Technical Analysis for 20 Nov 2025

Nifty, Bank Nifty & Sensex Predictions

The Indian stock market displayed remarkable resilience on Wednesday, November 19, 2025, as all three major indices closed in positive territory despite early volatility. The Nifty 50 surged 142 points to settle at 26,052, while the Sensex jumped 492 points to close at 85,165. However, the star performer of the day was Bank Nifty, which created history by closing above the 59,000-mark for the first time, ending at 59,216 and marking a new all-time high of 59,264. The IT sector emerged as the biggest driver of the rally, with heavyweights like HCL Technologies gaining 4.19%, Infosys up 3.74%, and TCS rising 1.94%. Thursday, November 20, brings added significance as Sensex faces its monthly expiry, which typically results in heightened volatility and sharp directional moves.

Key Observations of Today's Derivative Market Data

Wednesday's trading session witnessed a classic recovery pattern where markets tested previous day lows before bouncing back strongly. The Nifty 50 opened flat and briefly dipped to test the 25,876 level, which was the previous day's low, before finding solid support and rallying throughout the session. This buy-on-dips strategy, which has been emphasized in recent analyses, worked perfectly as the index respected the 20-day exponential moving average support.

Market breadth, however, painted a mixed picture with 2,597 stocks declining against 1,958 advancing stocks, indicating selective buying concentrated in large-cap IT and banking stocks. The advance-decline ratio stood at 31 gainers versus 19 losers on the Nifty 50 index itself. Foreign institutional investors (FIIs) sold shares worth ₹803 crore, while domestic institutional investors (DIIs) provided strong support by purchasing equities worth ₹2,188 crore on a net basis.

The sectoral performance revealed clear leadership from Nifty IT, which surged 2.97%, followed by Nifty PSU Bank at 1.16%. All stocks in the Nifty IT index ended in the green, led by Coforge with a 4.41% gain, followed by HCL Technologies at 4.19% and Persistent Systems at 3.87%. On the losing side, Tata Motors Passenger Vehicles declined 2.77%, followed by Maruti Suzuki at 1.19%, Coal India at 1.21%, Bajaj Finance at 0.77%, and Adani Ports at 0.74%.

The options chain data for Thursday's Sensex expiry reveals significant put writing support at the 85,000 level, indicating strong institutional buying interest. The straddle premium for the 85,200 strike is approximately 480 points, suggesting the market expects substantial movement during the expiry session. This high premium indicates traders are pricing in volatility, which is typical for monthly expiry days.

Support and Resistance Levels

For Thursday's trading session, the technical levels derived from hourly chart analysis and derivative data provide clear roadmaps for traders.

Nifty 50 Levels:

- Immediate Resistance: 26,074 (today's high)

- Major Resistance Zones: 26,148, 26,198, 26,270

- Immediate Support: 25,856 (today's low)

- Critical Support Levels: 25,797, 25,739

Bank Nifty Levels:

- Immediate Resistance: 59,264 (all-time high)

- Extended Resistance: 59,440, 59,530, 59,630

- Crucial Support: 59,000 (psychological level)

- Strong Support Zones: 58,998, 58,903, 58,798

Sensex Levels (Expiry Day):

- Immediate Resistance: 85,236 (today's high)

- Major Resistance Targets: 85,395, 85,498, 85,670, 85,874

- Psychological Target: 86,000

- Critical Support: 85,000 (round number with strong put writing)

- Deeper Support Levels: 84,998, 84,836, 84,733, 84,525

The resistance and support levels are strategically placed based on intraday pivot points, previous session's high-low ranges, and options chain open interest concentrations. The fact that Bank Nifty and Nifty MidCap are both at all-time highs eliminates any basis for short positions, as the overall market structure remains bullish.

Nifty Predictions – Technical Analysis for Tomorrow

Nifty 50 15-minute technical chart with support and resistance levels for 20 Nov 2025

The Nifty 50 index closed at 26,052 on Wednesday, just below the day's high of 26,074, indicating strong buying interest into the close. This positive closing bias, combined with the fact that the index held above the previous day's low throughout the session, suggests continued bullish momentum.

For Thursday's session, the key trigger level is 26,074, which represents today's high. A decisive breakout and sustenance above this level would open the path toward 26,148, followed by 26,198. If the momentum continues beyond 26,198, the index could test the 26,270 zone, which would bring it closer to potential all-time high territory.

The 20-day EMA continues to provide strong dynamic support, and as long as the Nifty remains above this moving average, the buy-on-dips strategy remains valid. The immediate support at 25,856 represents today's low and the first line of defense for bulls. A breakdown below this level would expose the 25,797 support, and further weakness could see the index test 25,739.youtube

The technical structure suggests a bullish bias as long as the Nifty stays above 25,856. Traders should look for buying opportunities near support zones while maintaining strict stop-losses below 25,739. For upside trades, a breakout above 26,074 with sustained buying could provide excellent risk-reward opportunities targeting 26,148-26,198 zones.

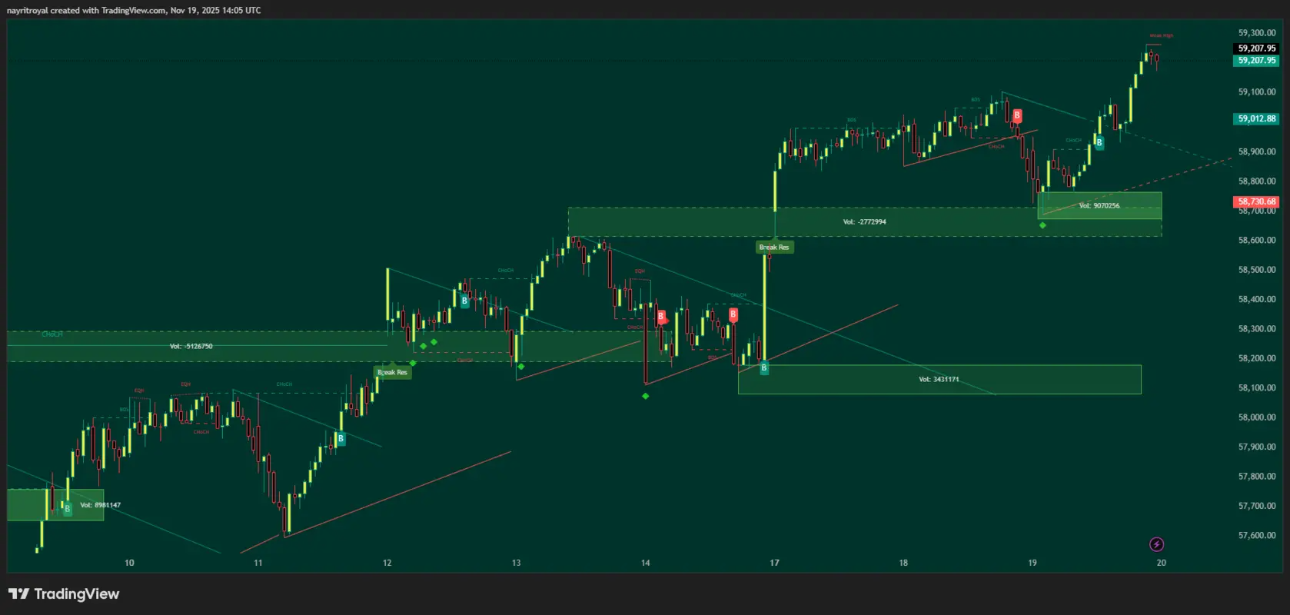

Bank Nifty Predictions – Technical Analysis

Bank Nifty 15-minute technical chart with support and resistance levels for 20 Nov 2025

Bank Nifty delivered a historic performance on Wednesday, breaking above the 59,000 psychological barrier and touching a new all-time high of 59,264. The index closed at 59,216, just 48 points below its intraday peak, demonstrating strong closing strength. This milestone was supported by robust gains in PSU banks, with Punjab National Bank rising 2.39%, Bank of Baroda gaining 1.77%, and Canara Bank advancing 0.94%.

For Thursday's trading, the immediate resistance stands at 59,264, the all-time high recorded on Wednesday. Given that Bank Nifty is in uncharted territory, the next resistance zones are projected at 59,440 and 59,530 based on Fibonacci extensions and momentum indicators. If the buying momentum accelerates, particularly driven by short covering in the expiry session, the index could target 59,630.

On the downside, the psychological support at 59,000 becomes crucial. Strong put writing at this level, as evident from the options chain, provides a cushion against sharp declines. Below 59,000, immediate support lies at 58,998, followed by 58,903 and 58,798, which was the previous day's low.

The technical setup for Bank Nifty remains overwhelmingly bullish with the index making higher highs and higher lows consistently. The absence of any significant overhead resistance means the index can continue its upward trajectory as long as it holds above the 59,000 support zone. Traders should look for pullbacks toward 59,000-59,100 as potential buying opportunities, with targets at new all-time highs above 59,264. A break below 58,998 would require a reassessment of the bullish outlook, but until then, the trend remains firmly upward.

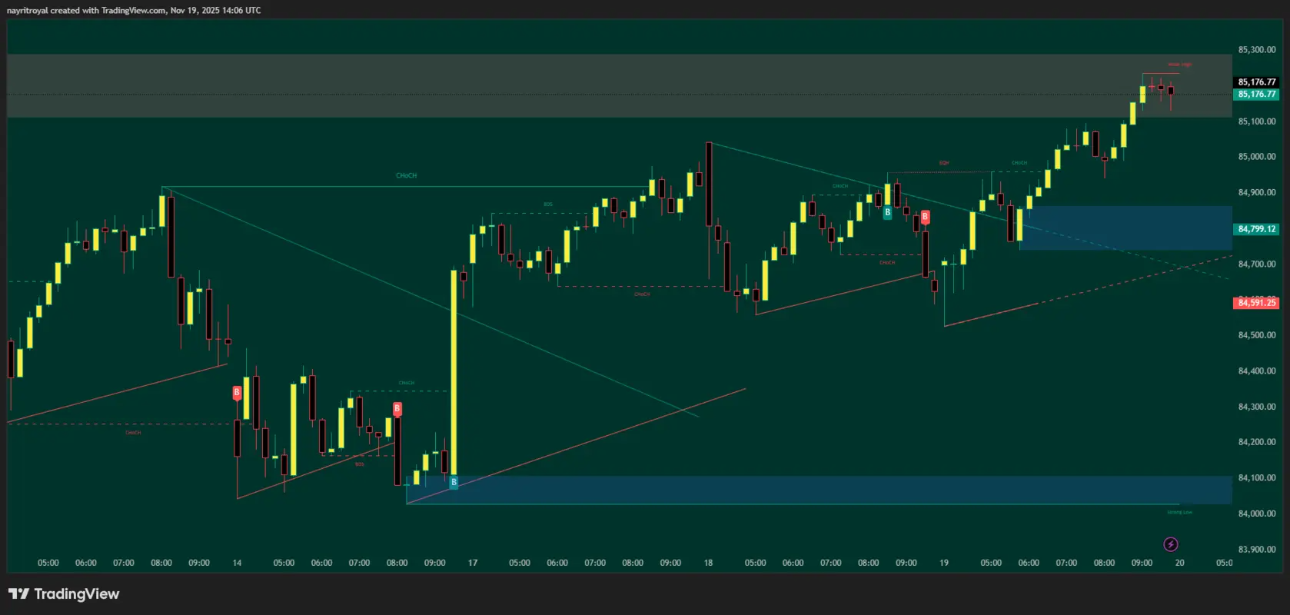

Sensex Predictions – Technical Analysis

Sensex 15-minute technical chart with support and resistance levels for 20 Nov 2025 expiry

The Sensex closed at 85,165 on Wednesday, registering a gain of 492 points or 0.58% after recovering from intraday lows. The index tested a low of 84,644 before staging a strong recovery to touch a high of 85,237. This recovery pattern mirrors the broader market's resilience and buying interest at lower levels.

Thursday, November 20, marks the Sensex monthly expiry, which historically brings heightened volatility and sharp directional moves. The options chain data reveals strong put writing support at the 85,000 level, with significant open interest accumulation indicating institutional confidence at this zone. The straddle premium of approximately 480 points suggests traders are expecting substantial movement during the expiry session.

On the upside, the immediate resistance is 85,236, today's high. A breakout above this level with conviction could trigger short covering, potentially driving the index toward 85,395. Further strength could see the Sensex test 85,498 and 85,670 levels. If the momentum becomes exceptionally strong, the index could even challenge the psychologically significant 85,874 and 86,000 marks.

On the downside, the 85,000 level acts as a formidable support due to heavy put writing by institutional players. As long as the Sensex holds above 85,000, the bullish bias remains intact. A breakdown below 85,000 would expose 84,998, followed by 84,836 and 84,733. The ultimate support for the day stands at 84,525, which was today's low.

Given the expiry dynamics, traders should be prepared for range-bound movement initially, with potential breakouts in either direction post noon. The analysis suggests avoiding aggressive averaging strategies on the expiry day and maintaining tight stop-losses. The bias remains cautiously bullish above 85,000, with a potential for short covering rallies if the index breaks and sustains above 85,236.youtube

Tomorrow's Market Prediction (November 20)

The overall market outlook for Thursday, November 20, 2025, remains cautiously bullish with a strong emphasis on monitoring key support and resistance zones. The fact that Bank Nifty and Nifty MidCap are trading at all-time highs eliminates any fundamental basis for aggressive short positions. However, the Sensex expiry introduces an element of uncertainty that could lead to volatile intraday swings.

The IT sector's strong performance, which single-handedly lifted the indices on Wednesday, needs to sustain for the rally to continue. Any profit booking in IT stocks could weigh on the broader indices. Conversely, if banking stocks join the rally alongside IT, the market could witness a broad-based surge.

Key sectoral cues to watch include auto stocks, which showed weakness on Wednesday with Tata Motors and Maruti declining. The broader market breadth needs to improve, as the negative advance-decline ratio of 2,597 decliners versus 1,958 advancers indicates underlying weakness in mid and small-cap segments.

The derivative data suggests maximum put writing at key support levels (85,000 for Sensex, 59,000 for Bank Nifty, and 25,850 for Nifty), indicating strong institutional support at these zones. As long as these supports hold, the market should maintain its positive bias. However, expiry-related volatility could lead to sharp, unpredictable moves in either direction, especially during the last hour of trading.

Traders are advised to watch the opening range carefully, as the first 30 minutes will set the tone for the day. A gap-up opening followed by sustained buying above resistance levels could trigger momentum-based rallies. Conversely, a gap-down opening that breaks support levels could lead to profit booking pressure.

Final Verdict

Based on comprehensive technical analysis, derivative data, and price action patterns, the market outlook for Thursday, November 20, 2025, is moderately bullish with expiry-induced volatility.

Nifty 50: Bullish above 25,856 with targets at 26,074, 26,148, and 26,198. Support at 25,797 and 25,739. The index is well-positioned to test higher levels if IT sector strength continues.

Bank Nifty: Strongly bullish with no overhead resistance. Critical support at 59,000. Potential targets at 59,440, 59,530, and beyond. The all-time high breakout suggests further upside momentum.

Sensex: Cautiously bullish above 85,000 (expiry day). Immediate resistance at 85,236 with potential to test 85,395 and higher levels. Strong put writing support provides downside cushion. Expect volatility due to expiry dynamics.

The previous day's analysis accurately predicted the buy-on-dips opportunity and the importance of the 20-day EMA support, which played out perfectly. The conviction in the bullish stance was based on the market trading well above key moving averages and strong derivative support, both of which validated the upward move.

For Thursday, the strategy remains to buy on dips near support levels while avoiding excessive averaging, especially given the expiry dynamics. Tight stop-losses are recommended, and traders should be prepared to book profits at resistance zones rather than chasing momentum blindly. The overall bias favors bulls as long as key support levels hold across all three indices.

Disclaimer

This technical analysis is provided for educational purposes only and should not be construed as investment advice. The Indian stock market involves substantial risk, and past performance is not indicative of future results. All trading levels, predictions, and strategies mentioned in this article are based on technical analysis and derivative data as of November 19, 2025, and are subject to change based on market dynamics.

Readers are strongly advised to consult with their financial advisors or SEBI-registered investment professionals before making any trading or investment decisions. Option Matrix India and the author do not guarantee the accuracy of predictions or the profitability of any trades based on this analysis. Trading in derivatives, equities, and other financial instruments carries inherent risks, including the potential loss of capital.

Always conduct your own research, maintain appropriate risk management practices, and trade only with capital you can afford to lose. The views expressed in this article are for informational purposes and do not constitute a recommendation to buy or sell any securities.