IT Stocks Analysis:

Navigating the AI Revolution and Market Volatility in 2024-2025

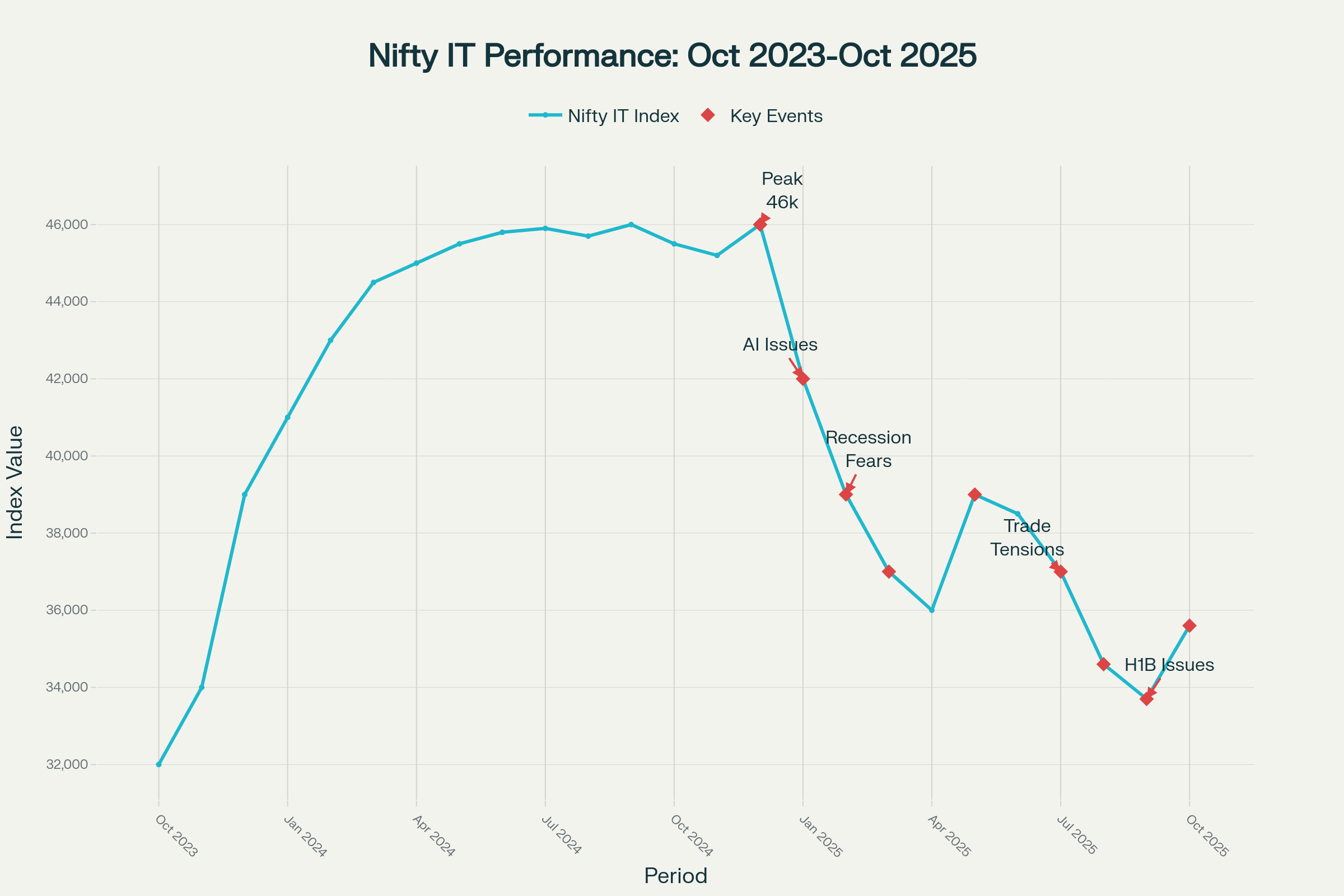

The Indian Information Technology sector stands at a critical juncture in 2024-2025, with the Nifty IT index experiencing significant volatility and a complex interplay of challenges and opportunities. From its all-time high of 46,000 in December 2024, the index has corrected to approximately 35,600 by October 2025, representing a substantial decline of over 22%. This comprehensive analysis examines whether IT stocks present a mega opportunity or remain a value trap, drawing insights from market performance, earnings data, and expert commentary from leading industry analysts.

Nifty IT Index Performance: Tracking the Decline from All-Time High to Current Levels

Current Market Landscape and Valuation Metrics

Sector Performance Overview

The Indian IT sector 2025 presents a compelling investment landscape as IT stocks India navigate through unprecedented market volatility and technological transformation. Our comprehensive Nifty IT analysis reveals that leading Indian software stocks are currently trading at attractive valuations, creating a significant IT stocks investment opportunity for discerning investors. The technology sector analysis indicates that while companies like TCS Infosys stock analysis show resilient fundamentals, the broader stock market IT sector faces headwinds from multiple factors including H1B visa IT stocks restrictions and regulatory uncertainties. However, the AI revolution IT industry is reshaping the competitive landscape, with AI impact IT companies driving new revenue streams and service offerings that could redefine sector growth trajectories. Current IT stocks valuation metrics suggest that many quality names are trading below historical averages, making this an opportune time to identify the best IT stocks to buy for long-term portfolio growth. Investors conducting thorough due diligence on individual companies' AI capabilities, client diversification, and adaptation strategies will be well-positioned to capitalize on the sector's eventual recovery and transformation into next-generation technology services providers.

The Nifty IT index currently trades at a Price-to-Earnings (P/E) ratio of 25.7, down from higher levels during the peak. This represents a significant improvement in valuation metrics compared to the sector's historical median P/E of approximately 27. The index comprises ten major IT companies with TCS commanding the largest weightage at 37.22%, followed by Infosys at 21.07% and HCL Technologies at 13.55%.

Recent quarterly performance data reveals mixed results across the sector. TCS reported Q2 FY26 revenue of ₹65,799 crore, representing a 2.4% year-on-year growth, while net profit increased marginally by 1.4% to ₹12,075 crore. Infosys demonstrated stronger momentum with revenue growth of 7.54% and profit growth of 8.68%. However, HCL Technologies faced headwinds with a 9.73% decline in profits despite 8.17% revenue growth.

Four Key Factors Behind the Correction

The dramatic correction in IT stocks can be attributed to four primary factors, each presenting varying degrees of long-term impact on sector fundamentals.

Artificial Intelligence Disruption (December 2024 - February 2025)

The emergence of Chinese AI company DeepSeek in January 2025 triggered widespread concerns about AI displacing traditional IT services. The Nifty IT index fell 3.35% in a single day on January 27, 2025. However, leading IT companies have demonstrated adaptability to this challenge. TCS reported that 18% of its $8.3 billion deal pipeline in Q1 FY25 came from AI-related projects, totaling $1.5 billion. The company has trained over 114,000 employees in AI skills and implemented successful AI solutions for clients like Australia's Foxtell Group.

US Recession Concerns (February - April 2025)

Fears of a US economic downturn created significant headwinds for Indian IT stocks, given that approximately 57% of the sector's revenue originates from the US market. However, this proved to be a short-lived concern as JP Morgan reduced recession probability estimates from 60% to 40% in May 2025, leading to a swift recovery in IT stock prices.

Trade Relations and Tariff Issues (July - August 2025)

US-India trade tensions culminated in the imposition of 50% tariffs on Indian exports by August 28, 2025, creating additional pressure on IT stocks despite the sector being largely exempt from these measures. The sentiment-driven decline is expected to reverse once bilateral trade agreements are finalized.

H1B Visa Restrictions (September - October 2025)

The Trump administration's implementation of a $100,000 fee for new H1B visas has created uncertainty for Indian IT companies. However, the impact appears manageable as H1B applications from Indian IT firms have already declined 50% from 42,000 in 2017 to approximately 20,000 in 2024. Companies like TCS face an estimated 1.52% negative earnings impact, while Infosys faces only 3.45%.

Artificial Intelligence: Catalyst or Threat?

Industry Transformation and Adaptation

The AI revolution presents both opportunities and challenges for Indian IT companies. NASSCOM projects that India will add almost 400,000 new AI-related jobs by 2025, indicating significant growth potential in this segment. Leading companies are actively repositioning themselves to capitalize on AI demand.

TCS has emerged as the sector leader in AI adoption, with CEO K. Krithivasan stating the company's ambition to become "the world's largest AI-led technology services company". The company has announced plans to establish a 1 GW AI data center in India and recently acquired ListEngage, a US-based Salesforce partner, for $72.80 million to enhance its AI capabilities.

Over 80% of Indian organizations are exploring autonomous AI agents, according to Deloitte's State of GenAI report, with 70% expressing strong interest in using GenAI for automation. This trend suggests robust demand for AI services that Indian IT companies are well-positioned to fulfill.

Sector-Specific AI Impact

The impact of AI varies significantly across different service categories. Companies providing routine, rules-based services face the highest disruption risk, while those focusing on complex, strategic consulting and innovation are likely to benefit. This explains the divergent performance among IT companies, with high-growth firms like Persistent Systems and Coforge commanding premium valuations of 55.05 and 59.63 P/E ratios respectively, reflecting their stronger positioning in AI-enabled services.

Financial Performance Analysis by Company Categories

Large-Cap Stability with Moderate Growth

Large-cap IT companies (TCS, Infosys, Wipro) trade at reasonable valuations with average P/E ratios of 21.41, significantly lower than their historical averages. These companies offer stability and consistent dividend yields, with TCS recently announcing an interim dividend of ₹11 per share.

TCS maintains its market leadership with robust fundamentals, including a Total Contract Value (TCV) of $10 billion in Q2 and strong performance across verticals led by BFSI growth of 1.1% quarter-on-quarter in constant currency. The company's operating margin expanded by 70 basis points to 25.2%.

Mid-Cap High-Growth Opportunities

Persistent Systems and Coforge represent the high-growth category, delivering exceptional performance with revenue growth of 21.79% and 56.49% respectively. These companies command premium valuations but offer significant upside potential for growth-oriented investors willing to pay higher multiples for superior execution capabilities.

Sectoral Recovery Indicators

Industry analysts anticipate a modest recovery in FY27, driven by stabilizing macroeconomic conditions in the US and Europe, along with increased enterprise-scale AI adoption. HSBC Global Research projects a 200-300 basis point improvement in revenue growth as digital transformation accelerates and AI projects scale up.

Investment Implications and Strategic Outlook

Near-Term Catalysts

Several factors could drive sector recovery in the coming quarters:

- US-India Trade Deal Resolution: A comprehensive trade agreement could trigger a relief rally across IT stocks

- Q2-Q3 Earnings Performance: Strong quarterly results and improved forward guidance from major companies

- AI Deal Pipeline Expansion: Increasing AI-related revenue contribution across the sector

- Macroeconomic Stabilization: Reduced recession fears and improved client spending patterns

Risk Factors and Mitigation Strategies

The proposed HIRE Act, which would impose a 25% tax on US companies outsourcing work abroad, represents the most significant long-term risk to the sector. However, industry experts expect extensive lobbying and legal challenges, given the substantial cost implications for US corporations heavily dependent on Indian IT services.

Companies are adapting by expanding their global footprint beyond the US market, focusing on Asia, Japan, Australia, Nordic countries, and the Middle East to diversify revenue sources. Additionally, the growth of Global Capability Centers (GCCs) provides an alternative growth avenue as US companies establish direct operations in India.

Conclusion and Investment Strategy

The Indian IT sector presents a compelling contrarian investment opportunity at current valuations, with the Nifty IT index trading below historical averages despite strong long-term fundamentals. The correction has created attractive entry points for investors willing to navigate near-term volatility.

Key investment criteria for stock selection include:

- AI readiness and pipeline contribution (target companies with >15% AI revenue)

- Diversified client base and geographic presence

- Strong balance sheet and cash generation capabilities

- Reasonable valuations relative to growth prospects

Companies like TCS and Infosys offer stability and reasonable valuations for conservative investors, while Persistent Systems and Coforge provide higher growth potential for those comfortable with premium valuations. The sector's ability to adapt to AI disruption, combined with improving macroeconomic conditions and attractive valuations, suggests that current levels may indeed represent a mega opportunity rather than a value trap for discerning investors with a medium to long-term investment horizon.

The path forward requires careful stock selection based on AI capabilities, client diversification, and financial strength, as the sector transitions from traditional outsourcing to AI-enabled digital transformation services. Those companies successfully navigating this transition are likely to emerge as the biggest winners in the post-correction recovery phase.

Disclaimer: The information provided is for educational purposes only and should not be considered as investment advice. Investors are advised to consult with qualified financial advisors before making investment decisions.