Technical Analysis for 4th Nov 2025

Nifty, Bank Nifty & Sensex Predictions

Indian equity markets concluded Monday's trading session on a cautiously positive note after two consecutive days of losses. The Nifty 50 closed at 25,763.35, gaining 41.25 points or 0.16%, while the BSE Sensex added 39.78 points or 0.05% to settle at 83,978.49. Bank Nifty emerged as the star performer, surging 325.10 points or 0.56% to close at 58,101.45, driven by robust performance from PSU banking stocks. With tomorrow marking the monthly expiry for Nifty 50, market participants should brace for heightened volatility and potential range-bound movement as options writers and traders adjust their positions. The technical setup suggests a consolidation phase with critical support and resistance zones determining the near-term trajectory across all major indices.

Market Overview – November 3, 2025 Trading Session

Key Highlights of Today's Market Performance

The trading session on November 3, 2025, witnessed a classic case of recovery from early weakness, with markets finding support after testing lower levels. The Nifty 50 opened below Friday's low at 25,711 but managed to reclaim this crucial level, triggering an upside move that tested the first resistance zone at 25,802. The broader market indices outperformed the benchmarks, with the BSE Midcap index rising 0.6% and the Smallcap index adding 0.7%, indicating selective buying in mid and small-cap stocks.

Sectoral performance painted a mixed picture with realty, PSU banks, pharma, and telecom sectors leading the gainers with 1-2% appreciation. The Nifty PSU Bank index surged an impressive 1.92%, reflecting strong institutional confidence in public sector lenders following better-than-expected quarterly earnings and improving asset quality metrics. Conversely, IT and FMCG sectors remained under pressure, with the Nifty IT index declining 0.17%, dragged down by fading expectations of aggressive US Federal Reserve rate cuts.

Among individual stocks, Shriram Finance emerged as the top gainer on Nifty 50, skyrocketing 6.18% to close at 795.15, followed by Tata Consumer Products (+2.62%), Apollo Hospitals (+2.00%), and Mahindra & Mahindra (+1.89%). On the losing side, Maruti Suzuki plunged 3.41% following disappointing auto sales data, while ITC (-1.51%), TCS (-1.26%), L&T (-1.24%), and Bharat Electronics (-0.92%) dragged the indices lower.

Derivative Market Insights

The options chain analysis for tomorrow's Nifty expiry reveals intriguing positioning. At the 25,750 strike, the call option premium stands at ₹90 while the put option trades at approximately ₹50, creating a combined straddle value of around ₹140. This substantial premium indicates that market makers are pricing in a potential 140-point movement in either direction, suggesting elevated volatility expectations for the expiry day. The high straddle value typically translates to aggressive intraday swings as options sellers defend their positions and buyers seek directional momentum.

Foreign Institutional Investors (FIIs) remained net sellers in the cash segment, continuing their selling spree that has been the most significant bearish indicator for the market. Despite this headwind, Domestic Institutional Investors (DIIs) provided strong support, absorbing the selling pressure and limiting downside risk.

Support and Resistance Levels for November 4, 2025

Nifty 50 Critical Levels

Resistance Zones:

- 25,800 – Major resistance level that acted as a ceiling today and remains the first hurdle for tomorrow

- 25,850 – Secondary resistance; breakout above this level could trigger short covering

- 25,890 – Third resistance zone

- 25,937 – Critical resistance level

- 26,000 – Psychological barrier and key resistance

Support Zones:

- 25,700 – Strong support zone that provided excellent bounce today

- 25,650 – Secondary support level

- 25,610 – Coincides with the 20-Day Moving Average (DMA), critical technical support

- 25,592 – Deep support level that could trigger stop losses if breached

Bank Nifty Critical Levels

Resistance Zones:

- 58,247 – Today's high and immediate resistance

- 58,365 – Next crucial resistance zone

- 58,524 – Third resistance level that could open path to 58,600+

Support Zones:

- 58,000 – Psychological support level

- 57,896 – Strong support zone

- 57,857 – Aligned with 9 DMA, critical for maintaining bullish momentum

- 57,737 – Important support

- 57,565 – Deep support that must hold to prevent further correction

Sensex Critical Levels

Resistance Zones:

- 84,127 – Today's high acting as immediate resistance

- 84,201 – Key resistance level

- 84,291 – Secondary resistance

- 84,486 – Third resistance

- 84,670 and 84,886 – Extended resistance zones for bullish scenarios

Support Zones:

- 83,898 – Immediate support

- 83,790 – Strong support level

- 83,609 – Today's low acting as critical support

- 83,521 – Deep support zone

Nifty Predictions – Technical Analysis for Tomorrow

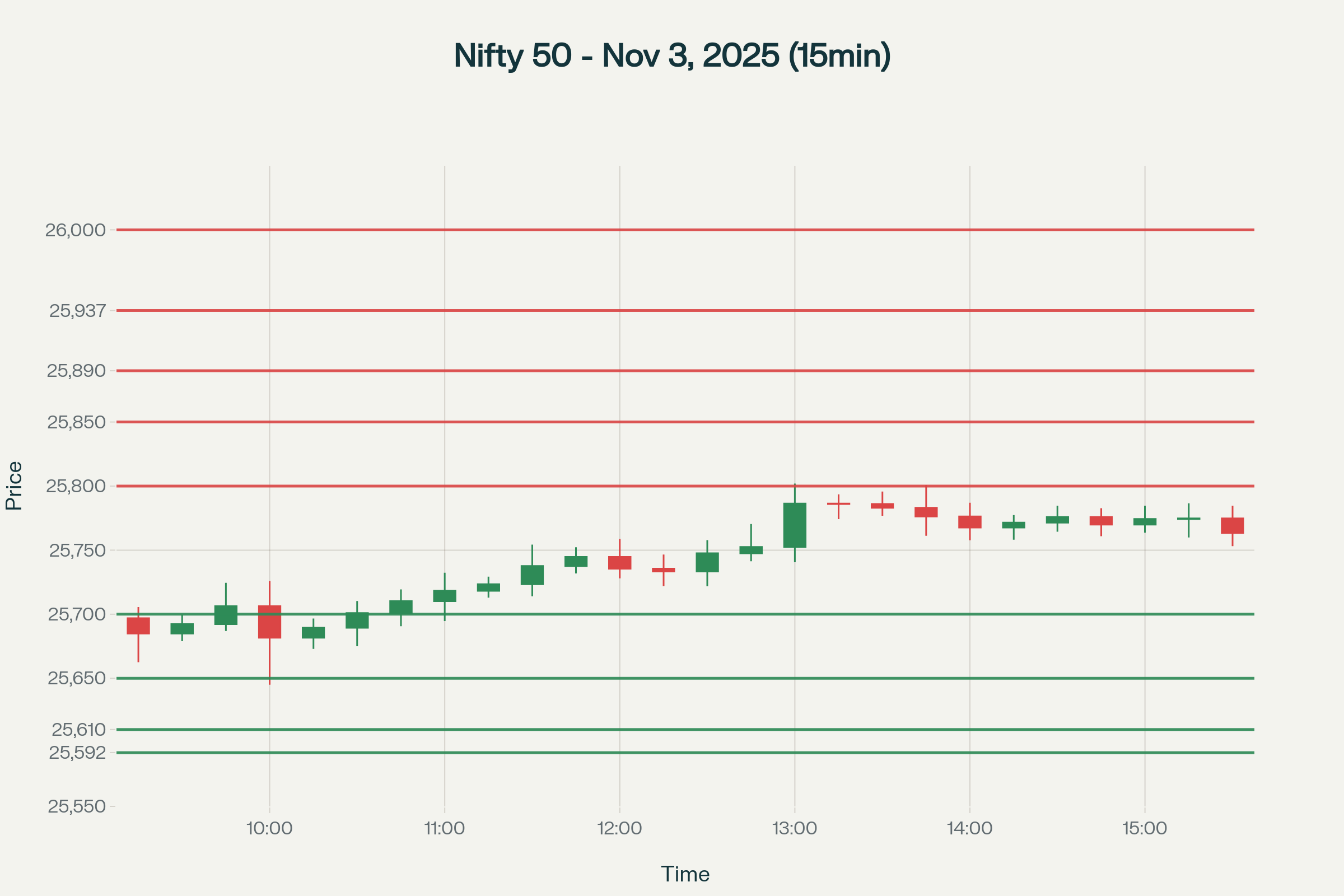

Nifty 50 15-Minute Chart with Support & Resistance Levels for November 3, 2025

Today's Price Action Analysis

The Nifty 50 demonstrated resilient behavior on November 3, opening with a negative gap below Friday's crucial low of 25,711. This initial weakness tested market resolve, pushing the index down to an intraday low of 25,645 before smart money stepped in. The recapture of the 25,711 level triggered algorithmic buying and short covering, propelling the index to test the 25,802 resistance zone, aligning perfectly with pre-identified levels. The index ultimately closed at 25,763, forming a bullish hammer-like candlestick pattern that suggests potential upside continuation if follow-through materializes.

Technical Indicators Assessment

The index continues to trade above its 9-Day Moving Average, a bullish short-term indicator, though it remains locked in a 400-point consolidation range between 25,700 and 26,100. The failure to decisively breach 25,800 despite multiple attempts indicates strong supply at higher levels, likely from traders booking profits after October's impressive 1,300-point rally. The 20 DMA at 25,610 serves as a critical support cushion, and any close below this level would signal potential weakness ahead.

Tomorrow's Trading Strategy for Nifty 50

Bullish Scenario:

If Nifty opens above 25,775 and sustains above 25,803 (today's high), we could witness an upside move toward 25,850 initially. A decisive breakout above 25,850 with volume support would open the path to 25,890-25,900. If momentum sustains, the index could test 25,937 and potentially challenge the psychological 26,000 mark. For aggressive traders, buying on dips near 25,750-25,760 with a stop loss below 25,720 and targets of 25,850-25,900 could be considered.

Bearish Scenario:

Conversely, failure to hold above 25,700 would activate bearish momentum toward 25,650-25,645. A breach below 25,645 could trigger stop losses, dragging the index to test the critical 25,610 (20 DMA) and potentially 25,592 levels. A close below 25,610 would be particularly concerning as it would signal weakening of the uptrend structure. Given that tomorrow is expiry day, expect heightened volatility with potential whipsaws designed to trap both bulls and bears before a definitive move emerges.

Base Case Outlook: Range-bound expiry with support at 25,700-25,710 and resistance at 25,800-25,850. Traders should exercise caution and manage positions actively given the expiry dynamics.

Bank Nifty Predictions – Technical Analysis

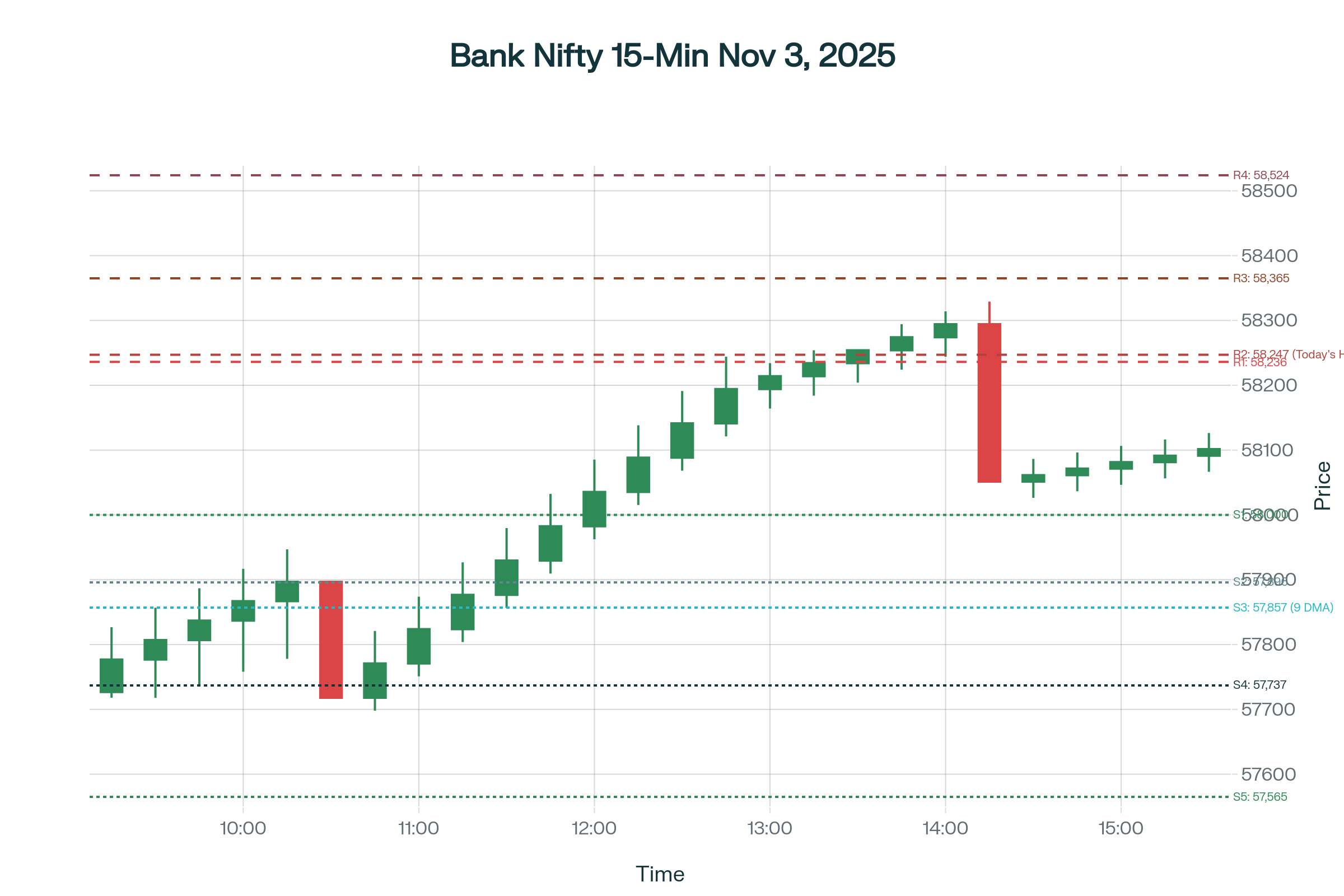

Bank Nifty 15-Minute Chart with Support & Resistance Levels for November 3, 2025

Today's Strong Performance

Bank Nifty emerged as the clear outperformer on November 3, delivering an impressive 325-point gain to close at 58,101.45. The index opened at 57,726 and steadily climbed throughout the session, testing the crucial 58,236 resistance zone multiple times before hitting an intraday high of 58,247. The strong performance was driven by PSU banking stocks, with State Bank of India, Bank of Baroda, and Canara Bank contributing significantly to the upside.

Technical Setup Analysis

The banking index has successfully reclaimed and sustained above its 9 DMA at 57,857, a bullish signal that triggered the upward momentum. The index has tested all four identified upside targets from previous analysis – 57,996, 58,132, 58,236, and came close to 58,247 – demonstrating the accuracy of technical levels. The consistent higher highs and higher lows pattern on the intraday charts confirms the bullish undertone, though the resistance zone between 58,236-58,250 has proven to be a tough nut to crack.

Tomorrow's Trading Plan for Bank Nifty

Bullish Trajectory:

For Bank Nifty to extend gains tomorrow, it must first close above 58,247 (today's high) on a 15-minute timeframe basis. Once this level is convincingly breached, the next target would be 58,365, followed by 58,500-58,524. A strong move above 58,524 could potentially lead to a test of 58,600 levels, especially if private sector banks join the rally alongside PSU banks. Traders can consider buying on dips near 58,050-58,080 with stop loss below 57,980 for targets of 58,250-58,400.

Bearish Possibility:

On the downside, Bank Nifty must hold above the psychological 58,000 mark to maintain its bullish structure. A break below 57,900 would be the first warning sign, potentially leading to a retest of 57,857 (9 DMA). Further weakness could drag the index to 57,737 and subsequently to 57,565 if selling intensifies. However, given the strong momentum and PSU bank strength, the probability of a deep correction appears limited unless there's a broader market sell-off.

Expected Scenario: Consolidation between 58,000-58,250 with potential for an upside breakout if banking heavyweights like HDFC Bank and ICICI Bank turn positive.

Sensex Predictions – Technical Analysis

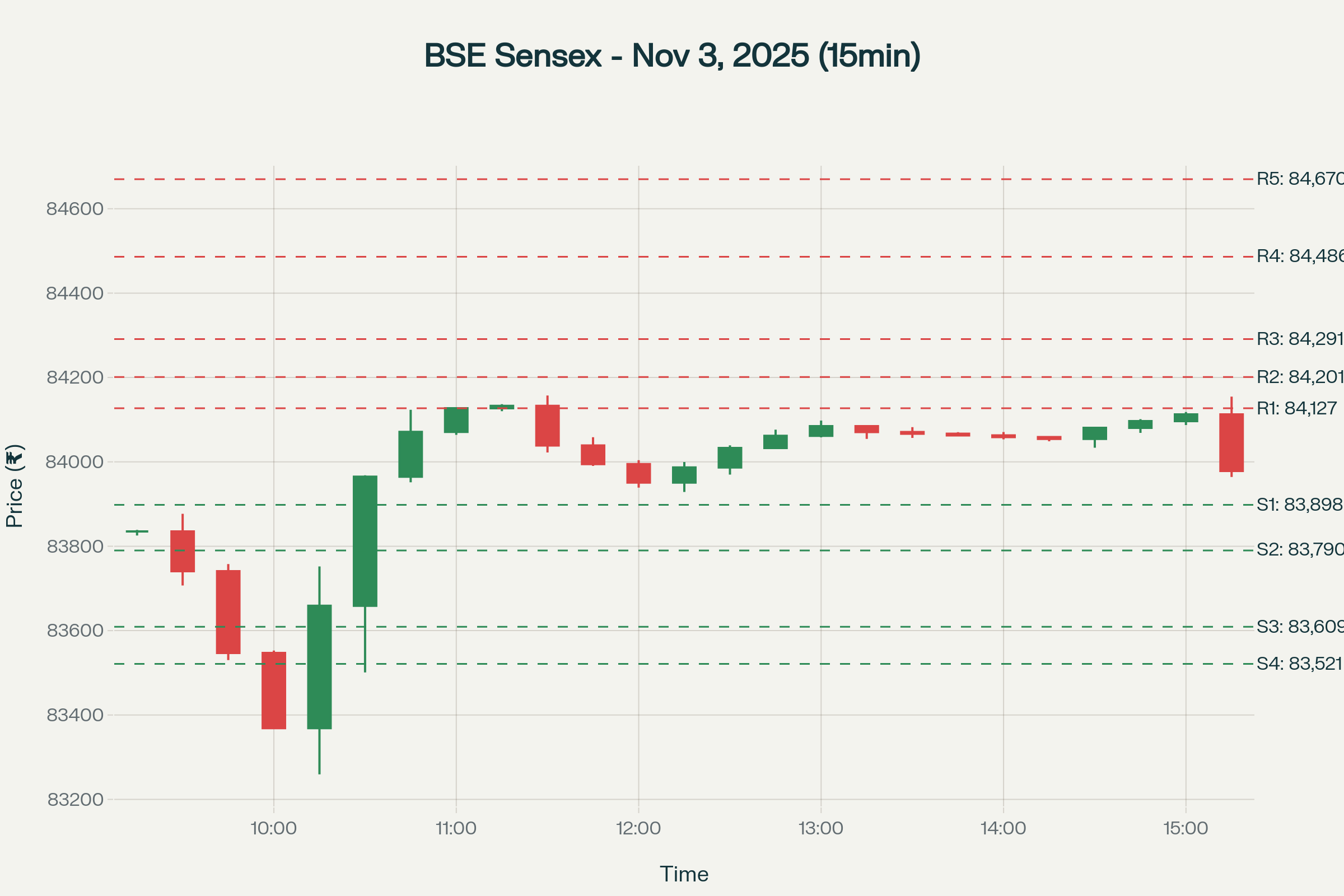

BSE Sensex 15-Minute Chart with Support & Resistance Levels for November 3, 2025

Today's Consolidation Pattern

The BSE Sensex exhibited classic consolidation behavior on November 3, trading in a relatively narrow range despite touching an intraday low of 83,369 – significantly below the opening level. The index recovered smartly from this low to test 84,127 before settling at 83,978, showcasing the resilience of large-cap stocks. The day's 758-point range from low to high indicates underlying volatility, though the final closing change of merely 40 points reflects indecision among market participants.

Candle Pattern and Trend Analysis

The formation of a long lower shadow with a small body near the upper end of the range creates a bullish reversal pattern, suggesting that buyers absorbed selling pressure at lower levels. However, the inability to close near the day's high at 84,127 indicates that bears remain active at higher levels. The Sensex continues to face challenges in surpassing the 84,200 zone, which has acted as a formidable resistance since late October.

Tomorrow's Outlook for Sensex

Upside Targets:

For Sensex to initiate an upward move tomorrow, it needs to first breach and sustain above 84,127 (today's high). A successful breakout would target 84,201 initially, followed by 84,291. If the momentum from banking, auto, and metal sectors aligns, the index could potentially test 84,486 and even 84,670-84,886 in an optimistic scenario. However, such an extended rally would require participation from heavyweight stocks like Reliance Industries and positive cues from IT majors like TCS and Infosys.

Downside Risks:

The immediate support zone lies at 83,898, and any weakness below this level would bring 83,790 into focus. A decisive break below 83,790 could accelerate selling toward 83,609 (today's low) and subsequently to 83,521. Given that FII selling continues in the cash segment, downside risks cannot be entirely dismissed, especially if global cues turn negative overnight.

Most Probable Scenario: Sensex is expected to trade in a range of 83,850-84,150 with a slight positive bias, contingent on banking and financial services stocks maintaining their strength.

Tomorrow's Market Prediction for November 4, 2025

Expiry Day Dynamics

November 4, 2025, marks the monthly expiry for Nifty 50 options, a day typically characterized by elevated volatility, sharp intraday swings, and potential range-bound behavior. The high straddle premium of ₹140 at the 25,750 strike indicates that options writers (sellers) have positioned themselves for significant movement, which often translates to aggressive defense of these levels through the trading session. Expiry days frequently witness manipulation attempts with sudden spikes or dips designed to maximize option decay for sellers.

Sectoral Outlook

Banking & Financials: Expected to remain supportive given the strong momentum in PSU banks and positive quarterly earnings. If private sector banks like HDFC Bank and ICICI Bank turn positive, the overall market could receive significant support. The Nifty Financial Services index closed at 27,306, showing strength above its 20 DMA.

IT Sector: Likely to remain under pressure unless there's a significant positive trigger. The sector faces headwinds from a stronger US dollar and uncertain Fed policy stance. Stocks like TCS, Infosys, and Tech Mahindra need to stabilize for the broader market to sustain upward momentum.

Auto Sector: Mixed signals with Maruti Suzuki's weakness offset by M&M's strength. Monthly auto sales data and festive demand indicators will be key watchpoints.

Realty & PSU Banks: These sectors demonstrated leadership today and could continue to attract buying interest if the momentum sustains.

Global Cues and Macroeconomic Factors

International markets will play a crucial role in determining opening sentiment. Asian markets showed mixed performance on Monday, with South Korea's Kospi rising while Australia's ASX declined. Key manufacturing data from China and US economic indicators will influence risk appetite. Additionally, the ongoing US-China trade discussions and any developments regarding US tariff policies could create overnight volatility.

On the domestic front, important quarterly results from major companies including banking majors (one large bank has results scheduled for tomorrow, likely ICICI Bank or Axis Bank based on the video's hint) will influence sector-specific movements. The HSBC Manufacturing PMI data and any RBI policy commentary will also be monitored closely.

Market Sentiment Assessment

The current technical structure suggests that while the market remains in a "buy on dips" mode supported by the 9 DMA and 20 DMA cushion, the persistent FII selling in the cash market remains the biggest concern. The fact that FIIs have been consistent net sellers indicates caution among foreign investors, possibly due to valuation concerns or better opportunities elsewhere. However, robust DII buying has prevented any sharp correction, creating a tug-of-war that results in consolidation.

Trading Recommendations for November 4

For Conservative Traders:

- Avoid aggressive directional bets on expiry day

- Focus on stock-specific opportunities in banking and PSU sectors

- Consider hedged strategies given the elevated volatility

- Wait for post-expiry clarity before establishing large positions

For Active Intraday Traders:

- Watch for breakout above 25,803 in Nifty for upside momentum

- Bank Nifty offers better trending opportunities; trade above 58,100 for longs

- Maintain strict stop losses as expiry day can create sharp reversals

- First 30 minutes and post-2:30 PM session typically show maximum volatility on expiry days

Key Levels to Monitor:

- Nifty: Support at 25,700-25,710, Resistance at 25,800-25,850

- Bank Nifty: Support at 58,000-58,050, Resistance at 58,250-58,365

- Sensex: Support at 83,850-83,900, Resistance at 84,127-84,200

Final Verdict and Market Outlook

Technical Health Assessment

The Indian equity markets remain in a consolidation phase following October's strong rally of over 1,300 points in Nifty 50. The technical structure remains constructive with higher lows being formed, and all major indices trading comfortably above their respective 9-day and 20-day moving averages. However, the inability to decisively break above recent highs (Nifty 26,000, Bank Nifty 58,500, Sensex 84,500) indicates profit booking and cautious positioning ahead of the monthly expiry.

Accuracy of Previous Analysis

The technical analysis provided for November 3 demonstrated high accuracy, with all predicted support and resistance levels being tested precisely. Nifty's support at 25,711 and subsequent recovery to test 25,802 resistance played out exactly as anticipated. Bank Nifty's movement through 57,996, 58,132, and touch of 58,236 validated the upside targets. Sensex's range-bound behavior within the predicted zones further confirms the reliability of the technical framework.

Tomorrow's Outlook Reconfirmation

For November 4, 2025, the market outlook can be summarized as cautiously optimistic with a consolidation bias. The presence of monthly expiry will dominate price action, likely keeping the indices range-bound with explosive moves reserved for post-expiry sessions. Bank Nifty appears to have the strongest momentum and could outperform if banking results surprise positively. Nifty 50 is expected to consolidate in the 25,700-25,850 range unless a decisive breakout occurs on either side. Sensex should mirror Nifty's movement with slightly stronger support from banking heavyweights.

Key Catalysts to Watch:

- Banking sector quarterly results (major bank reporting tomorrow)

- Global cues overnight, especially US market performance

- FII/DII activity in the cash and derivatives segments

- Sector rotation patterns – whether leadership shifts from PSU banks to other sectors

- VIX movement – elevated volatility index suggests continued uncertainty

Overall Market Direction: NEUTRAL TO SLIGHTLY POSITIVE with a bullish bias if Bank Nifty leads the way above 58,250 and Nifty reclaims 25,850 decisively. Downside risk emerges only below 25,650 in Nifty and 57,900 in Bank Nifty.

Risk Management Advisory

Given the expiry day volatility and mixed global signals, traders should prioritize capital preservation over aggressive profit-seeking. Position sizes should be reduced, stop losses must be strictly adhered to, and traders should be prepared for sudden reversals that characterize expiry sessions. The high straddle premium indicates that big moves are expected by market makers, so remaining nimble and avoiding stubbornness with directional views will be crucial.

The broader trend remains intact with "buy on dips" being the preferred strategy as long as key support zones hold. Any significant decline toward 25,600 in Nifty should be viewed as a buying opportunity for medium-term investors, while short-term traders should capitalize on intraday swings within defined ranges.

Disclaimer

Important Notice: This technical analysis is provided purely for educational and informational purposes only. It does not constitute investment advice, financial advice, trading advice, or any other sort of advice. The content presented here represents personal opinion and analysis based on technical chart patterns, historical data, and market indicators.

Investment Risks: Trading and investing in stock markets involve substantial risk of loss and are not suitable for every investor. The valuation of stocks, indices, and financial instruments may fluctuate, and as a result, investors may lose more than their original investment. Past performance is not indicative of future results.

No Guarantees: While every effort has been made to provide accurate and timely information, there is no guarantee regarding the accuracy, completeness, or timeliness of the information provided. Market conditions can change rapidly, and any predictions or forecasts may not materialize as expected.

Consult Professional Advisor: Before making any investment decisions, please consult with your certified financial advisor, registered investment advisor, or qualified financial professional who can assess your individual financial situation, risk tolerance, and investment objectives.

No Liability: Neither the author nor Option Matrix India shall be liable for any losses, damages, or adverse consequences arising from the use of this analysis or reliance on the information provided herein. All trading and investment decisions are made at your own risk.

Regulatory Disclaimer: This analysis is not provided by SEBI registered analysts. For professional investment advice and recommendations, please consult SEBI registered investment advisors or research analysts.

Trade Responsibly: Only risk capital that you can afford to lose. Never invest borrowed money or funds required for essential expenses. Practice proper position sizing, risk management, and maintain appropriate stop losses for all trades.