public sector banks were positioned to benefit from increased government infrastructure spending. With capex growth flat, these banks saw massive selling. PSU Banking Index crashed 5.6%, with:

- State Bank of India: -5.61%

- Bank of India: -7%

- Bank of Baroda: -6%

The narrative was: "If government doesn't spend, where do PSU banks get their lending opportunities?"

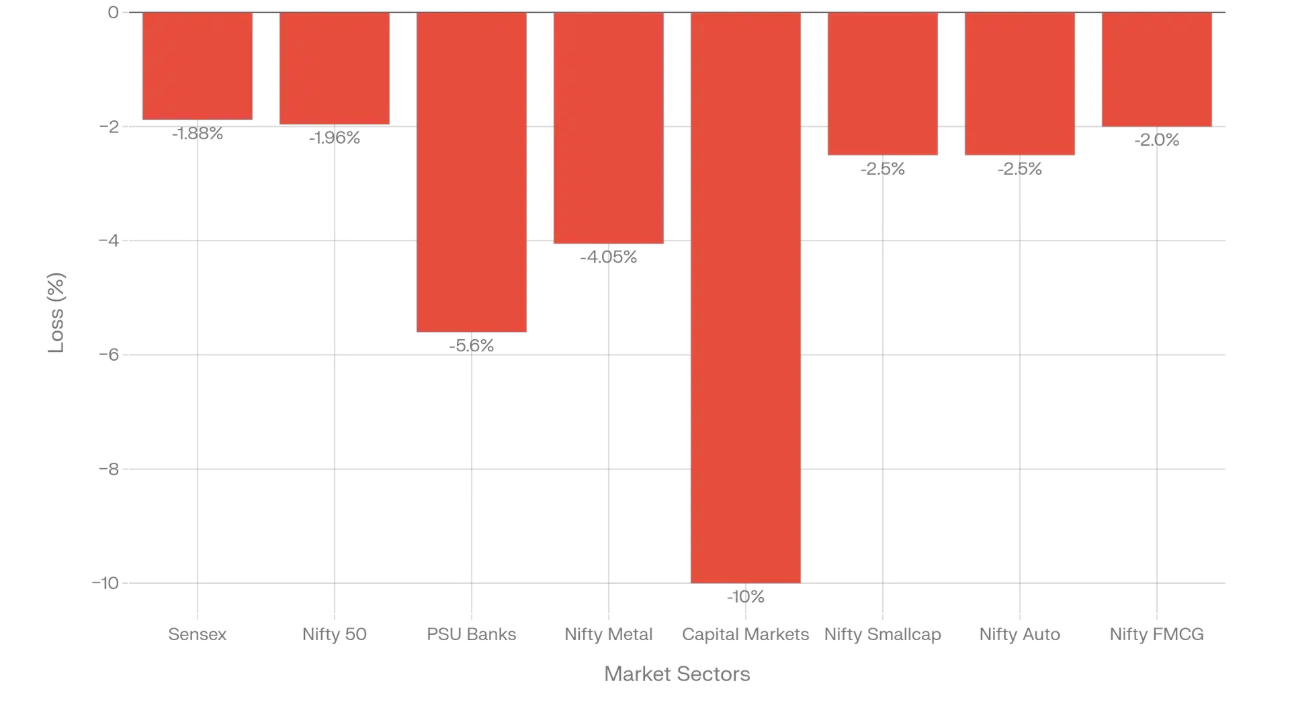

Budget 2026 Sector Winners & Losers: Visual Breakdown

[[Chart: Sector-wise Market Losses on Budget Day]]

Biggest Losers on Budget Day:

1. Capital Markets Sector (-10%)

- BSE (-8.5%)

- Angel One (-8.2%)

- MCX (-12%)

- Reason: STT hike directly impacts trading volumes and brokerage revenues

2. PSU Banks (-5.6%)

- Triggered by merger speculation and lack of infrastructure capex

- SBI alone lost ₹15,000+ crore in market cap

3. Metal Stocks (-4.05%)

- Nifty Metal Index crashed on slower infrastructure demand outlook

4. Broader Losses:

- Auto Sector: -2.5% (rural consumption theme less bullish without MNREGA boost)

- FMCG: -2% (middle-class tax benefits didn't materialize)

- Smallcap & Midcap: -2.5% to -3%

Winners (Surprisingly Few):

1. IT Sector (+0.6%)

- TCS, Infosys gained on data center infrastructure demand

- Long-term AI & cloud infrastructure push is positive for IT services

2. Healthcare & Pharma (+1-2%)

- Max Healthcare, Sun Pharma, Cipla benefited from:

- ₹10,000 crore BioPharma SHAKTI initiative

- 17 cancer drugs made cheaper (duty waiver)

- 3 new All India Institutes of Ayurveda

- 200 day-care cancer centers in district hospitals

3. Data Center Plays (+5-8% intraday)

- Anant Raj: +10% intraday before profit booking

- E2e Networks: +8% on 30-year tax holiday announcement

The Silver Lining: Budget 2026 Positive Announcements

While markets crashed, several long-term structural positives were announced:

1. 30-Year Tax Holiday for Data Centers (Until 2047)

Foreign companies setting up data centers in India get a complete tax holiday until March 31, 2047. This is a game-changer for:

- Cloud Giants: Microsoft, Google, Amazon

- Data Infrastructure: Projected $30-50 billion investment by 2030

- Capacity Growth: India's data center capacity expected to hit 8 GW by 2030 (from 1.5 GW today)

Why This Matters: India is positioning itself as the AI and cloud infrastructure hub for Asia. This will create jobs, attract FDI, and drive down compute costs for startups.

Key Details:

- 15% safe-harbor on cost for Indian-operated data centers

- Must route India customer services through Indian reseller entities

- Effective April 1, 2026

2. Banking Sector Reforms: The Long Game

While PSU banks crashed today, the high-level banking committee (to be formed) signals deeper structural reforms:

- Review of banking system structure for next-phase growth

- Focus on smaller/marginal banks for consolidation

- Improved asset quality already at 98%+ coverage

- Potential governance, risk management, and tech upgrades

For Long-Term Investors: PSU banks like SBI could be restructured for better efficiency, but near-term (6-12 months) merger uncertainty is creating volatility.

3. ₹10,000 Crore BioPharma SHAKTI Program

A dedicated ₹10,000 crore program over 5 years to build domestic capacity for:

- Biologics manufacturing

- Biosimilars production

- Cancer care infrastructure

This positions India as a biopharma manufacturing hub, potentially creating ₹500+ crore opportunity for pharma stocks.

4. Ayurveda & Traditional Medicine Push

- 3 new All India Institutes of Ayurveda

- 17 cancer drugs made cheaper

- ₹1.5 lakh caregiver training programs (Yoga/Ayurveda)

- Direct beneficiary: Patanjali, which has no listed entity but will benefit from rising Ayurveda demand

5. MSME & Rural Employment Support

- Dedicated liquidity fund for MSME sector

- G-RAAM MISSION (renamed MGNREGA) with enhanced budget allocation

- Improved rural employment framework

Beneficiaries: Hero MotoCorp, Mahindra & Mahindra (rural consumption themes)

STT Hike Impact: Real-World Examples for Traders

Example 1: Options Buyer/Seller

Scenario: You buy 1 lot of Nifty 50 Call options (65 lot size) at ₹100 premium

| Cost Component | Old Regime | New Regime | Difference |

| Premium Value | ₹6,500 | ₹6,500 | — |

| Brokerage (₹20) | ₹20 | ₹20 | — |

| STT (on premium) | ₹6.50 (0.1%) | ₹9.75 (0.15%) | +₹3.25 |

| Transaction Tax | ₹7 | ₹7 | — |

| Total Cost | ₹33.50 | ₹36.75 | +₹3.25 (9.7%) |

| Break-even Move | ₹6,533.50 | ₹6,536.75 | Needs 0.05 points more |

Verdict: Options traders see a modest 9-10% increase in trading costs. The impact is real but not catastrophic.

Example 2: Futures Trader

Scenario: You sell 1 Nifty 50 futures contract at ₹25,000 (25 lot size)

| Cost Component | Old Regime | New Regime | Difference |

| Contract Value | ₹6,25,000 | ₹6,25,000 | — |

| Brokerage (₹40) | ₹40 | ₹40 | — |

| STT (on contract value) | ₹125 (0.02%) | ₹312.50 (0.05%) | +₹187.50 |

| Transaction Tax | ₹8 | ₹8 | — |

| Total Cost (Round Trip) | ₹346 | ₹721 | +₹375 |

| Cost as % of Contract | 0.0553% | 0.1154% | +108% |

Verdict: Futures traders see a 100%+ increase in tax costs. A trader executing 10 round-trip daily trades will face ₹3,750 additional daily costs, or ~₹82,500 per month. This explains the flight from futures trading in the coming months.

The Bottom Line: What Should You Do?

For Options Traders:

✅ Continue trading — the cost increase (~₹3-4 per contract) is manageable

✅ Focus on quality setups — fewer but higher-probability trades are now more economical

✅ Track Greeks more closely — with higher transaction costs, position management matters more

❌ Avoid scalping strategies — 20-50 point moves won't cover the higher STT

For Futures Traders:

⚠️ Reassess your trading approach — daily scalping is now significantly more expensive

⚠️ Consider swing trading instead — 2-3 day holds become more cost-effective than intraday plays

⚠️ Monitor volume decline — expect F&O trading volumes to drop 20-30% in coming months

✅ Look at equities delivery — STT on delivery remains unchanged at 0.1%

For Long-Term Investors:

✅ No impact — equity delivery and mutual fund STT unchanged

✅ Use dips to buy — Friday's sell-off created excellent entry points for long-term portfolios

✅ Focus on fundamentals — STT hike doesn't change company earnings

Stock Picks to Watch:

Data Center Boom (Buy on dips):

- Anant Raj (30-year tax holiday appeal)

- E2e Networks (infrastructure play)

Banking (Medium-term hold, avoid now):

- SBI, HDFC Bank — wait for merger clarity

Pharma & Healthcare (Medium-term accumulate):

- Max Healthcare, Sun Pharma (BioPharma initiative)

- Cipla (cancer drug manufacturing)

Rural & Auto (Consolidation):

- Hero MotoCorp, Mahindra & Mahindra (MGNREGA boost eventually filters to rural consumption)

FAQ: Union Budget 2026 Common Questions

Q: Will the STT hike really reduce trading volumes?

A: Historical data suggests 20-30% volume reduction in the first 3-6 months. Government's own estimates suggest ₹1,000-2,000 crore additional tax revenue, implying lower volumes.

Q: Should I exit my F&O positions immediately?

A: No. The new rates apply from April 1, 2026. You have 2 months to adjust your strategy. Panic selling locks in losses.

Q: Is the banking sector rally over?

A: Not necessarily. Once merger clarity emerges (3-6 months), bank stocks could rebound strongly. The committee will take 6-12 months to make recommendations.

Q: Are data center stocks a buy now?

A: Yes, on dips. The 30-year tax holiday is a structural positive. Companies like Anant Raj and E2e Networks could 2x-3x over 2-3 years.

Q: Will delivery-based investors be impacted?

A: No. Equity delivery STT remains at 0.1%. Long-term investors are completely unaffected.

Conclusion: Budget 2026 Was About Long-Term Structural Change

While the immediate market reaction was negative, Finance Minister Sitharaman's Budget 2026 is actually signaling a major structural shift in India's economic direction:

- From Speculation to Stability: Discouraging excessive F&O trading

- From Infrastructure to Innovation: Emphasis on data centers, AI, and biotech

- From Urban Focus to Inclusive Growth: MGNREGA enhancement and rural employment

- From Imports to Manufacturing: BioPharma SHAKTI for domestic capacity

The 1.88% one-day crash is a short-term overreaction. For traders, it's an opportunity to:

- Exit weak positions (intraday scalping that's no longer viable)

- Reposition for long-term growth (data centers, healthcare)

- Reassess risk/reward (with higher trading costs, quality > quantity)

**For the Indian stock market overall, Budget 2026 is bullish long-term, painful short-term.

Last Updated: February 2, 2026

Disclaimer: This analysis is for educational purposes only. Consult a financial advisor before making investment decisions. Stock market investments are subject to market risk.