Technical Analysis for 30 Oct 2025

Nifty Predictions, Bank Nifty Predictions & Sensex Predictions

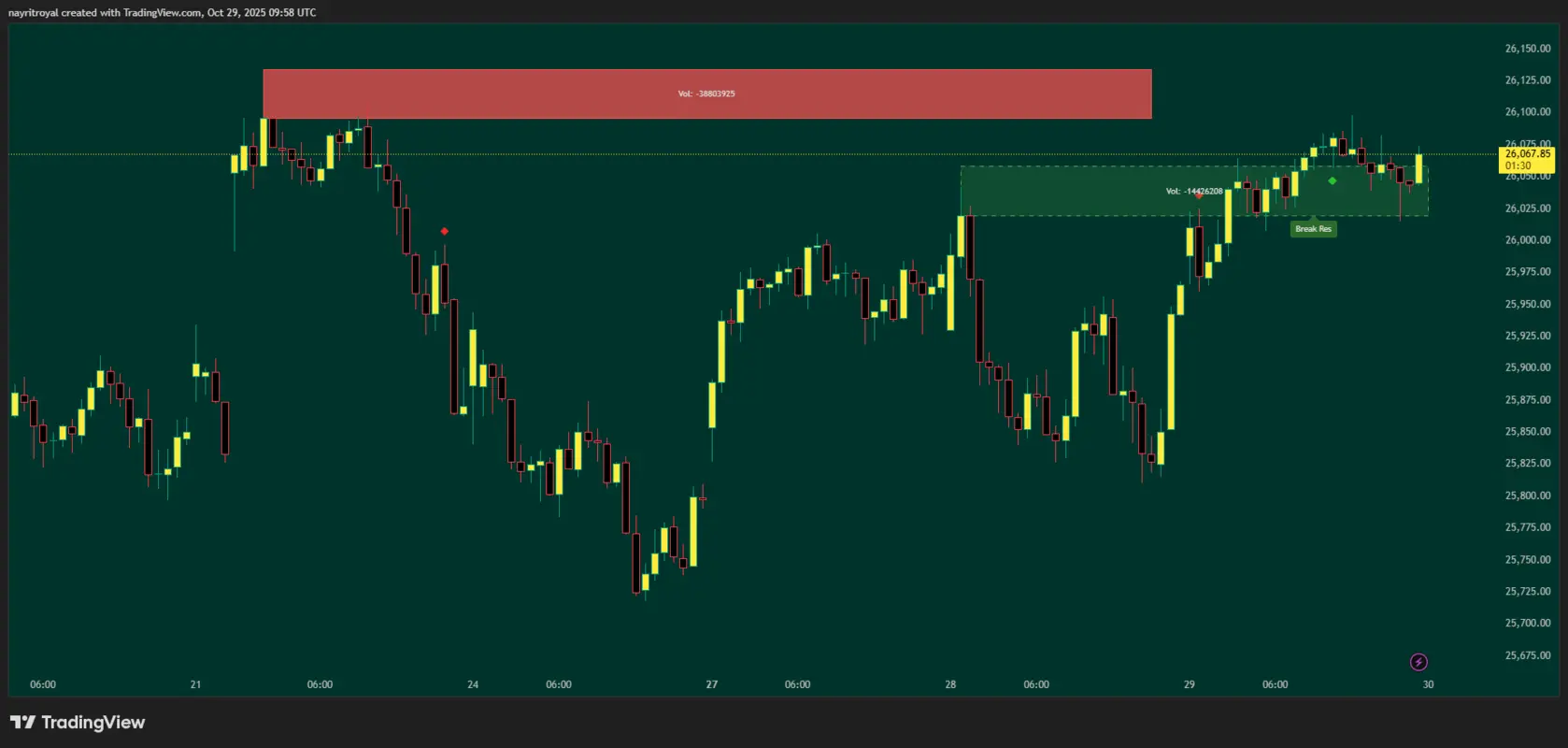

The Indian stock market witnessed notable volatility on October 29, 2025, as traders navigated through post-monthly-expiry positioning and global trade developments. The benchmark indices closed on a positive note with Nifty 50 gaining 0.45% to settle at 26,054, Sensex advancing 0.44% to 84997, and Bank Nifty rising 0.29% to 58,485. This comprehensive technical analysis provides detailed support and resistance levels, candle patterns, and actionable predictions for tomorrow's trading session on October 30, 2025.

Key Observations of Today's Market Closing (October 29, 2025)

Market Performance Summary

Nifty 50: The index opened at 25,982 and exhibited strong intraday momentum, reaching a high of 26,091.70 before closing at 26,053.90. The day's trading range highlighted improved market sentiment as buying interest emerged across key sectors.

Bank Nifty: The banking index opened at 58,316.25 and traded within a range of 58,087.05 to 58,469.90, finally settling at 58,485.25. The index maintained its position above critical moving averages, indicating sustained bullish momentum.

Sensex: The 30-share BSE Sensex opened at 84,628 and climbed to an intraday high of 84997.15 , demonstrating strong buying pressure across heavyweight stocks. The index recovered from its previous session's decline and moved closer to its record high levels.

Candle Pattern Analysis

On October 29, 2025, Nifty 50 formed a bullish candle pattern with higher high and higher low structure, suggesting positive momentum continuation. The index maintained its position above the 20-day, 50-day, and 200-day exponential moving averages (EMAs), confirming the structural uptrend remains intact. Bank Nifty also displayed a bullish candlestick formation with strong buying support near lower levels, while Sensex demonstrated recovery strength after testing support zones earlier in the session.

Support and Resistance Levels

Nifty 50 – Critical Levels for October 30, 2025

Major Resistance Levels:

- First Resistance: 26,106 (Critical breakout level)

- Second Resistance: 26,150

- Third Resistance: 26,270

- Fourth Resistance: 26,480

Major Support Levels:

- First Support: 26,000 (Psychological level)

- Second Support: 25,930

- Third Support: 25,812

- Fourth Support: 25,716

Bank Nifty – Critical Levels for October 30, 2025

Major Resistance Levels:

- First Resistance: 58,471 (Key breakout zone)

- Second Resistance: 58,583

- Third Resistance: 58,912

- Fourth Resistance: 59,200

Major Support Levels:

- First Support: 58,269 (Immediate support)

- Second Support: 58,000

- Third Support: 57,769

- Fourth Support: 57,500

Sensex – Critical Levels for October 30, 2025

Major Resistance Levels:

- First Resistance: 85,103 (Critical breakout level)

- Second Resistance: 85,300

- Third Resistance: 85,639

- Fourth Resistance: 86,045

Major Support Levels:

- First Support: 84,800 (Psychological support)

- Second Support: 84,579

- Third Support: 84,229

- Fourth Support: 83,959

Nifty Predictions

Based on comprehensive technical analysis and market structure, Nifty 50 is positioned at a crucial juncture for October 30, 2025. The index maintains a no trading zone between 26,000 to 26,106, suggesting consolidation before the next directional move.

Bullish Scenario

If a 15-minute candle closes above 26,106, the index will confirm bullish breakout with the following targets:

- 1st Target: 26,150

- 2nd Target: 26,270

- 3rd Target: 26,480

This scenario would indicate strong momentum continuation, driven by positive global cues and sustained domestic institutional buying.

Bearish Scenario

If a 15-minute candle closes below 26,000, downside pressure will intensify with the following targets:

- 1st Target: 25,930

- 2nd Target: 25,812

- 3rd Target: 25,716

A breakdown below 26,000 would suggest profit-booking at higher levels and could trigger short-term corrective pressure.

False Breakout Considerations

If Nifty crosses 26,106 but closes below it on a 15-minute candle, traders should adopt short positions targeting:

- 1st Short Target: 26,030

- 2nd Short Target: 25,950

Similarly, if Nifty crosses 26,000 downward but closes above it, bullish recovery targets would be:

- 1st Upside Target: 26,070

- 2nd Upside Target: 26,145

The Relative Strength Index (RSI) on the daily chart stands at 72.17, indicating strong momentum but approaching overbought territory. The MACD indicator shows positive divergence at 267.69, supporting the bullish outlook. Moving averages remain favorably aligned with the 5-day SMA at 25,925 and 10-day SMA at 25,795, both below the current market price.

Bank Nifty Predictions

Bank Nifty displays robust technical structure heading into October 30, 2025, with the index maintaining strength above key moving averages. The no trading zone is established between 58,269 to 58,471, representing a critical decision area.

Bullish Scenario

If a 15-minute candle closes above 58,471, the banking index will trigger upside momentum with targets:

- 1st Target: 58,583

- 2nd Target: 58,912

- 3rd Target: 59,200

This breakout would be supported by continued strength in private sector banks such as HDFC Bank, ICICI Bank, and Axis Bank, which have shown consistent buying interest.

Bearish Scenario

If a 15-minute candle closes below 58,269, downside targets include:

- 1st Target: 58,000 (Psychological support)

- 2nd Target: 57,769

- 3rd Target: 57,500

A breakdown below 58,269 would indicate profit-booking in banking stocks and could trigger short-term weakness.

False Breakout Scenarios

If Bank Nifty crosses 58,471 but closes below it on a 15-minute candle, short positions should target:

- 1st Short Target: 58,269

- 2nd Short Target: 58,057

If Bank Nifty crosses 58,269 downward but closes above it, recovery targets would be:

- 1st Upside Target: 58,400

- 2nd Upside Target: 58,550

Technical indicators for Bank Nifty remain constructive with RSI at 64.58, suggesting healthy upward momentum without excessive overbought conditions. The MACD stands at 940.36 with positive crossover, while the Stochastic indicator at 90.59 indicates strong bullish pressure. The index continues trading above all major simple moving averages, confirming the structural uptrend remains intact.

Sensex Predictions

The BSE Sensex demonstrates strong recovery momentum as it approaches the crucial no trading zone between 84,800 to 85,103 for October 30, 2025.

Bullish Scenario

If a 15-minute candle closes above 85,103, the index will confirm bullish continuation with targets:

- 1st Target: 85,300

- 2nd Target: 85,639

- 3rd Target: 86,045

A decisive breakout above 85,103 would place Sensex within striking distance of its all-time high of 85,978.25 recorded in September 2024. This scenario would be driven by strength in heavyweight stocks including Reliance Industries, HDFC Bank, and ICICI Bank.

Bearish Scenario

If a 15-minute candle closes below 84,800, downside targets include:

- 1st Target: 84,579

- 2nd Target: 84,229

- 3rd Target: 83,959

This would represent a corrective phase from current elevated levels, potentially triggered by profit-booking or weak global cues.

False Breakout Scenarios

If Sensex crosses 85,103 but closes below it on a 15-minute candle, short positions should target:

- 1st Short Target: 84,800

- 2nd Short Target: 84,650

If Sensex crosses 84,800 downward but closes above it, recovery targets would be:

- 1st Upside Target: 85,000 (Psychological level)

- 2nd Upside Target: 85,150

Market breadth on October 29 was positive with about 2,254 shares advancing against 1,474 declining, indicating broad-based buying interest. The Sensex is trading less than 1,000 points away from its record high, suggesting strong underlying momentum.

Tomorrow's Market Prediction (October 30, 2025)

Overall Market Outlook

For October 30, 2025, the Indian stock market is expected to open with a moderately bullish bias, supported by positive global cues and the announcement of potential US-India trade deal discussions. Gift Nifty trading at 26,163, up 73 points from Nifty's closing, suggests a positive opening.

Sectoral Outlook

Metal Sector: Expected to continue outperformance with Nifty Metal gaining 2.06% on October 29. Stocks like Tata Steel and JSW Steel show strong momentum.

Energy Sector: Nifty Energy advanced 2.16%, indicating sustained buying interest in oil and gas stocks including NTPC and Power Grid.

Banking Sector: Both private and PSU bank indices display positive technical setup, with potential for continued outperformance.

IT Sector: Nifty IT gained 0.89%, showing recovery from recent weakness. Further consolidation expected before next directional move.

Auto Sector: Nifty Auto declined 0.31%, indicating relative weakness. Traders should exercise caution in this sector.

Institutional Activity

Foreign Institutional Investors (FIIs) were net buyers with purchases of ₹10,339.80 crore on October 28, 2025, while Domestic Institutional Investors (DIIs) bought ₹1,081.55 crore. This sustained institutional buying provides strong support to the market and suggests accumulation at current levels. For October 2025 month-to-date, FIIs have purchased ₹10,040.2 crore while DIIs have bought ₹37,563.43 crore, indicating robust domestic participation.

Global Cues

US markets showed mixed performance with Nasdaq rising 0.80% while Dow Jones Futures declined 0.21%. Asian markets presented positive momentum with Nikkei 225 surging 2.21%. The potential US-China trade agreement and US-India trade deal discussions announced by President Trump at the APEC Summit provide supportive backdrop for emerging market equities.

Trading Strategy Recommendations

For Nifty Traders:

- Buy on dips strategy near 26,000-26,030 support zone with targets of 26,150-26,270

- Maintain strict stop-loss below 25,930 for long positions

- Sell on rallies approach above 26,270 with targets of 26,000-25,930 if rejection occurs

For Bank Nifty Traders:

- Accumulate near 58,269-58,316 support levels targeting 58,583-58,912

- Stop-loss should be maintained below 58,057 for long trades

- Book profits systematically above 58,912 levels

For Sensex Traders:

- Buying opportunity exists near 84,800-84,900 support zone

- Profit targets should be 85,300-85,639 for long positions

- Defensive positioning below 84,579 with stop-loss at 84,229

Risk Factors to Monitor

Traders should remain vigilant about the following risk factors:

- Federal Reserve monetary policy meeting outcomes expected this week

- Volatility around upcoming quarterly earnings announcements

- Geopolitical developments affecting global risk sentiment

- Crude oil price movements impacting inflation expectations

- Rupee movement against the US Dollar (currently at 88.21)

Final Verdict

Technical Assessment Summary

The technical setup for October 30, 2025, presents a moderately bullish outlook with all three major indices positioned near crucial resistance levels. The alignment of positive technical indicators, supportive institutional flows, and favorable global developments creates an environment conducive for further upside.

Nifty 50 Final Call: The index stands at the threshold of breaking above the 26,100 resistance zone. A decisive move above this level would confirm continuation of the uptrend that began in early October. The broader technical structure remains intact with the index trading above all major moving averages. Traders should adopt a buy on dips strategy near support levels while maintaining disciplined risk management. The path of least resistance remains upward, barring any negative surprises from global markets.

Bank Nifty Final Call: The banking index displays the strongest relative strength among major indices and could potentially lead the next leg of the rally. Technical indicators remain in bullish territory without being excessively overbought. A breakout above 58,471 would open doors for a test of the 59,000 psychological level. The sector continues to benefit from positive developments including potential increase in foreign investment limits for PSU banks. Buy Bank Nifty on dips strategy is recommended with proper stop-losses.

Sensex Final Call: The benchmark index is trading less than 1,000 points from its all-time high, suggesting strong underlying momentum. A move above 85,103 would put the index on track to challenge previous records. The participation of heavyweight stocks like Reliance Industries, HDFC Bank, and ICICI Bank will be crucial for sustaining the upward momentum. Accumulate quality large-caps on declines with a medium-term perspective.

Market Sentiment Indicators

The market sentiment for October 30, 2025, can be characterized as cautiously optimistic. The RSI on Nifty at 72.17 indicates strong momentum but approaches overbought territory, suggesting the possibility of short-term consolidation or profit-booking. However, the MACD remaining in positive territory and moving averages showing bullish alignment support the continuation of the uptrend.

Volume analysis from October 29 revealed that the rally occurred on healthy volumes, indicating genuine buying interest rather than short-covering. This is a positive sign for sustainability of the current move. The advance-decline ratio strongly favored advancing stocks, suggesting broad-based market participation beyond just index heavyweights.

Volatility Outlook

Post-monthly-expiry volatility is expected to moderate on October 30, 2025, as fresh positions are established for the new derivative series. The India VIX (volatility index) has been declining, indicating reduced fear and improving risk appetite among market participants. Lower volatility generally supports higher equity prices by encouraging institutional participation and reducing hedging costs for options traders.

Conclusion

As we enter the trading session on October 30, 2025, the Indian stock market offers attractive opportunities within a clear risk-reward framework. Key technical levels for Nifty (26,000-26,106), Bank Nifty (58,269-58,471), and Sensex (84,800-85,103) will guide the market's direction.

The post-expiry period typically sees lower volatility, making it a prime time for systematic trading strategies. Strong buying from institutional investors supports market stability, while potential US-India trade discussions add a positive sentiment.

Traders should remain cautious of risks, particularly near all-time highs and high RSI readings. The focus should be on maintaining discipline and adhering to support and resistance levels. Dips toward support should be seen as buying opportunities unless major breakdowns occur.

Investors should target stock-specific opportunities in strong sectors like metals, energy, and banking, while employing sound risk management practices. For October 30, 2025, the outlook is moderately bullish, favoring quality stocks and a defensive portfolio approach. Traders who follow the outlined strategies will be well-positioned to capitalize on market opportunities.

Disclaimer

Important Notice: This technical analysis is provided for educational and informational purposes only and should not be construed as investment advice, trading recommendations, or a solicitation to buy or sell any securities. The views and opinions expressed in this analysis are based on technical indicators, chart patterns, and market data available at the time of writing and are subject to change without notice.