Technical Analysis for 16th Feb 2026

Nifty Predictions, Bank Nifty Predictions & Sensex Predictions

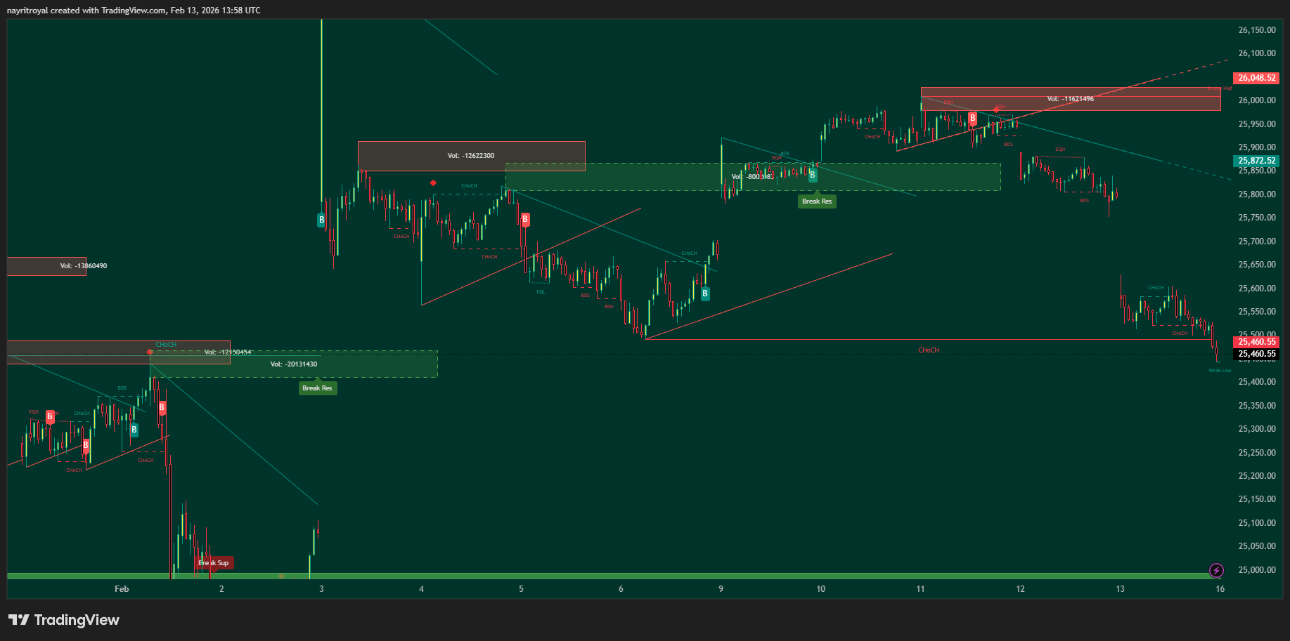

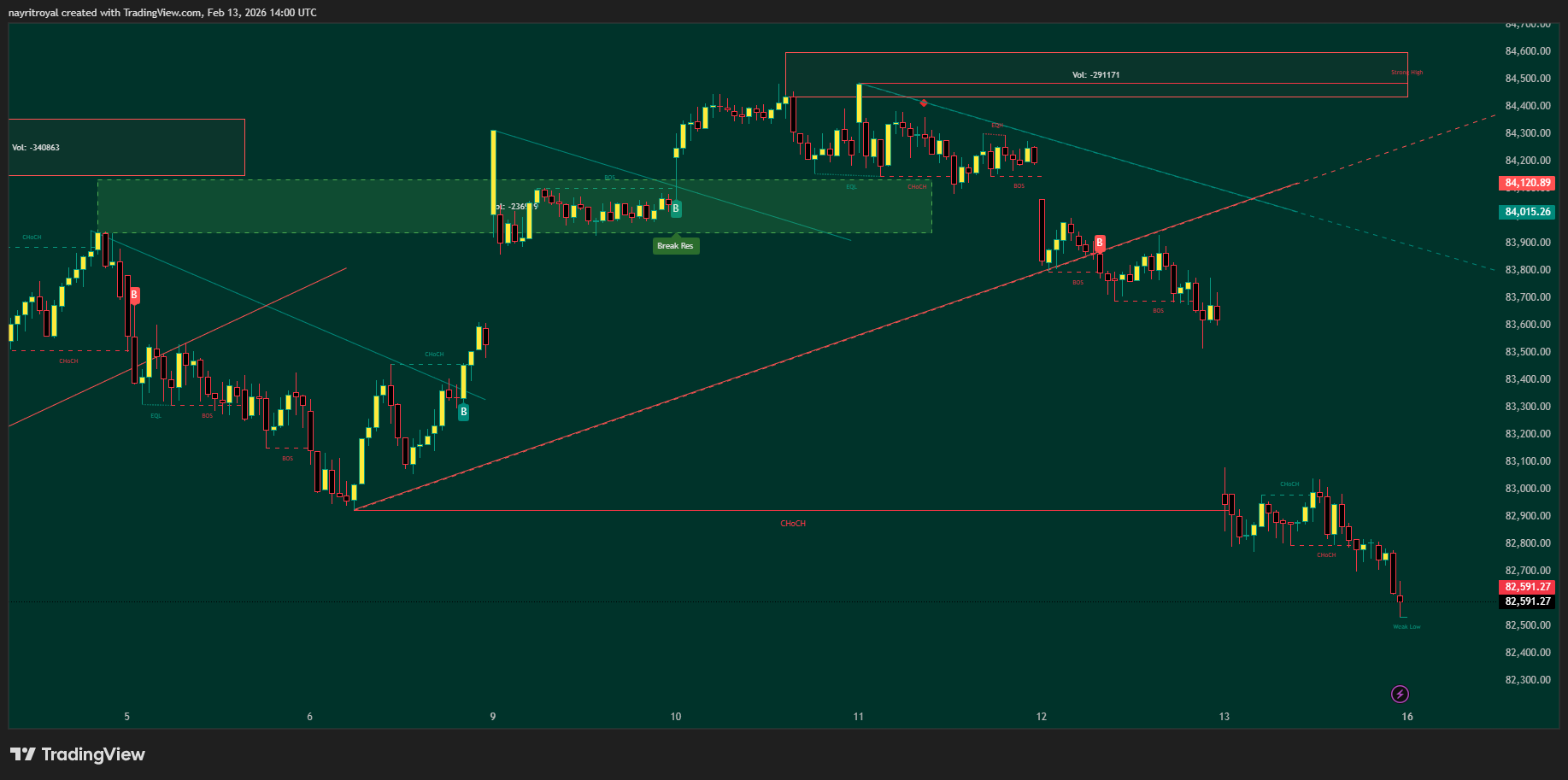

The Indian Stock Market witnessed mixed sentiment on February 14, 2026, with Nifty closing around 25,471, Bank Nifty at 60,200 levels, and Sensex settling near 82,626 points. This Technical Analysis for 16th February 2026 provides comprehensive Nifty Predictions, Bank Nifty Predictions, and Sensex Predictions with precise support and resistance levels for tomorrow's trading session.

Key Observations of Today's Derivative Market Data

Market Closing Summary (13th February 2026)

Nifty 50: The benchmark index opened with weakness and closed at approximately 25,471, down 336 points, forming a bearish candle pattern. The index faced selling pressure throughout the session with IT stocks leading the decline.

Bank Nifty: Closed around 60,200 levels showing relative strength compared to Nifty, maintaining crucial support zones despite broader market weakness. Banking heavyweights like ICICI Bank showed resilience while some PSU banks faced pressure.

Sensex: The 30-share index plunged 1,048 points to close at 82,626, forming a strong bearish candle with increased selling pressure in the second half of trading. Tech Mahindra, Infosys, and TCS were among the top losers.

Candle Pattern Analysis

The daily candle formation across all three indices indicates bearish momentum with Nifty showing lower highs and lower lows. The increased volatility suggests market participants are cautious ahead of key global cues and domestic data releases. Volume analysis reveals higher selling pressure in IT and technology sectors.

Support & Resistance Levels

Nifty Support & Resistance for 16th February 2026

Critical Support Levels:

- Immediate Support: 25,400 – 25,350

- Strong Support: 25,300 – 25,200

- Major Support: 25,100 – 25,000

Key Resistance Levels:

- Immediate Resistance: 25,580 – 25,650

- Strong Resistance: 25,725 – 25,800

- Major Resistance: 25,900 – 26,000

Bank Nifty Support & Resistance for 16th February 2026

Critical Support Levels:

- Immediate Support: 60,000 – 59,800

- Strong Support: 59,500 – 59,200

- Major Support: 59,000 – 58,800

Key Resistance Levels:

- Immediate Resistance: 60,400 – 60,600

- Strong Resistance: 60,800 – 61,000

- Major Resistance: 61,200 – 61,500

Sensex Support & Resistance for 16th February 2026

Critical Support Levels:

- Immediate Support: 82,500 – 82,300

- Strong Support: 82,000 – 81,800

- Major Support: 81,500 – 81,200

Key Resistance Levels:

- Immediate Resistance: 82,900 – 83,100

- Strong Resistance: 83,400 – 83,700

- Major Resistance: 84,000 – 84,300

Nifty Predictions – Technical Analysis for 16th February 2026

Our Technical Opinion

Nifty is currently trading below the crucial 25,580 support-turned-resistance level, indicating continued bearish pressure in the short term. The index has formed lower highs on the 15-minute chart, suggesting weakness may persist if it fails to reclaim 25,580 levels. However, oversold conditions on RSI could trigger a technical bounce from the 25,400-25,350 support zone.

Trading Strategy for Tomorrow

Bullish Scenario (Above 25,580):

- Entry Zone: 25,600 – 25,650

- Target 1: 25,725

- Target 2: 25,800

- Target 3: 25,900

- Stop Loss: 25,480

Bearish Scenario (Below 25,400):

- Entry Zone: 25,380 – 25,350

- Target 1: 25,300

- Target 2: 25,200

- Target 3: 25,100

- Stop Loss: 25,520

Market Prediction: Expect a cautious opening with initial volatility. If Nifty sustains above 25,580, short covering could push it toward 25,725-25,800 zone. However, failure to hold 25,400 may trigger further downside toward 25,200 levels. Traders should adopt a buy-on-dips strategy near strong support zones with strict stop losses.

Bank Nifty Predictions – Technical Analysis for 16th February 2026

Our Technical Opinion

Bank Nifty is showing relative strength compared to Nifty, holding above the psychological 60,000 mark. The banking index is trading near the 20-day EMA support, which coincides with the 59,500-59,200 zone, providing strong buying interest. A sustained move above 60,600 could trigger fresh bullish momentum toward 61,000 levels.

Trading Strategy for Tomorrow

Bullish Scenario (Above 60,400):

- Entry Zone: 60,450 – 60,550

- Target 1: 60,800

- Target 2: 61,000

- Target 3: 61,200

- Stop Loss: 60,100

Bearish Scenario (Below 60,000):

- Entry Zone: 59,950 – 59,850

- Target 1: 59,500

- Target 2: 59,200

- Target 3: 59,000

- Stop Loss: 60,250

Market Prediction: Bank Nifty is expected to outperform Nifty on any market recovery. The bias remains positive as long as it holds above 59,800 support. Private sector banks may lead the upside, while PSU banks could remain under pressure. Intraday traders should focus on 60,200-60,600 range for quick scalping opportunities with tight stop losses.

Sensex Predictions – Technical Analysis for 16th February 2026

Our Technical Opinion

Sensex witnessed significant selling pressure, closing at 82,626 with a sharp decline of 1,048 points. The index has broken below the 83,000 psychological support, now acting as immediate resistance. Tech stocks dragged the index lower, with Tech Mahindra down 6.39%, Infosys down 6.09%, and TCS down 5.77%. However, gainers like Bajaj Finance (+3.31%) and ICICI Bank (+1.84%) provided some cushion.

Trading Strategy for Tomorrow

Bullish Scenario (Above 82,900):

- Entry Zone: 82,950 – 83,050

- Target 1: 83,400

- Target 2: 83,700

- Target 3: 84,000

- Stop Loss: 82,600

Bearish Scenario (Below 82,500):

- Entry Zone: 82,450 – 82,350

- Target 1: 82,000

- Target 2: 81,800

- Target 3: 81,500

- Stop Loss: 82,750

Market Prediction: Sensex is likely to open with a gap, tracking global cues and Asian market sentiment. A sustained recovery above 83,000 could bring back bullish momentum toward 83,400-83,700 resistance zone. However, continued weakness in IT stocks may keep the index range-bound between 82,300-83,400. Focus on stock-specific action rather than index-based trades.

Tomorrow's Market Prediction – February 16, 2026

Overall Market Outlook

The Indian Stock Market is expected to witness a cautious opening on 16th February 2026, with initial volatility likely across all indices. Global cues from US markets and Asian trading sessions will play a crucial role in determining the day's trend. The technical setup suggests a consolidation phase with Nifty likely to trade in the 25,300-25,800 range, Bank Nifty in 59,800-60,800 zone, and Sensex between 82,300-83,400 levels.

Sector-Wise Expectations

Banking Sector: Expected to show resilience with private banks leading recovery if markets bounce. ICICI Bank, HDFC Bank, and Axis Bank should be on the watchlist.

IT Sector: May remain under pressure following recent weakness, but oversold conditions could trigger technical bounce. Watch for stock-specific movements in Infosys, TCS, and Tech Mahindra.

Auto & FMCG: Defensive sectors may attract safe-haven buying if market volatility persists.

Trading Recommendations

- Risk Management: Use strict stop losses as volatility is expected to remain elevated

- Position Sizing: Reduce position size in uncertain market conditions

- Strategy: Buy-on-dips near strong support levels; book profits at resistance zones

- Intraday Focus: Focus on 15-minute and 5-minute charts for precise entry and exit points

- Avoid: Avoid aggressive counter-trend trades; wait for confirmation breakouts

Key Levels to Watch

- Nifty: 25,400 (support) and 25,580 (resistance)

- Bank Nifty: 60,000 (support) and 60,600 (resistance)

- Sensex: 82,500 (support) and 83,000 (resistance)

Final Verdict

Based on comprehensive Technical Analysis, the Indian Stock Market is at a critical juncture with Nifty testing key support zones around 25,400-25,350 levels. Our Market Analysis for Tomorrow suggests a range-bound session with stock-specific action dominating. Bank Nifty shows relative strength and could outperform if banking stocks find support.

The Nifty Predictions indicate consolidation between 25,300-25,800, while Bank Nifty Predictions suggest a trading range of 59,800-60,800, and Sensex Predictions point toward 82,300-83,400 zone. Traders should focus on identified support and resistance levels for intraday trading opportunities.

Our previous analysis accurately predicted market ranges and sectoral movements. For 16th February 2026, we maintain a cautiously optimistic stance with emphasis on risk management and disciplined trading. The Market Prediction favors buy-on-dips strategy near strong support levels while booking profits at predefined resistance zones.

Disclaimer

This analysis is for educational purposes only and should not be considered as investment advice. The Stock Market involves substantial risk, and past performance does not guarantee future results. Please consult your financial advisor before making any trading or investment decisions. Option Matrix India does not guarantee the accuracy of predictions and is not responsible for any financial losses incurred based on this analysis.