Technical Analysis for 28th Oct 2025

Nifty Predictions, Bank Nifty Predictions & Sensex Predictions

The Indian stock market witnessed a powerful surge on 27th October 2025, with all three major indices closing in green territory. Nifty 50 closed at 25,966.05 (+170.90 points, +0.66%), Bank Nifty settled at 58,196 (+496 points, +0.86%), and Sensex finished at 84,778.84 (+566.96 points, +0.67%). This strong performance comes ahead of the monthly expiry on 28th October 2025, setting up an exciting trading session with high volatility expectations.

Market sentiment remains bullish as investors anticipate US-China trade deal progress and softer inflation data fueling expectations of additional Fed rate cuts in 2025. Domestic factors including sustained FII inflows, festival season demand, and healthy corporate earnings have reinforced positive momentum.

Key Observations of Today's Market Closing (27th October 2025)

Nifty 50 Performance

Opening: 25,795.15 | High: 26,005.95 | Low: 25,843.20 | Close: 25,966.05

The Nifty 50 formed a bullish candle pattern with a higher high and higher low, indicating strong buying interest throughout the session. The index tested the psychological resistance of 26,000 multiple times during intraday trading, with the high reaching 26,005.95. However, not a single 5-minute candle closed above the 26,000 mark, suggesting strong resistance at this level.

Bank Nifty Performance

Opening: 58,172.75 | High: 58,224 | Low: 57,796.45 | Close: 58,196

Bank Nifty demonstrated exceptional strength, closing near its all-time high levels with a gain of nearly 1%. The index showed a high wave candle pattern suggesting consolidation after a sharp rally. The banking index respected all upside levels provided in previous analysis, with resistance at 58,000 being decisively broken.

Sensex Performance

Opening: 84,667.23 | High: 84,932.08 | Low: 84,297.39 | Close: 84,778.84

Sensex surged 567 points, trading near the 85,000 psychological mark. The index showed strong bullish momentum with buying across sectors, particularly in metals, PSU banks, oil & gas, and realty.

Market Breadth & Sectoral Performance

Broader Market: The BSE Midcap index gained 0.7% and Smallcap index rose 0.5%, indicating widespread participation. About 1,925 shares advanced against 1,994 declining shares.

Top Sectoral Gainers: PSU Bank (+1.75%), Metal (+1.05%), Realty (+1.63%), Oil & Gas (+0.52%)

Top Sectoral Losers: Media (-0.38%), Pharma (-0.20%)

Top Stock Gainers: Reliance Industries (+2.24%), SBI Life (+3.41%), Bharti Airtel (+2%), Eternal (+2%)

Top Stock Losers: Kotak Mahindra Bank (-1.76%), Bharat Electronics (-1%), Infosys (-1.32%), Adani Ports (-1%)

Support & Resistance Levels for 28th October 2025

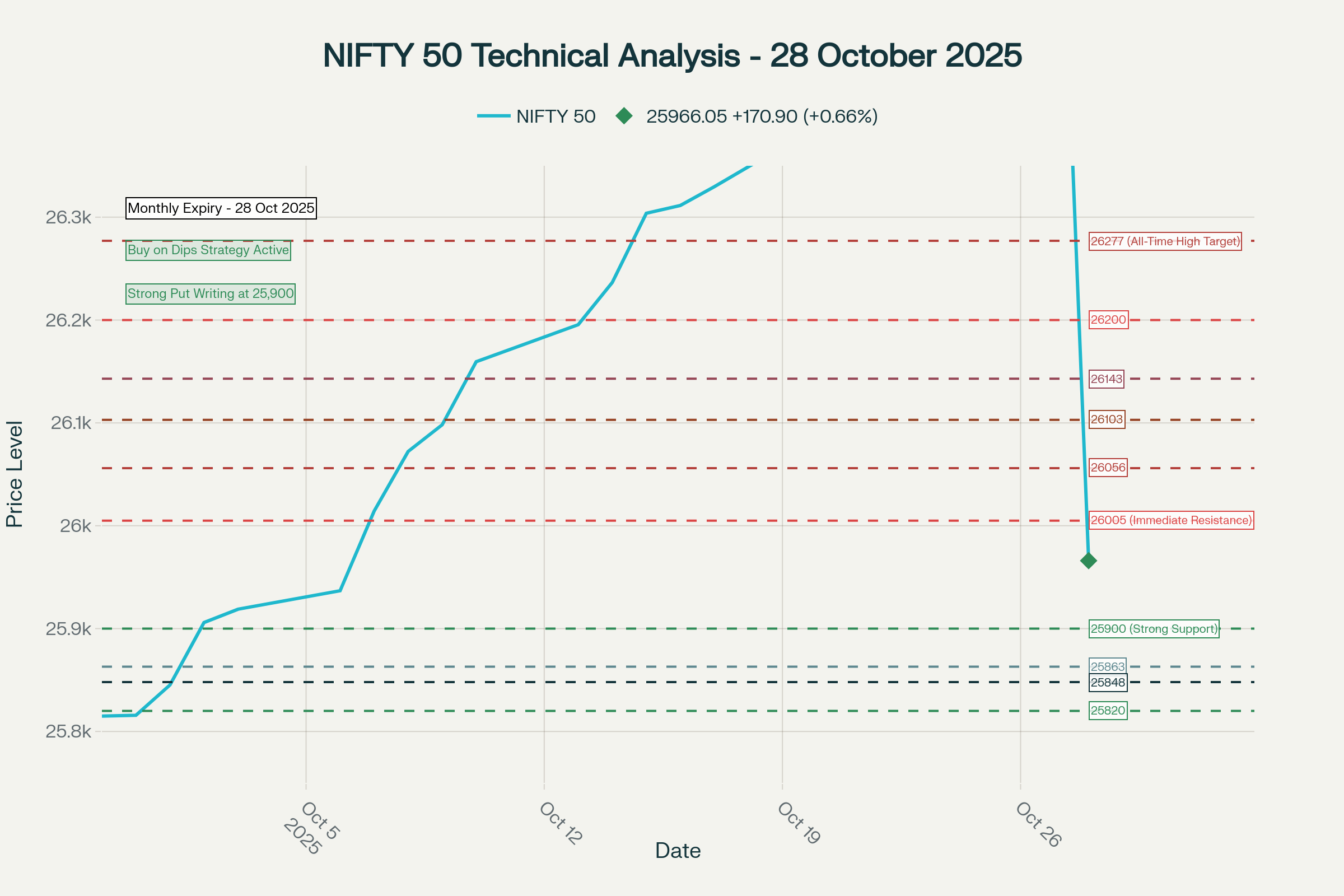

NIFTY 50 Technical Analysis Chart for 28 October 2025 showing key support and resistance levels for monthly expiry trading session

Nifty 50 Critical Levels

Resistance Zones:

- 26,005 - Immediate resistance (Today's high)

- 26,056 - Minor resistance

- 26,103 - Strong resistance zone

- 26,143 - Breakout level

- 26,200 - Psychological resistance

- 26,277 - Potential all-time high target

Support Zones:

- 25,900 - Strong put writing support (Critical level)

- 25,863 - Minor support

- 25,848 - Secondary support

- 25,820 - Deep support zone

The option chain data reveals massive put writing at 25,900, indicating strong institutional support at this level. Call writers have started unwinding positions at 26,000, with 58,523 contracts being unwound, suggesting reduced resistance at this psychological level.

Bank Nifty Critical Levels

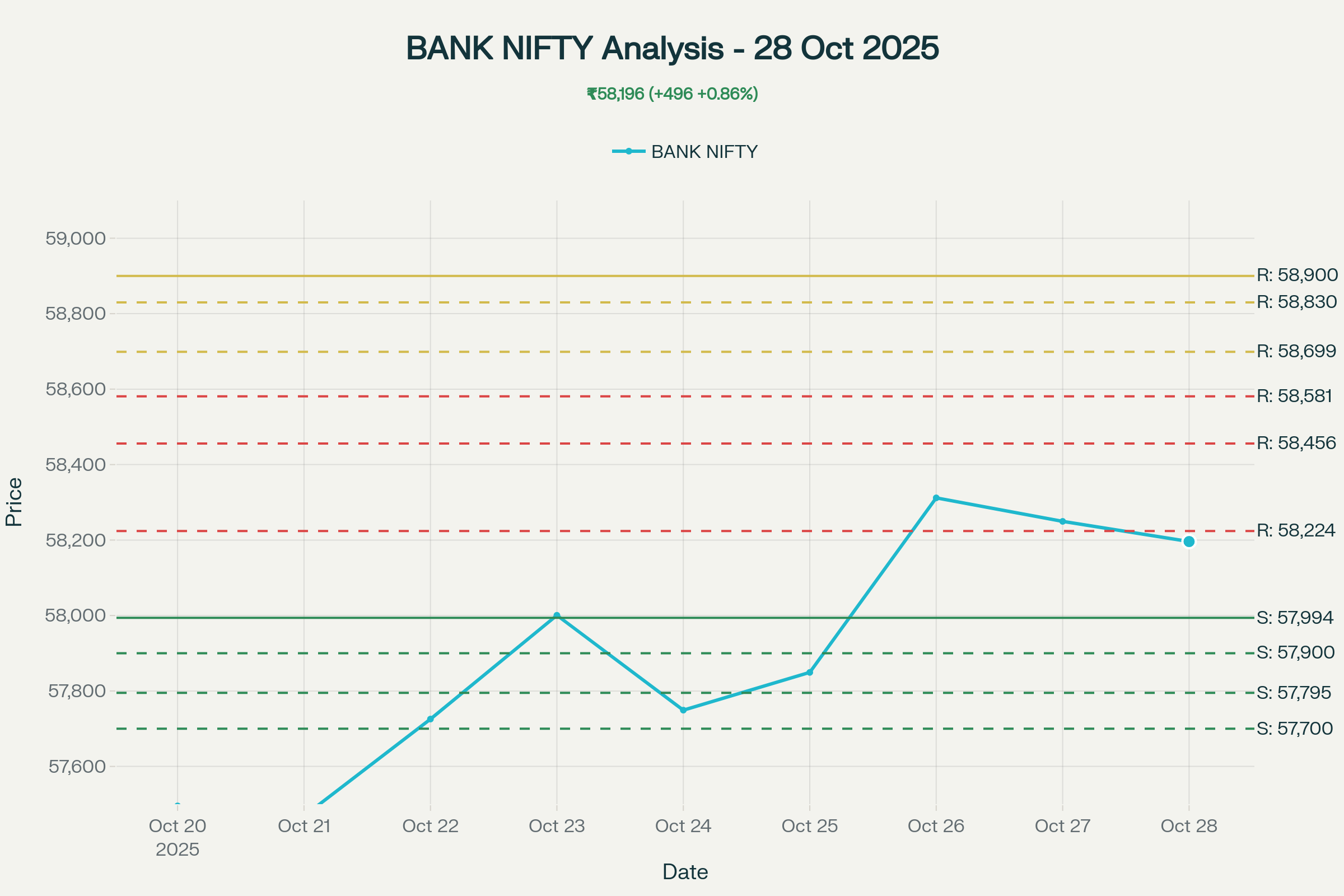

BANK NIFTY Technical Analysis Chart for 28 October 2025 showing key support and resistance levels for monthly expiry trading session

Resistance Zones:

- 58,224 - Today's high (Immediate resistance)

- 58,456 - First target

- 58,581 - Strong resistance

- 58,699 - Breakout level

- 58,830 - Extension target

- 58,900 - Major resistance zone

Support Zones:

- 57,994 - Critical support (57,900-58,000 zone)

- 57,900 - Strong support with put writing

- 57,795 - Secondary support

- 57,700 - Deep support level

The Bank Nifty option chain shows aggressive put writing at 58,000 and 58,200, indicating strong buyer confidence at these levels. Call writing at 58,500 suggests resistance, but unwinding patterns indicate potential short covering if this level breaks.

Sensex Critical Levels

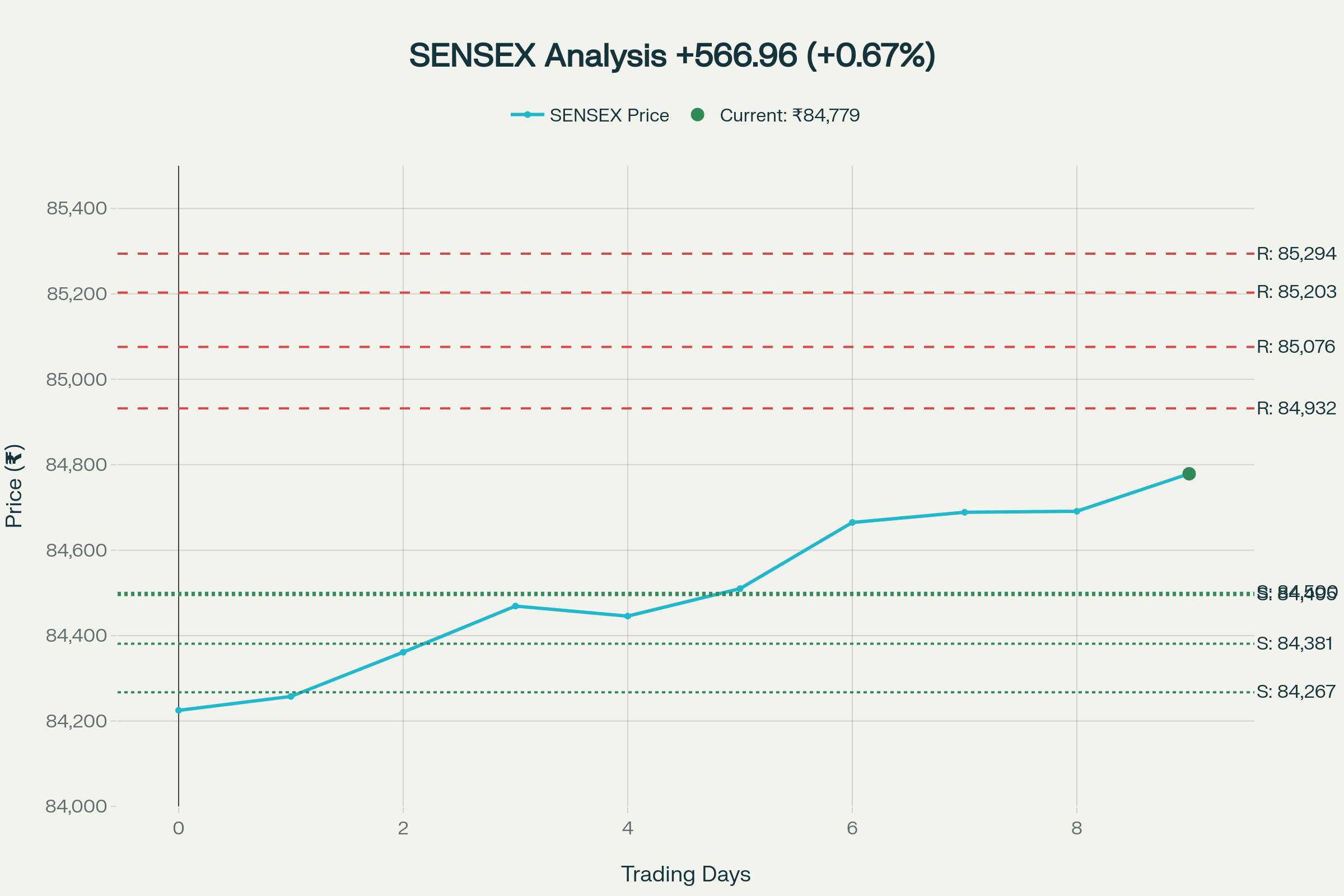

SENSEX Technical Analysis Chart for 28 October 2025 showing key support and resistance levels with bullish momentum

Resistance Zones:

- 84,932 - Today's high (Immediate resistance)

- 85,076 - First target

- 85,203 - Strong resistance

- 85,294 - Psychological target

Support Zones:

- 84,500 - Strong support zone

- 84,495 - Critical support

- 84,381 - Secondary support

- 84,267 - Deep support level

Sensex has cleared the 84,500 support comfortably and is now eyeing the 85,000 psychological milestone, which appears achievable given the current momentum.

Nifty Predictions –

Our Opinion: BULLISH with Caution

Trading Strategy for 28th October 2025:

The Nifty 50 is positioned at a crucial juncture ahead of the monthly expiry. Our analysis suggests a "Buy on Dips" strategy remains active, with the index showing strong support at the 25,900 level due to massive put writing activity.

Bullish Scenario:

If Nifty decisively breaks and closes above 26,005 in the first hour of trading, we can expect a swift move towards 26,056, followed by 26,103 and 26,143. A sustained close above 26,143 could trigger a rally towards the all-time high zone of 26,200-26,277.

The option chain analysis reveals that call writers are not confident in writing calls at higher strikes, with significant unwinding observed at 26,000 strike. This indicates limited resistance on the upside. The implied volatility and option premiums suggest a potential move of 130-140 points in either direction, favoring bullish participants.

Bearish Scenario:

If Nifty breaks below 25,900 support, we could see a quick decline towards 25,863 and 25,820. However, this scenario appears less likely given the strong put writing and "buy on dips" market structure.

Expiry Day Dynamics:

As this is the monthly expiry session, traders should be cautious of range-bound movements and avoid aggressive averaging. The market could witness movement in both directions as option positions get squared off.

Target Zones for Bulls: 26,056 → 26,103 → 26,143 → 26,200 → 26,277

Critical Support: 25,900 (Must hold for bullish continuation)

Bank Nifty Predictions

Our Opinion: STRONGLY BULLISH

Trading Strategy for 28th October 2025:

Bank Nifty has demonstrated exceptional strength, closing near its record highs with robust institutional support. The banking index is displaying classic breakout characteristics with strong put writing at 58,000 and unwinding of call positions at higher strikes.

Bullish Scenario:

A decisive break above 58,224 (today's high) will open doors for a sharp rally towards 58,456, followed by 58,581 and 58,699. If the momentum continues, we could witness an extension towards 58,830-58,900 zones, potentially marking new all-time highs.

The technical setup is particularly favorable as the index has formed a high wave candle with consolidation, which typically precedes a strong directional move. The option chain shows significant call unwinding at 58,500, suggesting potential short covering that could fuel further upside.

Neutral to Bearish Scenario:

Bank Nifty will only show weakness if it breaks below 57,900 decisively. The zone between 57,900-58,000 has very strong put support, making it an ideal buying zone for dip buyers. A break below 57,900 could lead to 57,795 and 57,700, but this appears unlikely given current market structure.

Monthly Expiry Considerations:

Given the monthly expiry, Bank Nifty could witness high volatility in both directions. However, the bias remains firmly bullish above 57,900.

Target Zones for Bulls: 58,456 → 58,581 → 58,699 → 58,830 → 58,900

Critical Support: 57,900 (Strong institutional buying zone)

Bullish Confirmation: Sustained close above 58,224

Sensex Predictions –

Our Opinion: BULLISH MOMENTUM CONTINUES

Trading Strategy for 28th October 2025:

Sensex has shown remarkable resilience, gaining 567 points in the previous session and marching towards the 85,000 psychological milestone. The index is trading in a strong bullish channel with support from heavyweight stocks like Reliance Industries, which surged 2% on AI venture news with Meta.

Bullish Scenario:

A break above 84,932 (today's high) will trigger buying interest towards 85,076, followed by 85,203 and the key target of 85,294. The 85,000 mark is a psychological resistance but not a major technical barrier given the current momentum.

The broader market breadth remains positive with sectoral leadership from PSU Banks, Metals, and Realty, indicating widespread participation in the rally. Heavyweight stocks like Reliance Industries, HDFC Bank, SBI, and Bharti Airtel are providing strong support to the index.

Bearish Scenario:

Sensex will face selling pressure only if it breaks below 84,500, which represents a strong support zone. Below this, the index could test 84,381 and 84,267. However, given the current market structure and global cues, this scenario appears less probable.

Market Drivers:

The positive sentiment is backed by US-China trade deal hopes, expectations of Fed rate cuts, and strong domestic institutional support. Any progress on the India-US trade deal could further uplift sentiment.

Target Zones for Bulls: 85,076 → 85,203 → 85,294

Critical Support: 84,500 (Strong demand zone)

Key Milestone: 85,000 (Psychological resistance)

Tomorrow's Market Prediction ( October 28, 2025)

Overall Market Outlook: BULLISH WITH VOLATILITY

The Indian stock market is positioned for an exciting monthly expiry session on 28th October 2025, with strong bullish undertones backed by positive global cues and robust domestic fundamentals.

Key Factors Supporting Bullish Outlook:

- Global Cues: US-China trade deal progress and softer inflation data supporting Fed rate cut expectationsbusiness-standard+2

- Domestic Flows: Sustained FII inflows and strong domestic institutional buyingnews.abplive+1

- Corporate Earnings: Healthy Q2 results supporting market sentimentgoodreturns+1

- Technical Setup: All three indices trading near resistance breakout zonesmoneycontrol+2

- Option Data: Strong put writing at key support levels indicating institutional confidence.

Key Risks to Monitor:

- Monthly Expiry Volatility: Expect sharp movements in both directions as option positions get squared off.

- Range-Bound Risk: There's a possibility of consolidation between key levels rather than directional moves.

- Global Events: Any negative news on trade deals or geopolitical tensions could trigger profit booking.

- Kotak Bank Impact: Weak Q2 results may weigh on banking stocks.

Trading Recommendations for 28th October 2025:

- Nifty: Buy on dips near 25,900-25,920 with targets of 26,100-26,200. Stop loss at 25,850

- Bank Nifty: Buy above 58,250 with targets of 58,500-58,700. Support at 57,900

- Sensex: Bullish above 84,500 with targets of 85,000-85,300

Sectoral Focus: PSU Banks, Metals, Realty, and Oil & Gas sectors showing strength.

Stock-Specific Opportunities: Reliance Industries, SBI, Bharti Airtel, and HDFC Bank leading the rally.

Final Verdict

Market Analysis Summary

The technical analysis for 28th October 2025 presents a compelling case for continued bullish momentum in the Indian stock market, tempered with caution due to monthly expiry volatility. Our comprehensive analysis of Nifty, Bank Nifty, and Sensex reveals:

Nifty 50: Trading at 25,966, the index has successfully held above the 9-day and 20-day EMAs, maintaining its bullish structure. The 26,000 resistance is weakening with significant call unwinding, suggesting an imminent breakout attempt. Strong put support at 25,900 provides a safety net for bulls.

Bank Nifty: The banking index is demonstrating exceptional strength, closing near record highs at 58,196. The technical setup favors a breakout above 58,224, which could trigger a sharp rally towards 58,700-58,900 zones. The consolidation pattern after a strong rally typically precedes the next leg up.

Sensex: At 84,778, Sensex is knocking on the doors of the 85,000 psychological milestone. Backed by heavyweight stocks like Reliance Industries (up 2% on AI venture news) and strong sectoral participation, the index appears poised for further gains.

Reconfirmed Outlook for 28th October 2025

BULLISH OUTLOOK MAINTAINED with the following expectations:

- Nifty: Expected to break 26,000 and test 26,100-26,200 zones. New all-time high possible if momentum sustains

- Bank Nifty: Likely to continue its outperformance, targeting 58,500-58,700 levels

- Sensex: 85,000+ levels achievable with support from index heavyweights

Market Structure: "Buy on Dips" strategy remains valid. Any decline towards support zones (Nifty 25,900, Bank Nifty 57,900, Sensex 84,500) should be viewed as buying opportunities.

Expiry Day Strategy: Given the monthly expiry, avoid aggressive averaging. Let the first hour's price action establish the trend before taking significant positions. High volatility expected in both directions.

Confidence Level: HIGH (Based on technical alignment, option data, and global cues)

Disclaimer

Important Notice: This technical analysis is provided for educational and informational purposes only. The predictions, support and resistance levels, and trading recommendations mentioned in this article are based on technical analysis and historical price patterns.

Not Investment Advice: This analysis should NOT be construed as investment advice or a recommendation to buy or sell any securities. Stock market investments are subject to market risks, and past performance is not indicative of future results.

Consult Your Financial Advisor: Before making any trading or investment decisions, please consult with your certified financial advisor who can assess your individual financial situation, risk tolerance, and investment objectives.

Risk Disclosure: Trading in stocks, derivatives, and options involves substantial risk of loss and is not suitable for all investors. The monthly expiry session on 28th October 2025 may witness heightened volatility. Please trade responsibly and never invest more than you can afford to lose.

Market Volatility: The Indian Stock Market can be highly volatile, and actual price movements may differ significantly from the predictions provided. Always use appropriate risk management strategies, including stop-loss orders.

Option Matrix India and the author of this analysis assume no responsibility for any financial losses incurred based on the information provided in this article. All trading and investment decisions are your own responsibility.