Technical Analysis for 22 Sept 2025:

Nifty, Bank Nifty & Sensex Prediction

By Option Matrix India | Your Trusted Technical Analysis Partner

Published: 19th September 2025

The Indian stock market closed Friday, September 19, 2025, on a cautious note after three consecutive days of gains, with all major indices ending in the red. As we approach Monday's trading session, technical indicators suggest critical levels that could determine the market's direction for the upcoming week. Foreign institutional investors continue their selling pressure with outflows exceeding $15 billion year-to-date, while domestic institutional investors provide crucial support. The market's performance hinges on key technical breakouts and the ongoing tug-of-war between foreign selling and domestic buying.

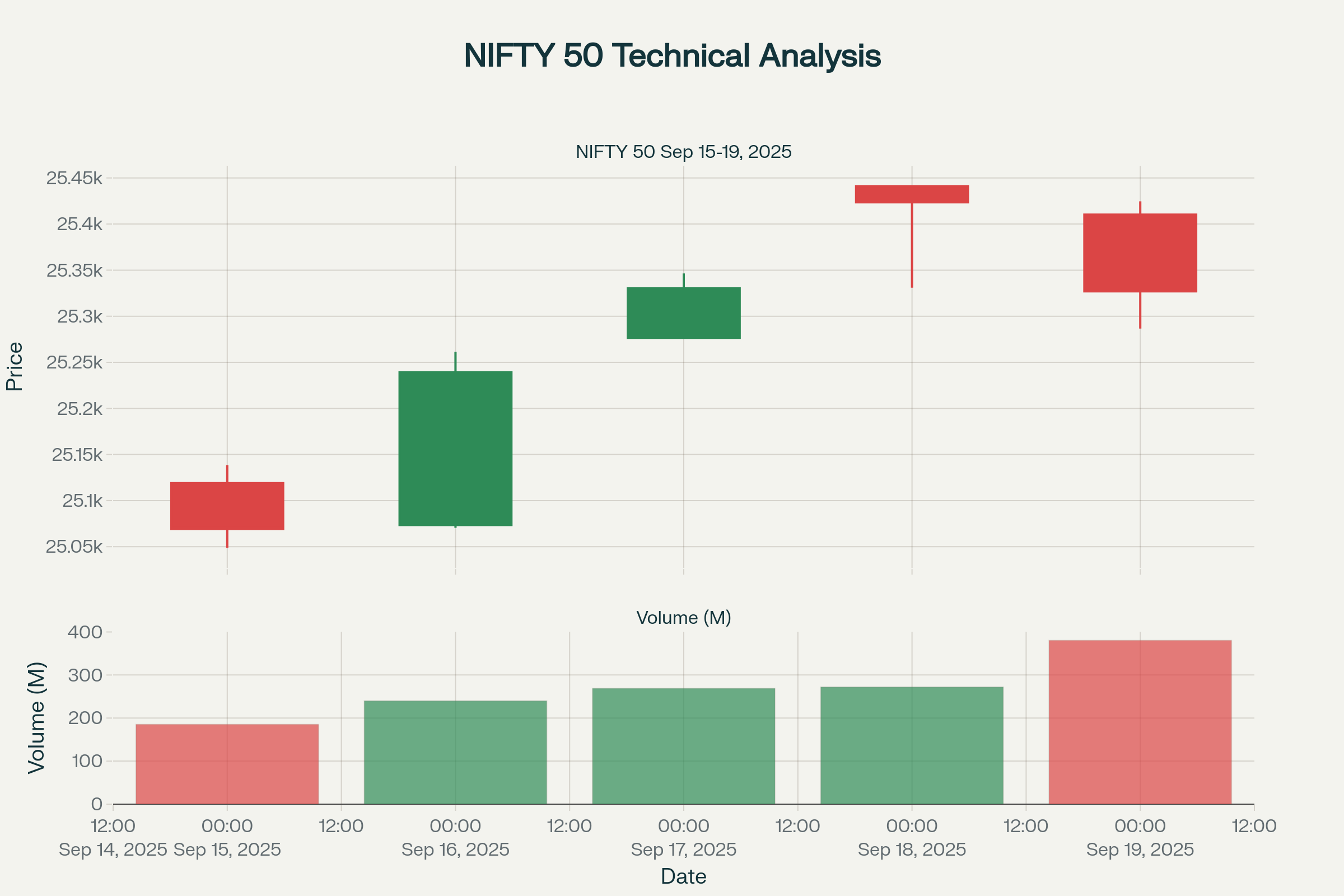

5-Day Price Movement Chart for NIFTY 50, BANK NIFTY, and SENSEX (September 15-19, 2025)

Current Market Sentiment & Key Developments

The Indian equity markets have faced significant headwinds in 2025, with benchmark indices delivering underwhelming returns compared to global peers. The Sensex's meager 1.9% return in USD terms has positioned India at the bottom of the global performance league table, a stark contrast to Korea's KOSPI surge of 53.5% and Germany's DAX rally of 36%. This underperformance stems from a combination of factors including elevated valuations, muted earnings growth, persistent foreign selling pressure, and the rupee's weakness beyond ₹88 against the US dollar.

Market Volatility and Risk Factors: The India VIX closed at 9.97 on September 19, indicating relatively low volatility expectations despite the underlying market stress. However, persistent concerns about US tariff policies on Indian goods, geopolitical uncertainties, and the timing of Federal Reserve policy adjustments continue to influence market sentiment. The technical setup suggests that while immediate downside risks exist, strategic support levels could provide buying opportunities for astute investors.

Nifty Predictions & Technical Analysis

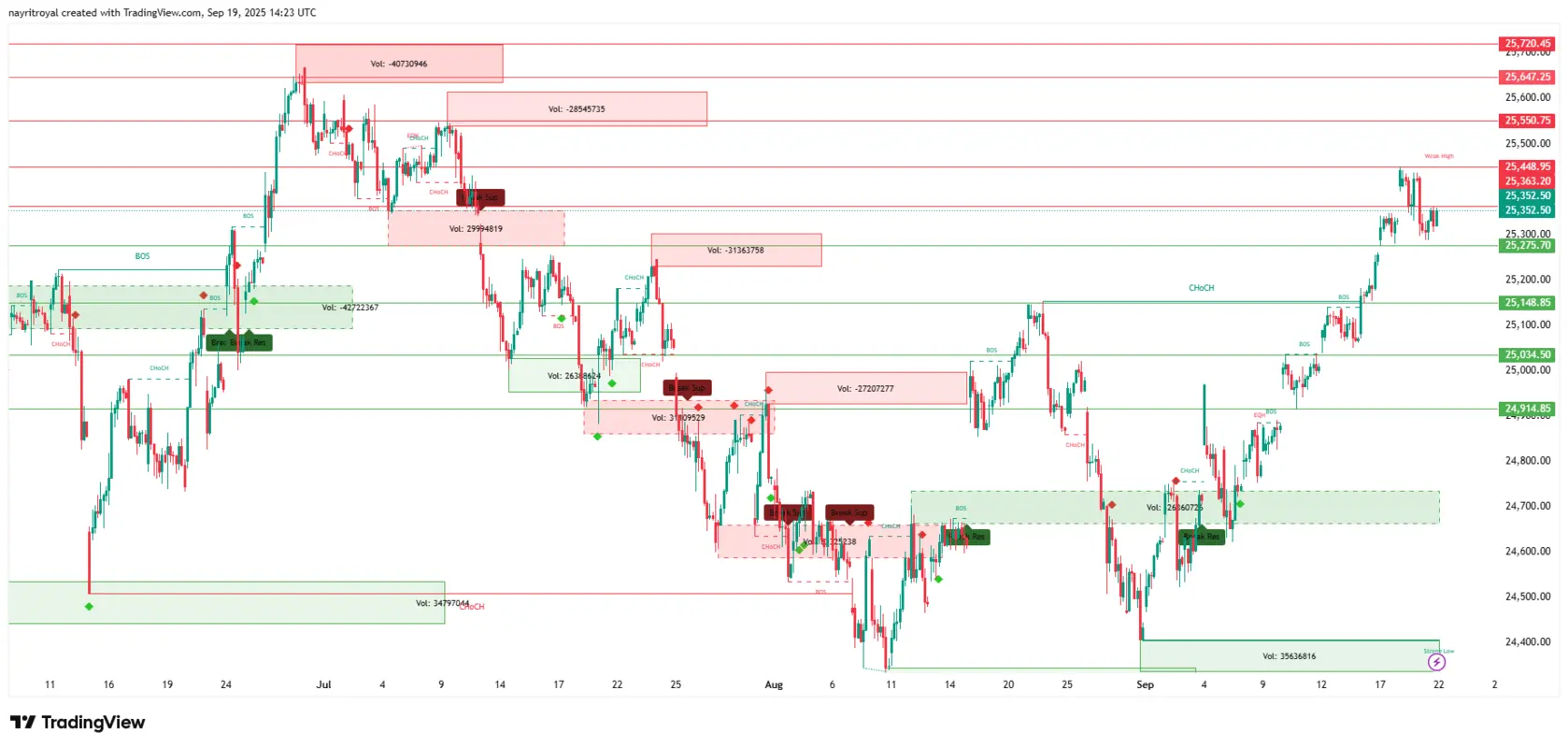

Current Technical Setup: The Nifty 50 closed at 25,327.05 on September 19, breaking its three-day winning streak with a decline of 0.38%. The index has established a crucial no-trading zone between 25,286 and 25,365, which will determine the near-term directional move. Technical indicators reveal that the index is trading near the upper band of its Bollinger Band range, with the RSI at 68.37, approaching overbought territory but maintaining bullish momentum.

Key Support and Resistance Levels:

- Immediate Resistance: 25,365 (critical breakout level)

- Strong Resistance: 25,424-25,442 zone

- Immediate Support: 25,286 (crucial floor)

- Strong Support: 25,200-25,148 zone

Trading Strategy for September 22, 2025:

If the Nifty sustains above 25,365 with a 15-minute candle close, traders should target 25,442 as the first objective, followed by 25,550 and 25,647 for extended moves. However, failure to hold above 25,365 could trigger selling pressure toward 25,286, with further weakness potentially targeting 25,200. A decisive break below 25,286 would open doors to 25,148, 25,038, and 24,914 levels.

Volume Analysis and Market Breadth: Friday's session witnessed elevated volumes of 380.36 million shares, the highest in the five-day period, indicating significant participant interest at these levels. The increased volume during the decline suggests genuine selling pressure rather than lack of buyers, making the 25,286-25,365 range even more critical for Monday's opening.

Bank Nifty Predictions & Technical Outlook

Current Market Position: Bank Nifty closed at 55,458.85 on September 19, declining 0.48% after an impressive 12-session winning streak. The banking index has shown remarkable resilience throughout September, consistently outperforming the broader market despite sectoral challenges. The no-trading zone lies between 55,361 and 55,832, with these levels serving as critical decision points for the upcoming session.

Critical Technical Levels:

- Key Resistance: 55,832 (immediate ceiling)

- Breakout Targets: 55,995, 56,160, and 56,490

- Primary Support: 55,361 (crucial for bulls)

- Downside Targets: 55,032, 54,780, and 54,396

Monday's Trading Plan: A sustained break above 55,832 with proper volume confirmation could propel Bank Nifty toward 55,995 initially, with extended targets at 56,160 and 56,490. Conversely, inability to reclaim 55,832 after an initial spike could lead to selling toward 55,600 and 55,480. A breakdown below 55,361 would be particularly bearish, potentially triggering a move toward 55,032 and subsequently 54,780.

Sector-Specific Factors: The banking sector continues to benefit from expectations of monetary policy easing and improving credit growth prospects. However, concerns about asset quality in certain segments and the impact of regulatory changes remain key monitorable.

Sensex Predictions

Technical Framework: The Sensex concluded at 82,626.23 on September 19, down 0.47% from the previous session. The index has established a no-trading zone between 82,487 and 82,748, with these boundaries likely to dictate Monday's price action. The 30-stock index mirrors the broader market's struggle between domestic support and foreign selling pressure.

Strategic Levels for September 22:

- Resistance Zone: 82,748 (immediate hurdle)

- Bullish Targets: 83,115, 83,419, and 83,769

- Support Base: 82,487 (critical defense)

- Bearish Objectives: 82,086, 81,753, and 81,224

Trading Methodology: Should the Sensex break above 82,748 with conviction, investors can anticipate a move toward 83,115, with further upside potential to 83,419 and 83,769. However, rejection at 82,748 could lead to consolidation with targets at 82,487 and 82,086. A decisive breach of 82,487 would signal deeper correction toward 82,086, 81,753, and potentially 81,224.

Market Analysis for Monday: Key Catalysts

Global Market Cues: International markets remain mixed, with investors closely monitoring Federal Reserve communications and geopolitical developments. The Bank of Japan's policy decisions and European Central Bank's stance on monetary policy will likely influence Asian market sentiment on Monday. US futures trading patterns suggest continued volatility as markets digest recent policy announcements.

Domestic Factors: The upcoming GST rate cuts effective September 22, 2025, represent a significant positive catalyst for consumer spending and business sentiment. These reforms aim to streamline compliance and reduce complexity, potentially boosting economic growth momentum. Additionally, expectations of RBI policy accommodation, including potential CRR cuts to release liquidity, could support market sentiment.

FII vs DII Dynamics: Foreign institutional investors have withdrawn approximately $13-15 billion from Indian equities in 2025, creating persistent headwinds for market performance. However, robust domestic institutional investor buying, including mutual funds and insurance companies, has provided crucial support during market corrections. This dynamic is likely to continue influencing intraday volatility and sector rotation patterns.

Support and Resistance Levels: Comprehensive Guide

Nifty 50 Levels:

- Resistance: 25,365 | 25,442 | 25,550 | 25,647

- Support: 25,286 | 25,200 | 25,148 | 25,038

Bank Nifty Levels:

- Resistance: 55,832 | 55,995 | 56,160 | 56,490

- Support: 55,361 | 55,032 | 54,780 | 54,396

Sensex Levels:

- Resistance: 82,748 | 83,115 | 83,419 | 83,769

- Support: 82,487 | 82,086 | 81,753 | 81,224

These levels represent confluence zones where multiple technical indicators align, making them high-probability areas for price reactions. Traders should monitor volume patterns and candle formations around these levels for confirmation signals.

Investment Strategy & Risk Management

Short-Term Trading Approach: Given the current market environment, traders should adopt a cautious stance with tight stop-losses and defined profit targets. The elevated volatility and ongoing FII selling pressure suggest that position sizes should be managed conservatively. Momentum strategies focusing on sectoral rotation and stock-specific opportunities may prove more effective than broad index plays.

Long-Term Investment Perspective: Despite near-term challenges, India's macroeconomic fundamentals remain robust with GDP growth above 7.5% and contained inflation around 2%. The current market consolidation phase may present attractive entry opportunities for long-term investors, particularly in sectors benefiting from structural reforms and policy support. Value-oriented investment strategies focusing on quality companies with reasonable valuations could outperform growth-oriented approaches in the current environment.

Risk Factors to Monitor: Key risks include escalation in US-India trade tensions, further rupee depreciation, and disappointing corporate earnings in the upcoming quarterly results season. Additionally, any significant change in global monetary policy expectations or geopolitical developments could impact market sentiment substantially.

Conclusion: Market Outlook for September 22, 2025

The Indian stock market approaches Monday's session at a critical juncture, with major indices testing important technical levels that could determine the near-term trend. While foreign selling pressure continues to weigh on sentiment, domestic institutional support and policy measures provide a stabilizing influence. The defined no-trading zones for all major indices offer clear frameworks for tactical trading decisions, with breakouts or breakdowns likely to trigger significant moves.

Investors should remain vigilant about global cues, domestic policy developments, and technical level monitoring while maintaining disciplined risk management practices. The upcoming week could prove pivotal in determining whether the market can sustain its recent resilience or succumb to the mounting pressure from multiple headwinds. Success will likely favor those who combine technical analysis with fundamental awareness and maintain flexibility in their approach to this evolving market environment.

📌 Pro Tip: Save this analysis. Refresh this page before market open on Friday. Watch the first few 15-minute candles like a hawk. Let price confirm the direction—then strike with confidence.

Trade smart. Trade safe. Let the charts lead.

Disclaimer: This analysis is for educational purposes only and should not be considered financial advice. The stock market involves significant risk. Always conduct your own research and consult with a qualified financial advisor before making any trading decisions. Past performance is not indicative of future results.