Technical Analysis for 17th Feb 2026

Nifty Predictions, Bank Nifty Predictions & Sensex Predictions

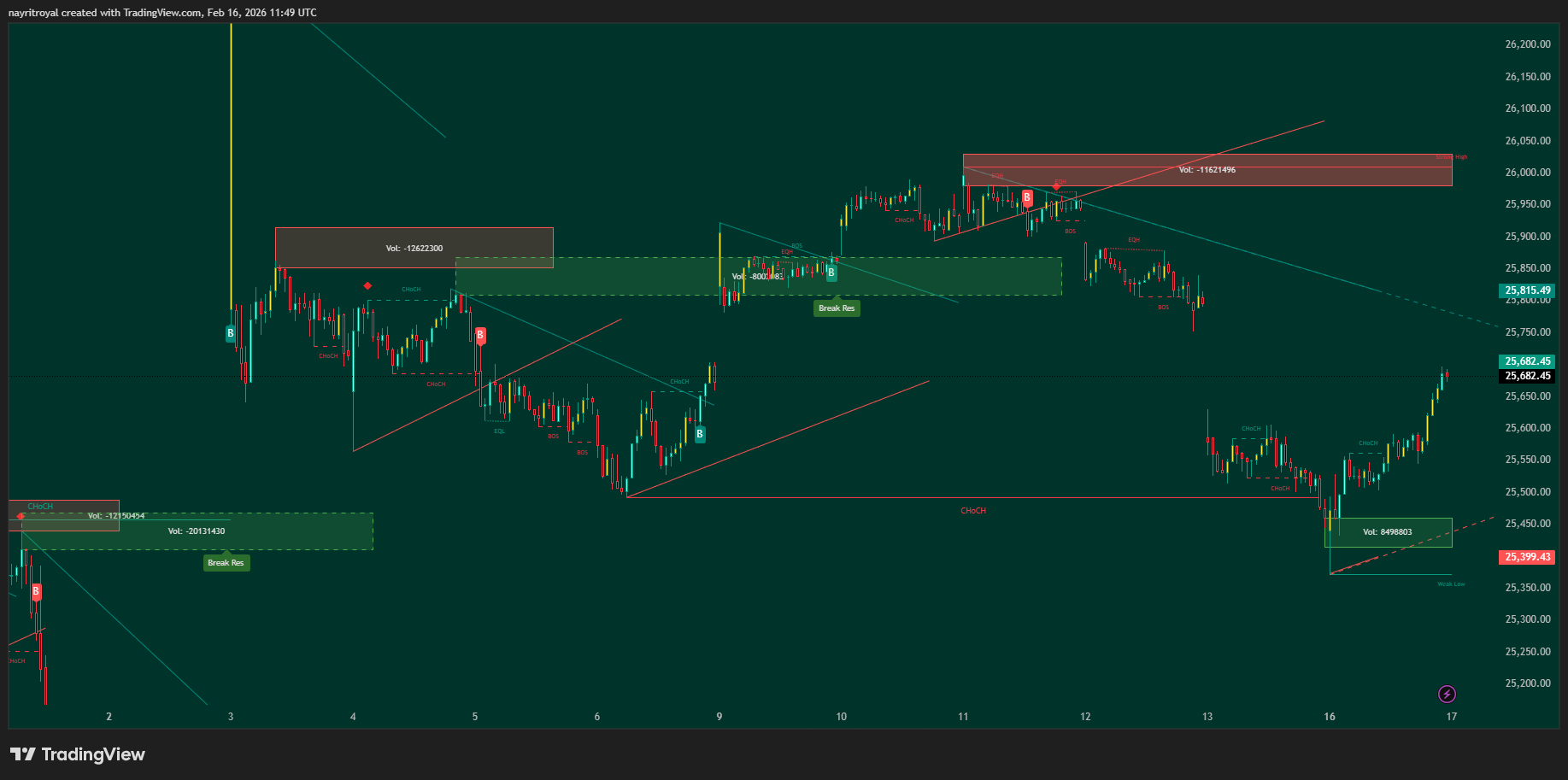

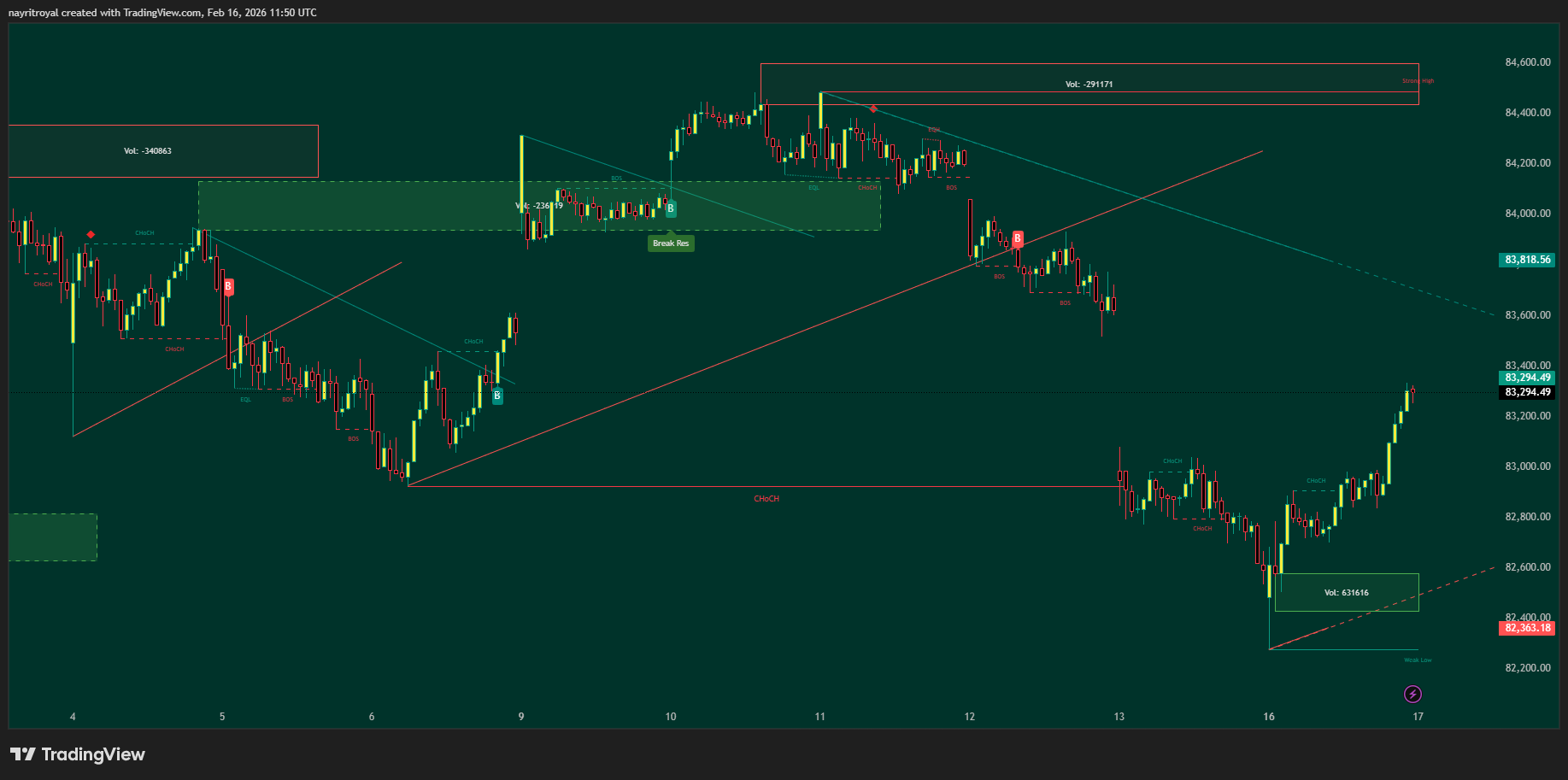

On 16 February 2026, the Indian Stock Market ended with a sharp decline after recent strength, with Nifty 50 closing at 25,471.10, down about 1.30%, while the Sensex settled at 82,626.76, down roughly 1.25%. This weakness came after a strong up‑move in the prior sessions, signalling profit‑booking and supply emerging at higher levels.

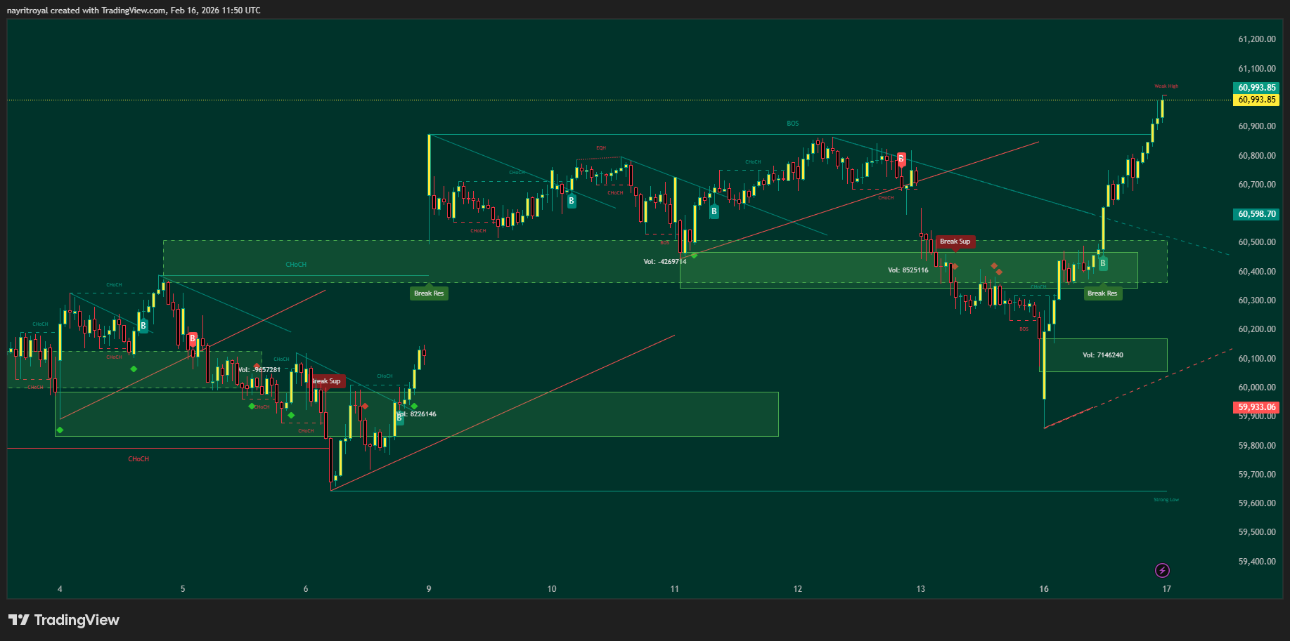

Bank Nifty also mirrored the broader weakness, with option data continuing to cluster around the 60,000 zone, indicating a heavy tug of war between bulls and bears near this psychological mark. For 17th February 2026, the focus remains on disciplined technical trading using clearly defined support and resistance levels on the daily and 15‑minute charts.

Today’s Derivatives & Market Structure

Recent F&O data shows that for Nifty 50, significant call writing has built up around and above the 25,600–26,000 zone, particularly at strikes such as 26,000 and 27,000, creating a strong overhead supply band for the short term. On the put side, open interest is concentrated between 25,300 and 25,500 strikes, suggesting option sellers are defending this lower band as support.

For Bank Nifty, active call positions around 60,700 and 61,000 highlight a ceiling, while puts around 60,000 and 59,500 indicate a demand pocket just below spot. At the same time, recent data shows FIIs increasing index futures shorts by around ₹2,500 crore and selling nearly ₹7,000 crore in the cash segment, even as clients remain heavily long on puts, underscoring a cautious to bearish institutional stance despite retail optimism.

Candle Pattern & Daily Bias

The broad‑based fall in Nifty and Sensex has effectively created a wide‑range negative candle on the daily chart, confirming that sellers regained control from the recent swing highs. Such wide‑range bearish candles often lead to either a continuation leg lower or a consolidation day with intraday whipsaws inside the prior day’s range.

For Bank Nifty, the combination of heavy call writing overhead and supports clustered just below current levels typically translates into a choppy, mean‑reverting intraday structure rather than a clean trend day. This backdrop supports a cautious stance for 17th February 2026, with traders better served focusing on support and resistance levels and respecting risk management.

Support and Resistance Levels

Below are the key zones to track for 17th February 2026 based on current price, option positioning and psychological round numbers:

- Nifty 50 – Support & Resistance Levels

- Support 1: 25,400–25,350

- Support 2: 25,250–25,200

- Resistance 1: 25,650–25,700

- Resistance 2: 25,800–26,000

- Bank Nifty – Support & Resistance Levels

- Support 1: 60,000–59,800

- Support 2: 59,500–59,300

- Resistance 1: 60,700–61,000

- Resistance 2: 61,400–61,800

- Sensex – Support & Resistance Levels

- Support 1: 82,000–81,800

- Support 2: 81,200–81,000

- Resistance 1: 83,200–83,500

- Resistance 2: 84,000–84,300

These zones are intended as trading bands for intraday Market Analysis for Tomorrow, not fixed numbers; minor deviation of 20–30 points on Nifty and 80–120 points on Bank Nifty is normal in live markets.

Nifty Predictions – Technical Analysis for 17 Feb 2026

Nifty’s close near 25,471 after a 330‑plus point fall indicates that supply emerged strongly from the higher band where call writers are active around 25,600–26,000. With put writers still present near 25,300–25,500, a broad trading range between 25,250 and 25,800 is the most probable structure for 17th February.

15‑Minute Chart View (TradingView overlay suggestion):

On the 15‑minute chart, traders can mark:

- Intraday support zone: 25,350–25,250 (demand pocket and likely prior intraday base).

- Intraday resistance zone: 25,650–25,750 (near where recent call OI is concentrated and prior intraday supply is expected).

Intraday Trading Plan (Nifty):

- Bullish zone (buy‑on‑dip idea):

- Prefer long trades if Nifty holds above 25,350–25,250 on 15‑minute closing basis.

- Upside intraday targets: 25,550 first, then 25,700.

- Protective stop‑loss: Below 25,220 on 15‑minute close.

- Bearish zone (sell‑on‑rise idea):

- Look for short setups near 25,650–25,750 if price rejects this zone on the 15‑minute chart.

- Downside intraday targets: 25,500 first, then 25,350.

- Protective stop‑loss: Above 25,800.

This aligns with the current option chain where heavy call writing appears near 26,000, capping major upside unless there is a strong gap‑up and follow‑through. Traders should treat any sustained move above 25,800–26,000 as a possible short‑covering breakout, but until then, short trades near resistance remain favourable.

Bank Nifty Predictions – Technical Analysis

Bank Nifty is structurally weaker than headline indices, with option data showing strong resistance created by calls at 60,700 and 61,000, and solid put positioning at 60,000 and 59,500 acting as support. This OI distribution strongly hints at a range‑bound to mildly bearish day between 59,500 and 61,000 unless a major trigger shifts sentiment.

15‑Minute Chart View (TradingView overlay suggestion):

Key trade zones to draw on the 15‑minute Bank Nifty chart:

- Demand zone: 59,800–59,500 (short‑term support band aligned with put OI).

- Supply zone: 60,700–61,000 (call‑heavy resistance with high probability of selling pressure).

Intraday Trading Plan (Bank Nifty):

- Buy‑near‑support approach:

- Consider long trades if price stabilises above 59,800–59,500 with clear rejection wicks or bullish 15‑minute candles.

- Upside intraday targets: 60,400 then 60,700.

- Protective stop‑loss: Below 59,400 on a 15‑minute close.

- Sell‑on‑rise approach (preferred bias):

- Priority selling zone: 60,700–61,000, especially if price shows rejection (upper wicks or bearish engulfing on 15‑minute chart).

- Downside intraday targets: 60,200 then 59,800 and 59,500.

- Protective stop‑loss: Above 61,100.

Given FIIs’ short build‑up and cash selling, Bank Nifty is vulnerable to sharp intraday dips if support fails, so traders should reduce position size and trail stops aggressively in case of a breakdown.

Sensex Predictions – Technical Analysis

Sensex closing near 82,627 after a fall of over 1,000 points shows clear profit‑booking from higher levels in line with Nifty’s correction. This decline turns the recent up‑move into a short‑term consolidation phase rather than a straight bullish trend.

For 17th February 2026:

- Immediate support is expected around 82,000–81,800, with a deeper demand pocket closer to 81,200–81,000.

- Resistance lies near 83,200–83,500, with a stronger supply zone towards 84,000–84,300.

Sensex 15‑Minute Trading View (conceptual):

- Buying interest is likely to emerge near 82,000–81,800 if global cues are neutral.

- Selling pressure is likely to show around 83,200–83,500; risk‑reward favours short trades closer to this band with tight stops.

Intraday Trading Idea (Sensex):

- Longs can be attempted near 82,000 with targets towards 82,700–83,000 and a stop below 81,800.

- Shorts can be attempted near 83,200–83,500 with targets back to 82,500–82,200 and a stop above 83,700.

Again, these levels are meant as trading zones rather than investment advice, and position sizing must respect individual risk profiles.

Tomorrow’s Market Prediction – Overall Outlook

Putting the price action, derivative data and index levels together, the Indian Stock Market setup for 17th February 2026 favours:

- A sideways to mildly bearish intraday structure in Nifty and Bank Nifty.

- A trading range of approximately 25,250–25,800 on Nifty and 59,500–61,000 on Bank Nifty, with spikes outside this band likely to be faded unless supported by strong volume.

- Sensex likely oscillating between 82,000 and 83,500 in absence of major global news.

Nifty option chain positioning with call writing at higher strikes and put clustering lower suggests that option sellers prefer the index to stay around the mid‑25,000 band rather than trend strongly in either direction. Combined with FIIs’ cautious stance and clients’ aggressive put positions, volatility intraday can remain elevated even if closing levels end inside this broader range.

Final Verdict – From Option Matrix Style View

Recent sessions have seen key levels derived from option OI and price action work well, with the indices repeatedly respecting major support and resistance bands before reversing, validating a level‑driven approach to intraday trading. For 17th February 2026, the same framework remains valid: respect the defined zones, avoid chasing gaps, and stay aligned with the Market Analysis for Tomorrow rather than emotional trades.

Nifty Predictions, Bank Nifty Predictions and Sensex Predictions all point to a market that is not in a one‑way trend but in a tactical zone where disciplined traders can extract intraday moves both long and short. For readers of Option Matrix India, the edge will come from combining these Support and Resistance Levels with strict stop‑losses, position sizing and post‑trade review, rather than from prediction alone.

Disclaimer

This Technical Analysis and Market Prediction is purely for educational and informational purposes and is not a buy or sell recommendation in any security or index. Trading in the Indian Stock Market, especially in derivatives like Nifty and Bank Nifty, involves substantial risk and may not be suitable for all investors. Please consult your registered financial advisor before taking any trading or investment decision.