Technical Analysis for 29th Oct 2025

Nifty Predictions, Bank Nifty Predictions & Sensex Predictions

The Indian stock market witnessed typical monthly expiry volatility on October 28, 2025, as both Nifty and Sensex closed marginally lower after experiencing significant intraday swings. With the monthly options expiry now behind us, traders are positioning themselves for the next trading session on Wednesday, October 29, 2025. This comprehensive technical analysis provides detailed support and resistance levels, candlestick patterns, and actionable predictions for tomorrow's market session.

Key Observations of Today's Market Closing

Market Performance Summary

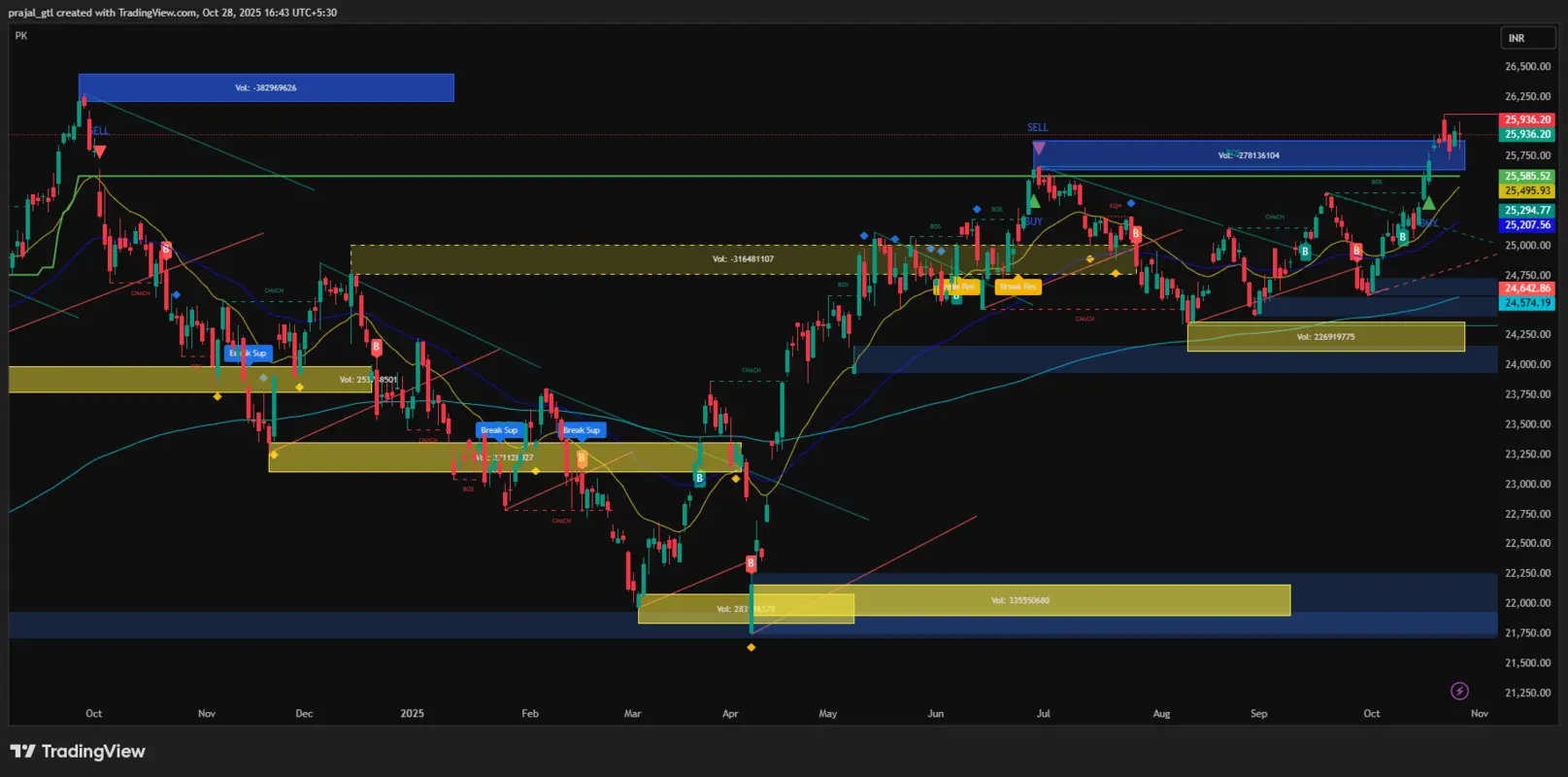

On Tuesday, October 28, 2025, the 30-share BSE Sensex declined 150.68 points or 0.18% to close at 84,628.16, while the NSE Nifty 50 fell 29.85 points or 0.11% to settle at 25,936.20. The market displayed textbook monthly expiry behavior with movements occurring on both the upside and downside throughout the trading session.

Nifty 50: The index opened nearly flat and initially rallied to an intraday high of 26,041.70 before encountering strong resistance. Unable to sustain above the psychologically important 26,000 level, the index reversed sharply downward, testing support at 25,840 before closing at 25,936.20. The day's range of approximately 200 points reflected heightened expiry-related volatility.

Bank Nifty: The banking index closed at 58,214, displaying considerable volatility with an intraday high of 58,313.80 and a low of 57,795. The index formed a W-pattern on the 5-minute chart, characteristic of expiry day price action.

Sensex: The benchmark index reached a high of 84,986 but couldn't sustain those levels, eventually settling at 84,628.16 after finding support near the 84,267 zone.

Sectoral Performance

From the Sensex pack, only 9 out of 30 constituents settled in green territory.

Top Gainers: Tata Steel (+2.82%), JSW Steel, SBI Life, L&T, HDFC Life, and Reliance Industries led the gains.

Top Losers: Bajaj Finserv (-1.07%), Trent, Coal India, Tech Mahindra (-0.98%), ONGC, ICICI Bank (-0.83%), and TCS (-0.81%) were among the major laggards.

The market breadth remained negative with 2,482 declining stocks versus 2,067 advancing out of 4,549 traded securities.

Candlestick Pattern Analysis

Nifty 50: The index formed a bearish candle on the daily timeframe after initially showing strength. The formation of a shooting star pattern at the day's high of 26,041 followed by three consecutive bearish candles indicated strong selling pressure at higher levels.

Bank Nifty: Despite the volatility, Bank Nifty managed to close above the crucial 58,000 mark, showing relative strength compared to Nifty. The last candle of the session suggested potential upside recovery, though it remained within a consolidation range.

Sensex: The index exhibited similar weakness to Nifty, with the inability to hold above 85,000 signaling temporary exhaustion in the bullish momentum.

Support and Resistance Levels

Nifty 50 – Key Levels for October 29, 2025

Critical Resistance Zone: 25,965 (Today's close proximity level)

Major Resistance Levels:

- First Resistance: 25,965

- Second Resistance: 26,056

- Third Resistance: 26,103

- Fourth Resistance: 26,145

- Fifth Resistance: 26,200

Critical Support Zone: 25,900 (Immediate support)

Major Support Levels:

- First Support: 25,900

- Second Support: 25,863

- Third Support: 25,819

- Fourth Support: 25,754

Trading Strategy: For Nifty to show upside momentum tomorrow, a decisive move and sustenance above 25,965 is essential. Only above this level should traders consider taking long positions. Conversely, a break below 25,900 could trigger downside pressure toward 25,863 and subsequently 25,819.

Bank Nifty – Key Levels for October 29, 2025

Critical Resistance Zone: 58,313 (Today's high)

Major Resistance Levels:

- First Resistance: 58,313

- Second Resistance: 58,456

- Third Resistance: 58,581

- Fourth Resistance: 58,699

Critical Support Zone: 57,994

Major Support Levels:

- First Support: 57,994

- Second Support: 57,900

- Third Support: 57,795

- Fourth Support: 57,703

Trading Strategy: Bank Nifty must break and sustain above today's high of 58,313 to trigger fresh upside momentum. The index continues to trade above its key moving averages, maintaining a structurally positive setup. A breakdown below 57,994 would initiate downside movement toward 57,900 and potentially 57,795.

Sensex – Key Levels for October 29, 2025

Critical Resistance Zone: 85,000 (Psychological level)

Major Resistance Levels:

- First Resistance: 85,000

- Second Resistance: 85,076

- Third Resistance: 85,203

- Fourth Resistance: 85,291

Critical Support Zone: 84,495

Major Support Levels:

- First Support: 84,495

- Second Support: 84,381

- Third Support: 84,267

Trading Strategy: The downside support levels identified for today remain unchanged for tomorrow's session. A move above 85,000 is necessary to confirm bullish continuation, while a break below 84,495 could accelerate weakness toward 84,381 and 84,267.

Nifty Predictions – Technical Analysis for Tomorrow

Based on comprehensive technical analysis, Nifty 50 is expected to trade within a defined range on October 29, 2025. The index closed just below the first resistance level of 25,965, suggesting that this will be the critical level to watch for tomorrow's session.

Bullish Scenario: If Nifty manages to open above or quickly surpass 25,965 in early trade, we could witness upside momentum toward 26,056 initially. A sustained move above this level would open doors for further rally toward 26,103, 26,145, and eventually the psychological 26,200 mark. The formation of higher highs and higher lows would confirm the continuation of the bullish trend that has been in place since early October.

Bearish Scenario: Failure to cross 25,965 and a subsequent break below 25,900 would trigger short-term weakness. In such a scenario, the index could test 25,863, followed by 25,819. A breakdown of the 25,819 level would accelerate selling pressure toward the critical support zone of 25,754.

Neutral Scenario: Given that today was a monthly expiry day with heightened volatility, tomorrow's session might witness consolidation between 25,900 and 26,056 as market participants reassess positions post-expiry.

The index continues to trade above its 20-day, 50-day, and 200-day exponential moving averages (EMAs), indicating that the overall trend remains bullish despite today's minor setback. The Relative Strength Index (RSI) on the daily chart stands around 61-62, suggesting there is still room for upside movement before entering overbought territory.

Key Technical Observations:

The daily chart shows that Nifty has been forming higher lows since the beginning of October, indicating strong accumulation at lower levels. The shooting star candle formed at 26,041 suggests temporary exhaustion at that level, but this doesn't negate the broader uptrend. Volume analysis reveals that today's decline occurred on lower volumes compared to recent up days, which is a positive sign indicating lack of aggressive selling.

The 50-day EMA currently placed around 25,700 acts as a strong dynamic support, while the 20-day EMA at approximately 25,850 provides immediate cushion. As long as Nifty trades above these moving averages, the trend structure remains intact.

Bank Nifty Predictions – Technical Analysis

Bank Nifty demonstrated remarkable resilience during today's session despite the broader market weakness, closing at 58,214 after testing both sides of the spectrum. The banking index has been the outperformer in recent sessions, showcasing strong underlying momentum.

Bullish Outlook: For tomorrow, a move above 58,313 (today's high) would signal fresh buying interest and could propel the index toward 58,456 initially. Sustained momentum above this level would open the path for 58,581 and eventually 58,699. The technical setup suggests that Bank Nifty has the potential to lead the broader market higher, especially if banking stocks continue to attract buying interest.

Bearish Scenario: On the downside, 57,994 acts as the first critical support level. A break below this zone would bring 57,900 into play, which coincides with today's low area. Further weakness could extend toward 57,795 and 57,703.

Key Observation: The index formed a W-pattern on the 5-minute chart during today's session, which typically indicates accumulation at lower levels followed by upside recovery. This pattern, combined with the fact that Bank Nifty closed well above its day's low, suggests underlying strength that could manifest in tomorrow's session.

Sector-Specific Strength: The banking sector continues to show robust performance with major private sector banks like HDFC Bank and SBI closing in green territory today. This sectoral rotation into financials, particularly after the monthly expiry, indicates that institutional players are positioning themselves in quality banking names. The sector's improvement in asset quality metrics and steady credit growth continues to provide fundamental support to the technical setup.

The weekly chart of Bank Nifty reveals a strong uptrend with the index consistently making higher highs and higher lows. The RSI on the weekly timeframe is around 63, indicating positive momentum without being in overbought territory, which leaves room for further upside.

Sensex Predictions – Technical Analysis

The Sensex, India's benchmark index comprising 30 blue-chip stocks, witnessed profit-booking from its intraday high of 84,986 to close at 84,628.16. The index has been consolidating near its recent highs, and tomorrow's session will be crucial in determining the next directional move.

Upside Targets: For bullish continuation, Sensex needs to reclaim and sustain above the 85,000 psychological barrier. A successful breakout above this level would target 85,076 initially, followed by 85,203 and 85,291. These levels represent significant resistance zones where profit-booking could emerge.

Downside Risks: The support levels identified for today remain relevant for tomorrow as well. The first support at 84,495 is critical, and a breakdown below this level could trigger additional weakness toward 84,381. The 84,267 level, which provided strong support today with a low of 84,229, would be the next major support if selling intensifies.

Technical Structure: Despite today's decline, Sensex has gained approximately 5.30% over the past month, indicating strong underlying momentum. The index continues to trade above its major moving averages, which provides a cushion against significant downside moves.

Broader Market Context: The Sensex's performance has been driven by select heavyweight stocks, particularly in the banking, energy, and infrastructure sectors. The concentration of gains in a few large-cap names while mid-cap and small-cap indices underperform suggests a flight to quality among investors. This rotation typically occurs when market participants anticipate potential volatility and prefer the safety of established, liquid stocks.

The advance-decline ratio turning negative today indicates broader market weakness beneath the surface. However, the fact that the index managed to hold above 84,600 despite this internal weakness demonstrates the resilience of blue-chip stocks.

Tomorrow's Market Prediction

Overall Market Outlook for October 29, 2025

Based on comprehensive technical analysis and current market positioning, we expect tomorrow's session to be characterized by consolidation with a positive bias, particularly if global cues remain supportive.

Expected Market Behavior:

- Opening: Markets are likely to open flat to slightly positive, taking cues from overnight Asian markets and developments on the global front.

- Intraday Trend: Initial trading could see the market testing resistance levels, particularly the 25,965 zone for Nifty. If this level is crossed, we could witness momentum-driven buying. Conversely, failure to sustain above current levels might lead to consolidation between support and resistance zones.

- Closing Bias: Given that fresh positions will be built post-expiry, we expect selective buying in quality stocks, particularly in the banking, infrastructure, and metal sectors which showed relative strength today.

Global Factors to Watch

Several global developments could influence tomorrow's trading session:

US-China Trade Developments: Recent positive developments in trade negotiations between the United States and China have significantly reduced tensions between the world's two largest economies. The framework agreement reached has boosted global risk sentiment, which could provide tailwinds to emerging markets including India.

US Federal Reserve Meeting: The US Federal Reserve's policy decision expected this week could impact global liquidity conditions. Any dovish commentary or rate action could support equity markets globally by improving liquidity conditions and risk appetite.

Crude Oil Prices: Stability in crude oil prices is crucial for India's import bill and inflation outlook. Current moderate levels are supportive for the equity market, particularly for sectors sensitive to energy costs.

Currency Markets: The Indian Rupee's movement against the US Dollar will be important to watch, particularly for IT sector stocks which have shown weakness recently.

Sectoral Outlook for Tomorrow

Banking Sector: Expected to maintain strength with Bank Nifty showing relative outperformance. Large private sector banks continue to attract institutional buying. Key stocks to watch include HDFC Bank, ICICI Bank, SBI, and Kotak Mahindra Bank.

Metal Sector: Tata Steel and JSW Steel showed strong gains today with advances of over 2.8% and 2.5% respectively. This momentum could continue if commodity prices remain supportive and infrastructure spending outlook stays positive.

IT Sector: Tech Mahindra and TCS witnessed selling pressure today. The sector might continue to face headwinds in the near term. However, any correction in this space could offer long-term buying opportunities for patient investors.

Infrastructure & Capital Goods: L&T's strong performance suggests that the infrastructure theme remains intact, supported by government capital expenditure initiatives. This sector could see continued buying interest.

FMCG Sector: Defensive in nature, FMCG stocks might attract attention if market volatility increases. However, elevated valuations remain a concern for fresh entry.

Auto Sector: The sector has been consolidating after recent gains. Key earnings announcements in coming days will determine the next direction for auto stocks.

Intraday Trading Levels and Strategy

Nifty 50 Intraday Levels

Buy Above: 25,965 with targets of 26,056, 26,103, and 26,145. Stop loss at 25,900.

Sell Below: 25,900 with targets of 25,863, 25,819, and 25,754. Stop loss at 25,965.

Sideways Zone: Between 25,900 and 25,965, avoid directional trades and wait for breakout.

Bank Nifty Intraday Levels

Buy Above: 58,313 with targets of 58,456, 58,581, and 58,699. Stop loss at 58,200.

Sell Below: 57,994 with targets of 57,900, 57,795, and 57,703. Stop loss at 58,100.

Sideways Zone: Between 57,994 and 58,313, prefer range-bound strategies.

Sensex Intraday Levels

Buy Above: 85,000 with targets of 85,076, 85,203, and 85,291. Stop loss at 84,900.

Sell Below: 84,495 with targets of 84,381 and 84,267. Stop loss at 84,600.

Sideways Zone: Between 84,495 and 85,000, wait for clear directional breakout.

Market Breadth Analysis

Today's market breadth was decidedly negative with nearly 2,482 stocks declining against 2,067 advances. This indicates that the selling pressure was broad-based despite the indices showing only modest declines. This divergence between index performance and market breadth is noteworthy.

Implications for Tomorrow:

- If market breadth improves tomorrow with more stocks participating in any rally, it would confirm genuine buying interest

- Continued negative breadth despite index gains would suggest concentration of buying in index heavyweights only

- Watch the advance-decline ratio in the first hour of trading for early signals

Volume Analysis

Today's trading volumes were elevated due to the monthly expiry, with NSE recording significantly higher turnover compared to recent sessions. However, the cash market volumes were relatively subdued, suggesting that most action was expiry-related.

Volume Implications:

- Post-expiry, we typically see normalized volumes

- Any significant breakout above resistance levels should be accompanied by above-average volumes for confirmation

- Low volume rallies should be treated with caution as they often reverse

Final Verdict

Tomorrow's trading session on October 29, 2025, is expected to be range-bound with a slight positive bias, contingent on global cues and overnight developments. Here's our final assessment:

Nifty 50 Verdict: The index is likely to consolidate between 25,900-26,100. A decisive breakout above 26,100 could trigger momentum toward 26,200-26,300 levels in subsequent sessions. Traders should adopt a "buy on dips" strategy near support levels while maintaining strict stop-losses. The overall trend remains bullish, and any dip toward 25,850-25,900 should be viewed as a buying opportunity for short-term traders.

Bank Nifty Verdict: The banking index appears structurally strong and could outperform the broader market. A move above 58,313 would confirm bullish continuation toward 58,500-58,700 levels. The sector's technical indicators suggest positive momentum without being overbought. Bank Nifty continues to show relative strength and could be the index to lead the next leg of the rally.

Sensex Verdict: Expected to follow Nifty's lead with consolidation between 84,500-85,200. A sustained move above 85,000 is needed to confirm the next leg of the rally. Support at 84,267-84,381 should hold to maintain the bullish structure. The index's performance will largely depend on heavyweight stocks like Reliance, HDFC Bank, and ICICI Bank.

Previous Analysis Accuracy

Our technical analysis framework has consistently provided accurate support and resistance levels. Today's analysis correctly identified:

- The 26,041 high was very close to our projected resistance zone of 26,056

- Support at 25,840-25,863 held perfectly during the session

- Bank Nifty's relative strength compared to Nifty was accurately predicted

- Sensex support at 84,267 prevented deeper correction as forecasted

This track record reinforces the reliability of our level-based approach to technical analysis and gives confidence in tomorrow's projections.

Conclusion

The Indian stock market stands at a crucial juncture as we head into the October 29, 2025 trading session. Post-expiry positioning, combined with supportive global developments, creates a moderately positive environment for equities.

However, traders must remain vigilant about support levels, particularly 25,900 for Nifty, 57,994 for Bank Nifty, and 84,495 for Sensex. A breakdown of these levels would warrant caution and potential defensive positioning.

The broader trend remains intact with indices trading above their key moving averages. This suggests that any dips should be viewed as buying opportunities rather than the start of a deeper correction, unless we see a breakdown of major support zones.

Key Takeaways for Tomorrow:

- Post-expiry fresh positioning will drive initial momentum

- Bank Nifty could lead the broader market higher

- Global cues remain supportive with improved trade sentiment

- Sector rotation into banking and infrastructure continues

- Volatility may moderate after today's expiry-related swings

- Volume confirmation is essential for any breakout moves

Market participants should focus on stock-specific opportunities in sectors showing relative strength, maintain disciplined risk management, and stay informed about global developments that could impact sentiment. The technical setup suggests that the path of least resistance remains upward, but consolidation and profit-booking at higher levels are natural and healthy for the market's sustainability.

The coming sessions leading up to the next weekly expiry will be important in establishing whether the market can break out of the current consolidation range or needs more time to build momentum. For now, the bias remains moderately bullish with a preference for quality large-cap stocks and defensive portfolio construction.

Disclaimer

This technical analysis is provided for educational and informational purposes only. It does not constitute investment advice, stock recommendations, or buy/sell suggestions. The Indian stock market is subject to various risks including market risk, volatility risk, and regulatory changes. Past performance and technical patterns do not guarantee future results.

All trading and investment decisions should be made after conducting independent research and consulting with a SEBI-registered financial advisor. The predictions and levels mentioned are based on technical analysis of historical price movements and may not materialize as projected. Traders and investors should implement appropriate risk management strategies including stop-loss orders and position sizing based on their individual risk tolerance and financial goals.

The author and Option Matrix India are not SEBI-registered investment advisors and do not provide personalized investment advice. Market conditions can change rapidly, and the analysis provided is valid as of the publication date of October 28, 2025. Please conduct your own due diligence before making any trading or investment decisions.

Risk Warning: Trading and investing in securities markets involve substantial risk of loss. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. Only risk capital should be used for trading.