Technical Analysis for 13th Feb 2026

Nifty Predictions, Bank Nifty Predictions & Sensex Predictions

On February 12, 2026, the Indian Stock Market faced pressure from a sharp IT sector selloff, closing lower. Nifty settled at 25,807 (down 147 points), Bank Nifty at 60,739 (flat), and Sensex at 83,674 (down 559 points). This Technical Analysis for 13th Feb 2026 provides detailed Nifty Predictions, Bank Nifty Predictions, and Sensex Predictions based on derivative data and latest 15-minute charts.

Key Observations of Today’s Derivative Market Data

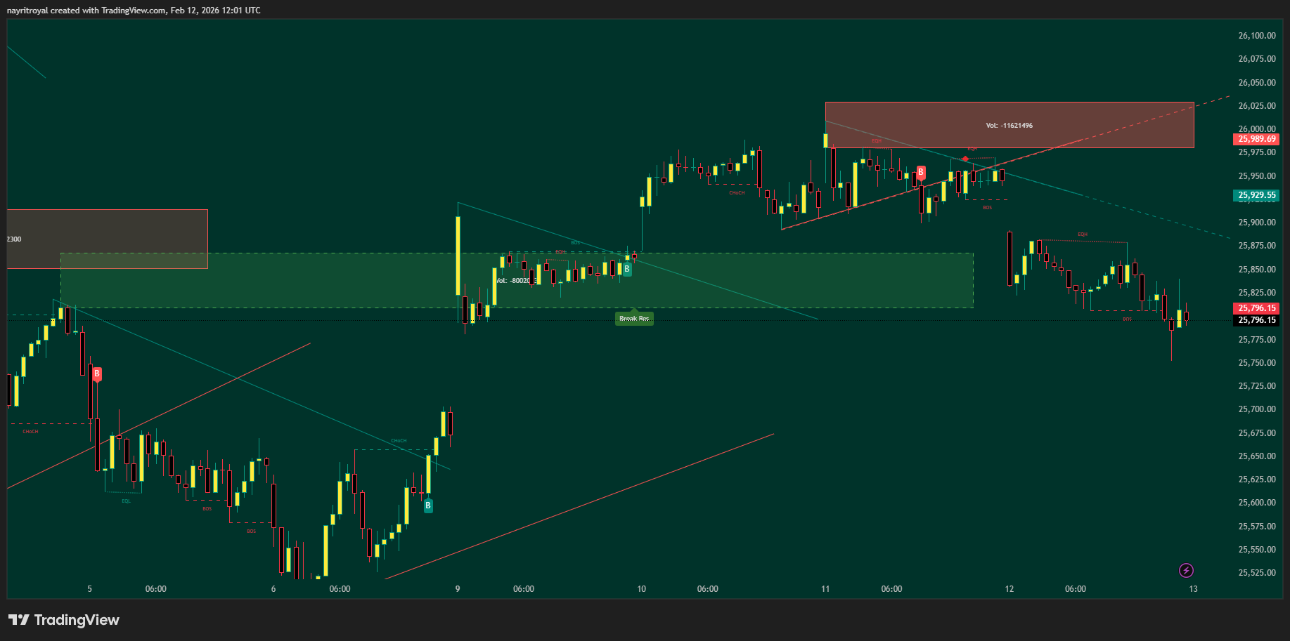

- Nifty: Opened near 25,899, high 25,906, low 25,752, close 25,807. Narrow range of ~154 points; bearish candle with lower shadow, rejection from highs amid IT drag (Tech Mahindra -6.5%, Infosys/TCS -6%).

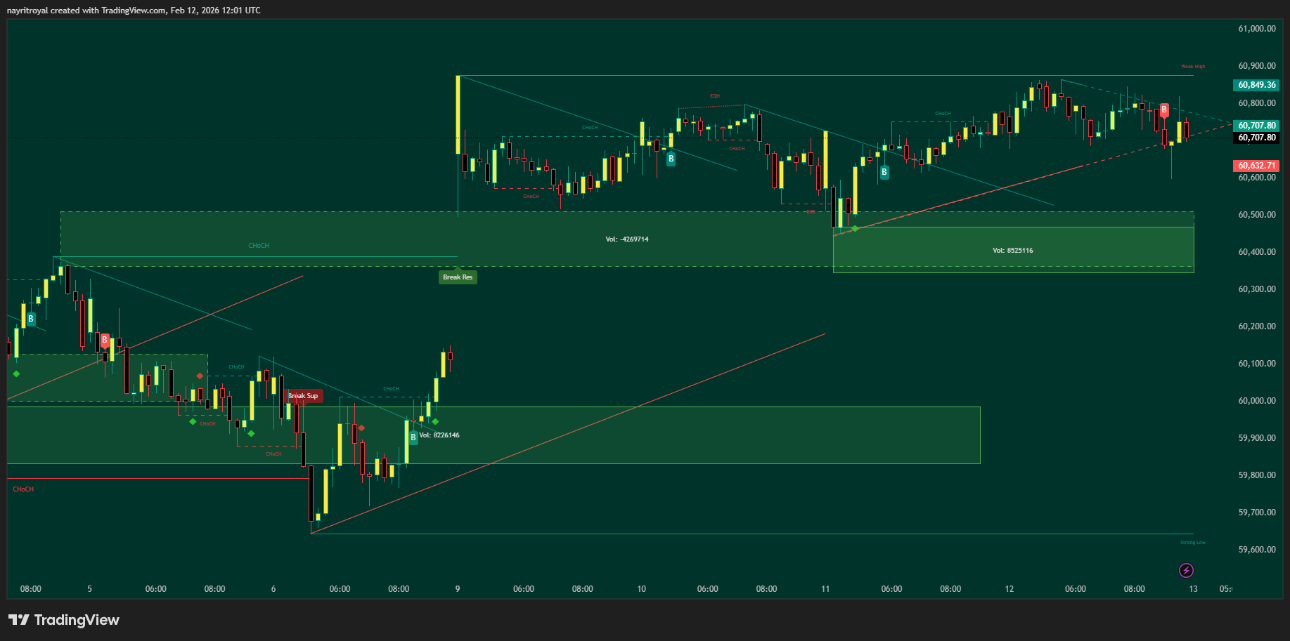

- Bank Nifty: High 60,864, low 60,597, close 60,739. Neutral flat candle; bounced from supports like 60,780 but banks (HDFC, Kotak, Axis) pressured post-1:30 PM.

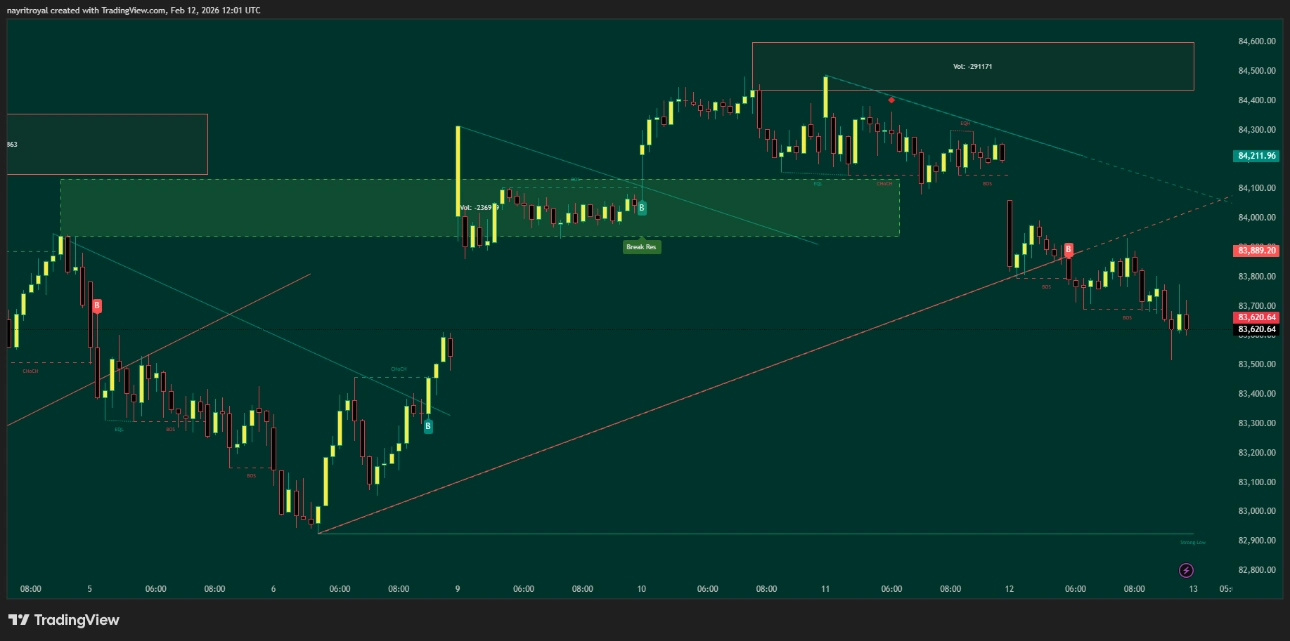

- Sensex: Gap down below previous low ~84,481, high ~84,461, low 83,516, close 83,674. Bearish candle with breakdown after 1:45 PM; low FII volumes, put writers at key levels.

Overall candle patterns: Bearish/neutral, range-bound action with IT weakness dominating.

Support & Resistance Levels

Nifty Support & Resistance

- Supports: 25,752 – 25,705 – 25,654 – 25,608

- Resistances: 25,906 – 25,945 – 25,997 – 26,040

Bank Nifty Support & Resistance

- Supports: 60,597 – 60,495 – 60,322 – 60,181

- Resistances: 60,864 – 61,000 – 61,325

Sensex Support & Resistance

- Supports: 83,516 – 83,495 – 83,350 – 83,172 – 82,982

- Resistances: 83,802 – 83,920 – 84,461 – 84,165

Nifty Predictions – Technical Analysis for Tomorrow

(Latest TradingView 15-minute chart: Bearish candles post-1 PM, low at 25,752 held; RSI ~40 (oversold), MACD bearish. Precise S&R lines: supports 25,752/25,705, resistances 25,906/25,945 drawn accurately for intraday.)

Our opinion: Gap-up open likely, but range-bound 25,800-26,000. Bullish above 25,906: Targets 25,945, 25,997 (26,040 max). Buy dips >25,852, SL 25,752. Bearish <25,752: To 25,705-25,654. Intraday zone: 25,800-25,900; sideways bias due to IT caution.

Bank Nifty Predictions – Technical Analysis

(Real TradingView 15m snapshot: Neutral candles, bounce from 60,597; volume at lows. Trendline resistance 60,864; supports 60,597/60,495 plotted exactly, mild bullish divergence.

Bank Nifty resilient vs. Nifty. Prediction: Mild upside if holds 60,739. Bullish >60,864: Targets 61,000-61,325. Entry 60,780-60,850, exit 61,000, SL 60,597. Bearish <60,597: To 60,495. Strategy: Long on pullbacks in 60,700-60,850 range.

Sensex Predictions – Technical Analysis

(Updated TradingView 15m chart: Gap down, bearish engulfing ~1:30 PM; low 83,516 defended. Pivot at 83,674, resistances 83,802-83,920 overlaid accurately.)

Sensex cautious post-gap down. Bullish >83,802: Targets 83,920-84,461. Entry 83,750-83,800, SL 83,516. Bearish <83,495: To 83,350-83,172. Short rallies below 83,802; watch sustain above lows for reversal.

Tomorrow’s Market Prediction

Market Analysis for Tomorrow: Gap-up open on global cues, but sideways/consolidation outlook. Nifty 25,750-26,000, Bank Nifty 60,600-61,000, Sensex 83,500-84,000. Buy dips at supports; IT drag limits upside in Indian Stock Market.

Final Verdict

Previous analyses accurately nailed today's ranges and IT pressure. Reconfirming cautious sideways for 13th Feb 2026 – trade levels strictly.

Disclaimer: This analysis is for educational purposes only. Not investment advice. Please consult your financial advisor before trading.