The Ultimate Trading Profit Strategy :

91% Traders Don't Know This Secret Formula

Discover the game-changing trading strategy that can transform your option trading results and help you achieve consistent profitability in the Indian stock market.

Every trader dreams of finding that one secret formula that can unlock consistent profits in the volatile world of options trading. What if we told you that such a strategy exists, and 91% of traders are completely unaware of it? Welcome to the ultimate trading Strategy – a comprehensive guide that will revolutionize your approach to options trading in the Indian stock market.

The ultimate trading profit strategy in the Indian stock market is not about luck but about mastering a secret trading formula that focuses on price chart analysis instead of just underlying movements. Most traders fall into the expiry day trading trap, but consistent profits come from proper risk management in trading, avoiding overtrading, and following proper setup like M-pattern trading setup for high-probability entries. With the right option trading strategy India, traders can achieve consistent trading profits by controlling emotions, using disciplined position sizing, and applying options trading psychology effectively.

The Hidden Truth About Trading Profits

Why Most Traders Fail in Options Trading

The statistics are sobering – according to SEBI reports, 91-95% of option traders are in loss over a one-year period. This isn't because the market is rigged against retail traders, but because most traders make fundamental mistakes that compound over time:

- Over-trading: Making 10-15 trades daily instead of 1-2 quality trades

- Expiry day trap: Falling for the allure of cheap premiums on expiry days

- Lack of risk management: Taking big losses while booking small profits

- Wrong chart analysis: Using underlying charts instead of price charts for stop-losses

The Real Secret: Price Chart Analysis

The biggest revelation in modern options trading is understanding the difference between underlying charts (Nifty/Bank Nifty) and price charts (option premium charts). While 91% of traders draw their support and resistance lines on underlying charts, the real money is made by analyzing price charts.

Why Price Charts Matter More:

- Your actual profit/loss happens through price movements, not underlying movements

- Price charts show the true sentiment and momentum of your specific option

- Support and resistance levels are more accurate on price charts

- Trend analysis becomes clearer when you focus on premium movements

The Expiry Day Trap: How Markets Deceive Traders

The Dangerous Allure of Expiry Day Trading

Expiry day trading has become increasingly popular, especially with the introduction of weekly expiries. However, this is where most traders lose their accumulated profits.

The Psychology Behind Expiry Day Losses:

- Cheap Premium Temptation: ₹3 premium looks attractive but rapid decay makes it dangerous

- Increased Position Size: Traders take 10-20 lots instead of their usual 1-2 lots

- Time Decay Acceleration: Theta decay becomes extremely aggressive on expiry day

- Market Manipulation: Institutions often create sideways movements to maximize time decay

Real Example:

- Normal capacity: 2 lots at ₹10,000 investment

- Expiry day: 20 lots at ₹4,800 investment (₹3 premium × 80 lot size × 20 lots)

- Result: Higher risk with lower probability of success

Why You Should Avoid Expiry Day Trading

The market has a systematic way of trapping expiry day traders:

- Morning Session: Creates hope with small movements in both directions

- Afternoon Consolidation: Price moves sideways for 1-2 hours, causing time decay

- Final Hour Movement: When most positions are already worthless, real movement begins

The Four Pillars of Successful Trading

Pillar 1: Never Take Big Losses

The foundation of profitable trading is protecting your capital. Big losses can wipe out weeks of small profits in a single trade.

Implementation Strategy:

- Set maximum loss per trade (1-2% of capital)

- Use position sizing to control risk exposure

- Never average down in losing positions

- Accept small losses as part of the business

Pillar 2: Book Small Losses Yourself

Don't wait for stop-losses to hit automatically. When your analysis goes wrong, exit immediately.

Key Indicators to Exit:

- Price fails to move in expected direction within reasonable time

- Market structure changes against your bias

- Volume doesn't support your thesis

Pillar 3: Profit Booking in Percentages

Instead of hoping for unlimited profits, book profits systematically based on percentages.

Percentage-Based Profit Strategy:

- 20% profit: Book 50% of position

- 50% profit: Book additional 30% of position

- 100% profit: Book remaining 20% with trailing stop-loss

Pillar 4: Avoid Negative Averaging

Never add more positions when you're in loss. This is the fastest way to turn a small loss into a account-destroying loss.

The M-Pattern: Your Ultimate Profit Predictor

Understanding the M-Pattern in Price Charts

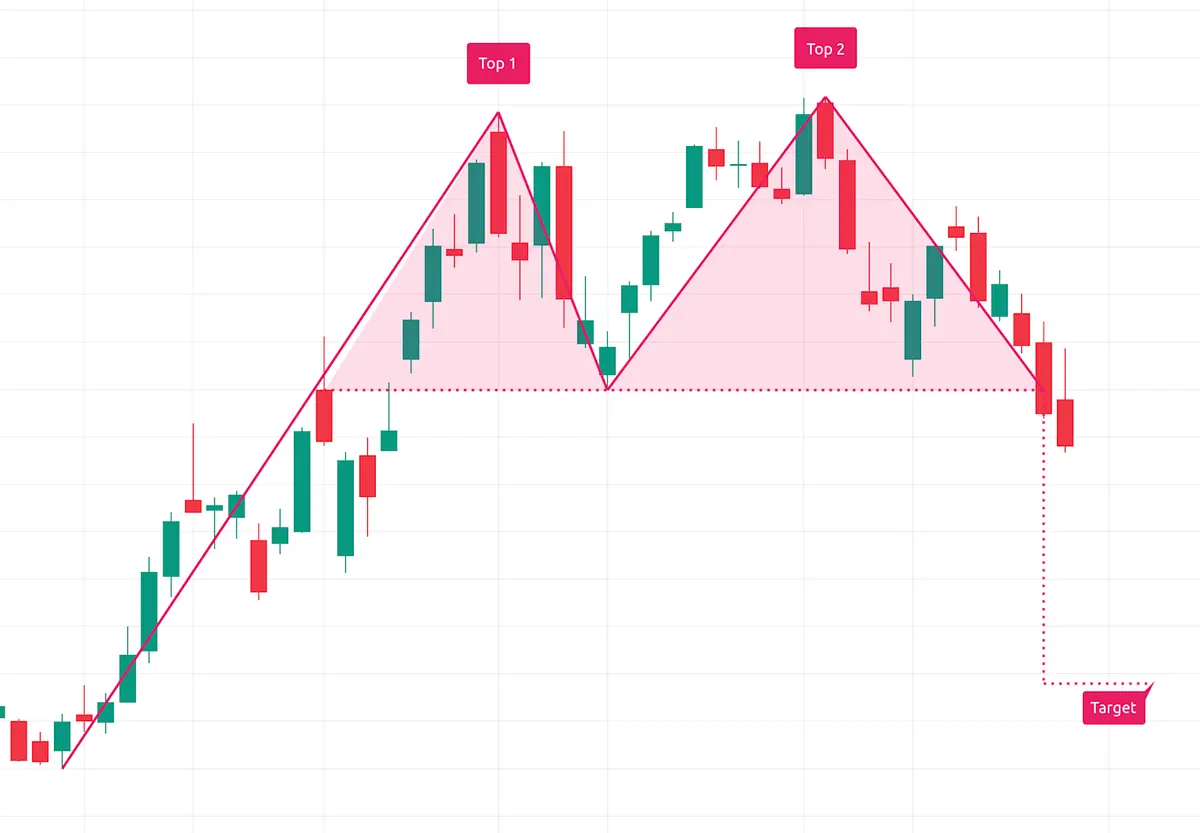

The M-pattern (or Double Top pattern) is one of the most reliable bearish reversal patterns in price chart analysis.

M-Pattern Characteristics:

- Two peaks at similar price levels

- Two peaks at similar price levels

- Second peak fails to exceed the first peak significantly

- Clear breakdown below the neckline confirms the pattern

- Target equals the height of the pattern projected downward

Trading the M-Pattern:

- Entry: When price breaks below neckline with volume

- Stop-Loss: Just above the second peak

- Target: Height of pattern measured from neckline

- Risk-Reward: Typically 1:2 or better

The Power of Trend Following

Instead of trying to catch every small movement, focus on following the main trend in price charts.

Trend Following Principles:

- Higher timeframes (1-hour) for entry signals

- Avoid 5-minute chart noise that creates false signals

- Look for price making higher highs and higher lows (uptrend)

- Enter on pullbacks, not breakouts

Advanced Risk Management Techniques

Position Sizing Based on Volatility

Your position size should inversely correlate with market volatility.

Position Sizing Formula:

- Low volatility: 3-5% of capital per trade

- Medium volatility: 2-3% of capital per trade

- High volatility: 1-2% of capital per trade

The 4-Trade Rule

Limit yourself to maximum 4 trades per day, preferably 1-2 quality trades.

Why This Works:

- Reduces overtrading and transaction costs

- Forces you to wait for high-probability setups

- Improves win rate through selectivity

- Reduces emotional decision making

Dynamic Stop-Loss Management

Use trailing stop-losses to protect profits while letting winners run.

Trailing Stop Strategy:

- Initial stop: 2-3% below entry

- First target (20% profit): Move stop to breakeven

- Second target (50% profit): Trail stop at 30% profit level

- Final target: Let remaining position run with wider trailing stop

Practical Implementation Guide

Daily Trading Routine

Pre-Market (9:00-9:15 AM):

- Analyze global markets and overnight news

- Identify key support/resistance levels

- Plan maximum 2-3 potential trades

Market Hours (9:15 AM-3:30 PM):

- Wait for setups to develop naturally

- Enter only high-probability trades

- Monitor positions actively but avoid overanalyzing

Post-Market (After 3:30 PM):

- Review trades and journal lessons learned

- Plan for next trading day

- Avoid any trading activity

Weekly Performance Review

Track these key metrics weekly:

- Win rate percentage

- Average profit vs average loss ratio

- Maximum drawdown

- Total trades executed

- Adherence to trading rules

Common Mistakes to Avoid

The Scalping Trap

While scalping can generate quick profits, it typically leads to long-term losses due to:

- High transaction costs

- Increased trading frequency

- Emotional exhaustion

- Lower win rates over time

Indicator Overload

Focus on price action rather than complex indicators:

- 80% importance: Psychology and risk management

- 10% importance: Strategy and setup identification

- 10% importance: Technical indicators

The Revenge Trading Cycle

After a loss, never immediately enter another trade to "recover" losses. This leads to:

- Emotional decision making

- Increased position sizes

- Abandoning of trading rules

- Larger losses

Building Your Trading Psychology

The Patience Factor

Successful trading requires immense patience:

- Wait for perfect setups rather than forcing trades

- Accept that some days will have no trading opportunities

- Focus on process over profits

Emotional Control Techniques

Before Trading:

- Set daily loss limits

- Review trading rules

- Visualize successful execution

During Trading:

- Stick to predetermined position sizes

- Avoid checking P&L frequently

- Focus on price action, not profits

After Trading:

- Journal all trades regardless of outcome

- Identify areas for improvement

- Plan tomorrow's potential setups

Technology and Tools for Success

Recommended Chart Analysis Tools

- TradingView: For advanced charting and analysis

- Broker platforms: Real-time data and execution

- Position sizing calculators: Risk management tools

Mobile-Friendly Trading Setup

Since most Indian traders use mobile devices:

- Set up price alerts for key levels

- Use simple moving averages for trend identification

- Keep charts clean and uncluttered

- Practice one-handed trading for mobility

Long-Term Wealth Building Through Options

The Compound Effect

Small, consistent profits compound significantly over time:

- 2% weekly return = 180% annual return

- Focus on consistency over home runs

- Protect capital during adverse market conditions

Building Multiple Income Streams

Primary Strategy: Core trend-following approach

Secondary Strategy: Conservative option selling in low-volatility periods

Hedge Strategy: Protective positions during uncertain times

Conclusion: Your Path to Trading Success

The ultimate trading Strategy isn't a complex system or secret indicator – it's a combination of disciplined risk management, proper chart analysis, and emotional control. The 90% of traders who fail are not necessarily less intelligent; they simply lack the discipline to follow proven principles consistently.

Key Takeaways:

- Focus on price charts rather than underlying charts for option trading

- Avoid the expiry day trading trap that destroys capital

- Implement the four pillars: avoid big losses, book small losses, percentage-based profits, no negative averaging

- Master the M-pattern for high-probability trade setups

- Maintain strict position sizing and risk management

- Trade less, earn more through selectivity

Remember, successful trading is not about being right all the time – it's about being wrong small and right big. The market will always provide opportunities, but capital preservation is your primary responsibility as a trader.

Start implementing these principles gradually, focus on consistency over profits, and watch your trading transform from gambling to a systematic approach to wealth creation in the Indian stock market.

Ready to implement the trading strategy in your own trading? Start with small position sizes, focus on price chart analysis, and remember – patience and discipline are your greatest assets in the options trading journey.

Disclaimer: This analysis is for educational purposes only and should not be considered as investment advice. Market investments are subject to risks. Please consult your financial advisor before making investment decisions.